Exchange-traded funds (ETFs) are an increasingly popular way for investors to gain exposure to the global financial markets. One of the key differences between an ETF and a ‘traditional' fund is that regardless of the underlying asset, ETFs are traded on a stock exchange, just like company shares. That makes them a convenient and cost-effective way to benefit from investing in a whole basket of assets in one trade but who have consistently been the best performing ETFs?

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.

Now that the sector is more established, it's possible to pick out the best performing ETFs to trade. But before we discuss the best performing ETFs on the market at the moment and how to get the most out of using them, there is a little bit of background information worth knowing.

Table of contents

- What Are ETFs?

- The Benefits of Trading ETFs

- Five of the Best ETFs

- State Street SPDR Portfolio Aggregate Bond ETF (SPAB)

- Betashares Crypto Innovators ETF (CRYP)

- Invesco S&P 500 UCITS ETF (SPXS)

- Global X Copper Miners ETF (COPX)

- iShares Global Financials ETF (SGFS)

- What You Need to Know About ETFs

- FINAL THOUGHTS

What Are ETFs?

ETFs are simply a convenient way to gain exposure to a group of assets or a whole sector, such as equities, rather than an individual stock, and that diversification helps reduce single stock risk. The neat functionality of the instruments means their value changes in real time and in accordance with the price feed relating to each underlying asset. That means they can be traded whenever the market is open – unlike traditional funds there's no need to wait for a month-end dealing day to adjust your position.

Most ETFs are passively managed, meaning there is no fund manager intervention. If you buy an S&P 500 index ETF, the basket of stocks you hold in that one position will reflect the makeup of the index itself. There's no input by the manager to go over or underweight in the stock of any particular company. As with stock indices, there will be regular adjustments as to which stocks are and aren't included. When these occur, the ETF fund manager will simply mimic that change by adjusting the holdings of the ETF.

For many traders, ETFs represent a straightforward way of taking a diversified position in a sector they think will outperform the market. The product range extends from green energy stocks and bonds to commodities and cryptocurrencies, so there is a product for every type of investor. The below ETFs have been studied using fundamental and technical analysis and are the AskTraders top picks.

The Benefits of Trading ETFs

The global ETF market has ballooned from $1.04bn in size in 2009 to more than $10trn in 2022. Another indication of the scale of the market is that in the US, approximately 12% of listed equities are traded as part of ETF baskets.

The growth in the popularity of ETFs has been primarily driven by the convenience they offer and being able to trade in and out of an ETF position intraday highlights how easy it is to manage positions. The live price feed also means that investors can get a real-time update on the value of their investment.

Product choice is another area where ETFs do well. As mentioned, nearly every sector can be traded using ETFs, so those looking to buy government bonds but would rather not invest time and resources in studying the sector in granular detail can take a position by buying an ETF.

As the market has grown, the costs associated with ETF trading have tumbled. Good brokers offer transparent reporting of the ER (Expense Ratio) that details the annual costs of holding a position.

Forbes calculates the industry average ER for stock index ETFs to be 0.18%. That means that for every $1,000 invested each year, $1.8 would go to the fund manager in terms of fees. This relatively low charge compares well to mutual funds and actively managed funds and stems from ETFs being passively rather than actively managed.

The functionality and low trading costs associated with ETFs mean they can be used by traders running more complex and short-term strategies. ETFs could, for example, facilitate short-term hedging of a broader portfolio. Gold's role as a safe-haven asset means traders looking to reduce risk on their portfolio could, in some scenarios, buy the Van Eck Gold Miners UCITS ETF with one click of a button. That ETF is a basket of large-cap, gold mining stocks listed on exchanges ranging from Canada to Egypt, mainly tracking the price of gold.

If a strategy would benefit from there being a position more closely linked to the price of gold, then products such as the ETFS Physical Gold (GOLD) ETF allows investors to take a position in a fund which holds bullion in physical form.

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.

Five of the Best ETFs

State Street SPDR Portfolio Aggregate Bond ETF (SPAB)

The structure of ETFs makes them relatively low-risk instruments. The fact that a basket of positions is held helps them generate lower volatility returns. Embracing that functionality and taking it one step further makes ETFs ideal for investors to generate steady income returns from the bond market.

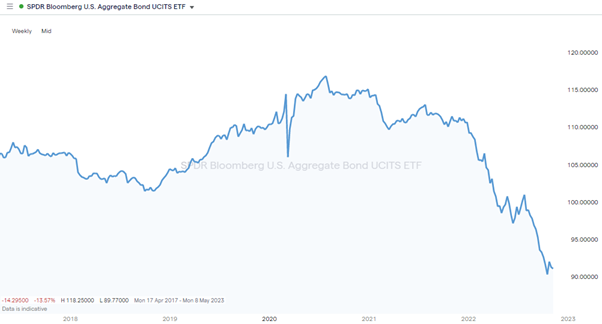

The State Street SPDR Portfolio Aggregate Bond ETF (SPAB) tracks a Bloomberg-managed market value-weighted index of US dollar-denominated investment-grade bonds. The bonds included in the basket have at least one year to maturity. They include Treasuries, government-related and corporate securities, asset-backed securities, mortgage-backed securities, and collateralised mortgage-backed securities.

The returns are, to some extent, capped thanks to the fixed-income nature of the underlying instruments, but risk is diversified, and with one position investors can gain broad exposure to a bond market with a strong credit rating.

Annual fees on the SPAB product are low, with the ETF recording a Total Expense Ratio of 0.17%. Like other ETFs, it's eligible for inclusion in a variety of tax-efficient schemes such as SIPPs and ISAs, and it distributes income to investors semi-annually.

Betashares Crypto Innovators ETF (CRYP)

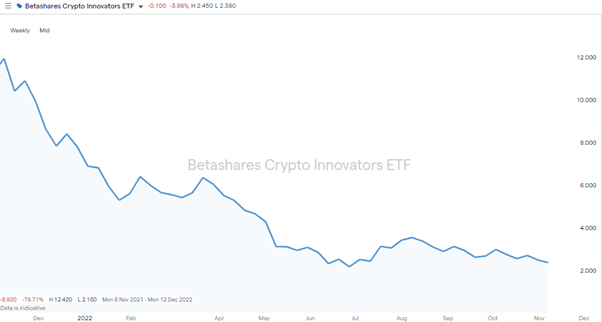

Demonstrating the versatility of ETFs and how they can occupy both ends of the investment spectrum leads to the Betashares Crypto Innovators ETF launched in November 2021. That launch date couldn't have been worse-timed with 2022 being dubbed a crypto-winter, but the subsequent fall in crypto prices has resulted in the CRYP ETF offering investors a chance to buy at the bottom.

The fast-moving nature of cryptocurrency markets means investments in the sector benefit greatly from how ETFs cast a broad net over a range of exciting investment opportunities. The Betashares CRYP ETF is designed to provide investors with exposure to a portfolio of global companies at the forefront of the rapidly emerging crypto economy.

The CRYP ETF offers' picks and shovels' exposure to the companies which allow the crypto ecosystem to thrive. It includes firms involved in building crypto mining equipment, crypto trading venues, and other vital services. It also invests in up to 50 crypto leaders, such as Coinbase, Riot Blockchain, and Microstrategy.

The Betashares Crypto Innovators ETF doesn't invest directly in coins, but some of the firms it tracks do. It's designed to capture the full breadth of the crypto ecosystem and is a good starting position for those who see the sector's prospects improving.

Picking the few winners in the crypto world is as difficult as it is rewarding, and the CRYP ETF takes the approach of investing a small position in many firms so that if one does take off, there would be some kind of positive return posted to the bottom line. The expense ratio of 0.67% is relatively high compared to other ETFs but still compares well to the average for mutual funds, which is between 0.5% and 1.0%.

Invesco S&P 500 UCITS ETF (SPXS)

Positioned in between low-risk bonds and high-risk cryptos are large-cap stocks. A desire by investors to gain exposure to the major stock indices helped trigger the creation of the ETF market because the instruments are an ideal way to gain exposure to a large number of different equities conveniently and cost-effectively.

The S&P 500 is often seen as the flagship stock index thanks to its inclusion of around 500 of the world's largest multinational corporations. Those looking to track the fortunes of those 500 companies don't have to book a time-consuming number of separate trades but can buy an ETF that does the work for them. The fee charged by Invesco for providing that service in the form of its S&P 500 UCITS ETF is a modest 0.05% per annum.

With the S&P 500 covering about 80% of available US equities, an investment which tracks that index captures the core essence of the global stock market. Invesco's S&P 500 ETF has been doing that since it was first introduced in May 2010. Since that date, the annualised return has been an impressive 12.66%, which supports the claim that this ETF is an ideal vehicle for those looking to make long-term, relatively low volatility returns.

Global X Copper Miners ETF (COPX)

In a single trade, the Global X COPX ETF delivers efficient access to a basket of companies involved in the mining of copper. That's a chance for investors to tap into a raw material seen as one of the key components of the move towards a greener global economy.

From the batteries needed to create and transfer renewable energy to the charging stations being rolled out to support EV use, demand for copper is everywhere. The building of next-generation infrastructure is a multi-year project which continues to build momentum, and that can only be good news for copper stocks.

The metal also has its traditional uses to fall back on, and as new mines can take up to ten years to come online, supply in the near term is restricted. That's led to some predicting we could be about to enter a commodity supercycle. If that happens, investors in the COPX ETF will be positioned to post significant gains.

The price of the COPX ETF backs up the argument that the copper sector is an ideal one to invest in now. While the broader stock market experienced a painful 2022, the COPX price held up relatively well. The total expense ratio of 0.65% is a little on the high side, but the COPX trade is relatively high-risk return based on substantial capital growth rather than low-margin income returns.

iShares Global Financials ETF (SGFS)

The ability of ETFs to give exposure to a whole sector opens the door to investors using macro-style strategies. Analysis which points to stocks of banks and financial firms being some of the best performers in a high inflation environment is followed up by the question of which ones to buy. In the case of the iShares Global Financials ETF, the answer is most of them.

Instead of researching each firm, the SGFS ETF allows investors to buy into the top 1,200 financial firms in the world. It tracks the performance of the S&P Global 1200 Financials Sector Index. That means with a single trade it's possible to take positions in a range of internationally based companies that provide financial services to commercial and retail customers. That includes banks, investment funds, and insurance companies.

The reason finance stocks are gaining popularity is that higher interest rates typically follow high inflation, and bank stocks, in particular, do well when those rates are higher. The bid-offer spread on rates offered to borrowers and savers can be widened, and that helps them increase their revenue streams.

The expense ratio on the iShares Global Financials ETF is 0.40%. There are financial ETFs with lower fees; the Fidelity MSCI Financials Index ETF, for example, has an expense ratio of 0.08%. The advantage the iShares product has over the Fidelity product, and the reason it is more expensive to run, is that there are a greater number of shares in that ETF, with many of them being drawn from emerging markets. Fidelity's ETF tracks the performance of US firms and doesn't offer the extra kicker offered by small-cap firms in growth markets.

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.

What You Need to Know About ETFs

The risks associated with ETF investments are the same as if you built the portfolio yourself. It's convenient that ETFs pack up a range of assets and present them to you in a wrapper, but prices can still go down as well as up. Even the relatively low-risk SPAB ETF is subject to risks which include interest rate risk (bond prices and interest rates are inversely correlated), issuer default risk, issuer credit risk, liquidity risk, and inflation risk

Competition among fund managers is intense. Of course, that is a good thing for investors who have seen the costs associated with ETF investing come down in recent years. The transparent nature of the fee reporting is also to be welcomed. It is essential, though, to avoid being penny-wise and pound-foolish and prioritise ensuring that the investment suits your personal objectives. It is also important to read the small print and factor in any fees for dealing when selling them.

The selection of funds on our list of the best ETFs to buy now purposefully includes a range of different asset groups. This demonstrates how the ETF market has grown and matured. The SPAB bond ETF is a suitable instrument for those looking to balance their portfolio with fixed-income returns, and the CRYP cryptocurrency ETF offers the potential for more significant capital gains. The allocation of capital would come down to investor risk appetite, but few seasoned pros would suggest the position in CRYP should be more important than that in SPAB, but with ETFs, all options are open.

If you are developing a portfolio of ETF positions, it is worth looking into the details of the products you buy and the Top 10 holdings by size list. This avoids the risk of unintentionally exposing your portfolio to single-stock risk. The S&P 500 and Copper ETFs listed above will contain some of the same stocks, and if duplication becomes excessive, then the diversification element of the product will be negated.

FINAL THOUGHTS

Whether you are an experienced investor or are new to trading, the ETF market is one to consider exploring. The nature of the products makes them versatile and user-friendly instruments which can be included in the most basic or complex portfolios.

They don't completely do away with investment risk but go some way to mitigating it. As the sector has flourished, more and more brokers have entered the market, which helps with operational risk. There's no need to select an obscure broker to hold your ETF positions, and some of the well-recognised names on this list of trusted brokers offer competitive T&Cs and product selection to help your trading get off to a great start.