It’s all about being in control, cutting out the middle-man and getting direct access into the markets. Step one involves choosing the right broker for you. Read on, as this article covers how to compare CFD brokers.

- What are CFDs?

- What to look for when comparing CFD brokers

- Reliable CFD brokers

- Top tips on how to make a profit from CFDs

- Final thoughts

WHAT ARE CFDs?

CFD is the abbreviation of Contract For Difference. It’s a bit of a mouthful, but the keyword is ‘contract’. As an example, if you and a broker were to agree that if you buy $2,000 of gold and the value of it goes up to $2,250 and you then sell it, then you’ll be paid the $250 profit.

You’ll be able to withdraw your funds, the whole $2,250 and walk away, or alternatively, reinvest it in another position.

If your gold trade had gone against you, and the price of gold fell till you decided to sell at $1,600 (for example), then your account balance would debit by $400. The market will determine the ‘difference’ between the opening and closing price of the trade and the ‘contract’ ensures both parties make good their part of the bargain.

Using the CFD principle, your broker will ‘create’ markets in assets ranging from oil to Apple shares. These are accessed online using high-tech trading platforms that allow you to follow real-time prices.

While you will be trading in the markets, your relationship is with your broker, which is why it’s crucial you choose the right one for you.

KEY CRITERIA FOR COMPARING CFD BROKERS

If you are considering trying out CFDs, then it’s strongly recommended you start off using one of the free demo accounts that are readily available. It’s safer to start off using virtual funds and it’s also hard to beat the hands-on experience.

Clicking on the links to regulated brokers will take you to our overview of their Demo accounts where you’ll get a good idea of what they have to offer.

The trading experience is a key part of trading, but there are other factors to consider when establishing which is the best CFD trading platform for you.

- Education & learning— Whether you’re a novice who is just starting out, or an experienced trader looking to learn about a new market, the support material offered by your broker is crucial. The brokers that score most highly in this area offer materials in a range of formats including video and written formats.

- Research & analysis— When it comes to putting your money at stake, you’ll want to have a well-thought-out strategy. Some brokers offer more than others in terms of materials to help you identify trading opportunities. IG stands out because it offers a full range of trading ideas based on fundamental and technical The FP Markets ‘The Week Ahead’ videos, which are released on Sunday evenings, are also a valuable resource.

- Spreads, commissions & fees— Trading costs have been driven down in recent years. New technology and competition among brokers mean that traders can take positions in the markets at little expense. Even small costs can stack up and keeping an eye on the fees charged at your broker can help you squeeze out a better net return.

- Customer support— This can be measured in terms of quality and accessibility. Pepperstone provides a good benchmark. Its multiple award-winning customer support team is contactable by phone 24/5. Considering you might have a query on a live trading position, it’s crucial you feel happy with the level of support your broker offers.

- News services— There are a lot of free market news sources available. Brokers that offer their own bespoke service do provide something tailored to individual traders. The broker XTB offers free market audio as part of its service. IG has its own TV station-style broadcasts and FX Pro provides daily newsletters covering all sectors.

- Mobile trading— Good platforms now provide their clients with apps and browser-based platforms. Markets can be fast-moving, so any tools that help you keep track are to be welcomed.

- Client protection— This is one of the most important features of the selection process. It’s a good idea to stick with brokers who are regulated Tier-1 authorities, such as the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC).

Source: FXPro

Finding the fitting broker for you will involve understanding what your priorities are. Different strategies and different lifestyles work better with different brokers.

All of the below brokers are highly regarded, but it can’t be stressed enough that trying out the free demo accounts is a great way to get a better appreciation for what they offer. Demo accounts take a matter of moments to set up, are free to use and, as you’re trading virtual funds, are risk-free. Based on the above metrics, we would recommend staring your CFD broker comparison with these established names:

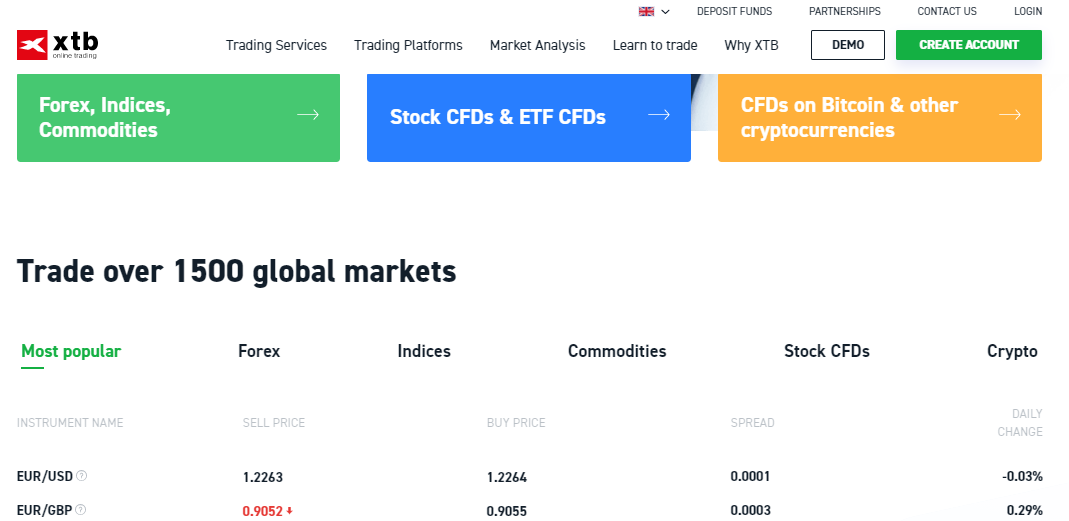

XTB

A proven broker with a strong reputation in the CFD trading community, XTB offers competitive pricing and reliability, and a few neat innovative features as well. It is now one of the world’s largest stock exchange-listed CFD & FX brokers and offers the security and convenience that comes with having offices in over 13 countries around the world.

The xStation 5 proprietary platform is a contender for best-in-class. Trialling it in demo account format is well worth doing if only to establish quite what other brokers have to beat.

- Client protection — XTB Limited is authorised and regulated by the UK Financial Conduct Authority (Registration Number522157)

Source: XTB

PEPPERSTONE

If customer service is important to you, then Pepperstone deserves to be on your shortlist of broker candidates. The firm is very client-focussed as demonstrated by the hoard of industry awards it has picked up for supporting its clients.

It offers a choice of trading platforms and more than enough CFD markets to allow you to get exposure to a range of asset classes.

- Client protection — Pepperstone Limited is authorised and regulated by the Financial Conduct Authority (Registration Number 684312).

Source: Pepperstone

FXPRO

FxPro offers Contracts for Difference (CFDs) on six asset classes: forex, shares, spot indices, futures, spot metals and spot energies. It takes its clients to the heart of the markets by providing access to top-tier liquidity and advanced trade execution with no dealing desk intervention.

The trading infrastructure is of a high enough quality to support institutional as well as retail investors from more than 170 different countries.

- Client protection — FxPro UK Limited is authorised and regulated by the Financial Conduct Authority (Registration number 509956).

Source: FXPro

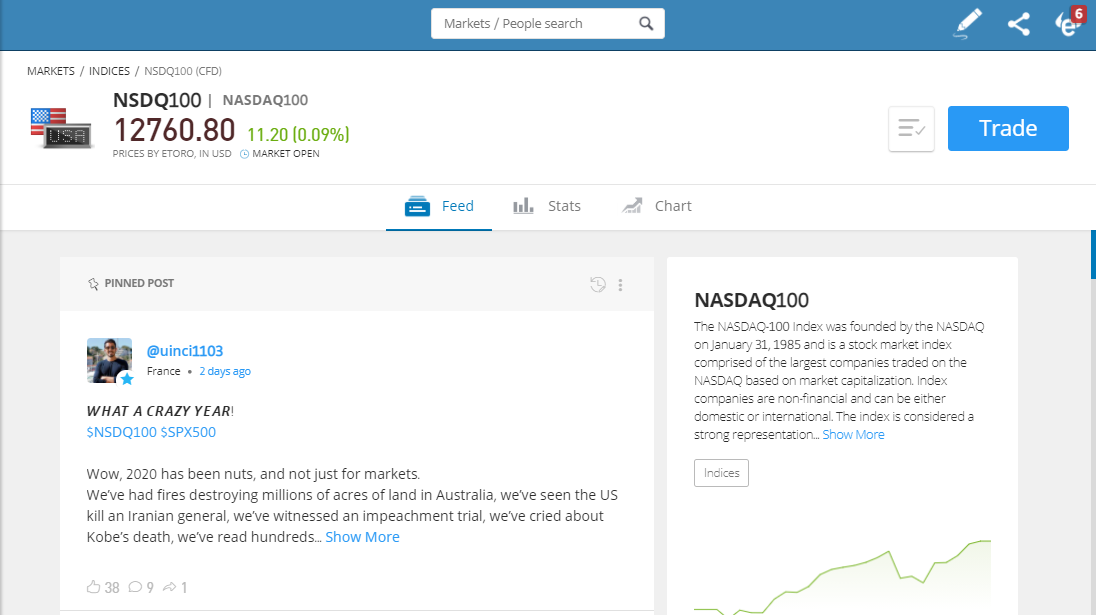

ETORO

The popularity of eToro speaks for itself and 13 million users can’t be wrong. This broker offers one of the most user-friendly trading experiences. From logging onto the demo account, to putting on your first trade, the whole process is smooth and easy.

It offers an extensive range of markets, but the real angle eToro has to be the Copy Trading function. The platform hosts thousands of traders who are willing to share their trading ideas with you. This can be done informally by accessing the chat rooms of each market, or by applying their trade instructions to your account.

- Client protection — eToro (Europe) Ltd is authorised and regulated by the Cyprus Securities Exchange Commission, CySEC, (License 109/10). eToro (UK) Ltd is authorised and regulated by the Financial Conduct Authority, FCA (License number 583263).

Source: eToro

IG

With over 17,000 markets available to trade, IG is one of the few brokers really worthy of the name ‘multi-asset’. It offers markets ranging from options and bonds to ETFs and 24/7 indices.

The in-house platform is a user-friendly but powerful piece of software and the broker is hard to beat in terms of research & analysis and customer service.

- Client protection – IG is a trading name of IG Markets Ltd, which is authorised and regulated by the Financial Conduct Authority. (Register number 195355).

Source: IG

TICKMILL

Tickmill is all about the trading experience. Clients get to use the market-leading MetaTrader MT4 trading platform, which is renowned for facilitating fast, reliable and cost-effective trading. Some of the markets at Tickmill have bid-offer spreads of 0.0 pips. In addition, its research and analysis sections are particularly popular due to being very trade-orientated.

- Client protection — Tickmill is a trading name of Tickmill UK Ltd which is authorised and Regulated by the Financial Conduct Authority (Registration Number 717270).

Source: Tickmill

FP MARKETS

FP Markets leads the way in terms of the number of stock markets on offer. This scalping-orientated operation bucks the trend to some extent by offering markets in over 10,000 stocks and 19 major indices.

FP Markets was rated by Investment Trends as the Best for Quality of Trade Execution 2019.

- Client protection – First Prudential Markets Ltd has its regulation and authorisation from the Cyprus Securities and Exchange Commission, CySEC (License number 371/18)

Source: FP Markets

TOP TIPS ON HOW TO MAKE A PROFIT FROM TRADING CFDs

There are some general principles that apply, regardless of which broker you choose to use.

- Have a clear strategy— Broker platforms are a good place to find trading ideas based on technical and fundamental analysis. They also provide information on the different trading strategies such as scalping, momentum, break-outs and reversions.

- CFD risk management— Stop losses and take-profit orders are instructions built in to positions to ensure your losses are limited to a certain amount. They also ensure that you scale out of positions if they make a certain amount of profit.

- Develop a trading mentality— Successful trading requires the right mental approach. Be disciplined about putting on trades. ‘Boredom’ trades will eat their way through your account. Also, try to take the emotion out of trading and trade in sizes small enough to let you consider trading decisions objectively.

- Learn from others— Some brokers will allow you to take on the ideas of others. Copy trading involves you paying a fee for signals from another trader to be applied to your account. Social trading involves accessing online groups where ideas are shared.

- Keep an eye on the economic calendar— Markets can transform from one mood to another in an instant. Some of the triggers are known beforehand and monitoring upcoming announcements such as interest rate announcements can help you manage your positions.

- Plan your day— Be realistic about how much time you can offer up to CFD trading. Choosing types of strategies that fit in with your existing commitments is a good start.

- Sit on your hands— The old saying among professional investors is that some of the best trades you do are the ones you don’t do. There is nothing wrong with spending time out of the market and waiting for the optimal opportunity.

- Experiment— Whether you are a novice or an experienced trader, it’s a good idea to keep your demo account running. That way, you can try new ideas out without risking capital.

FINAL THOUGHTS

The best way to see if CFD trading is for you, or not, is to try it using a demo account. If you do well and graduate to live trading, then start off in small size to ensure you maintain the right approach.

Whether you make a profit will depend largely on your skillset and approach, but the CFD brokers mentioned can also help you with that. They all have a slightly different focus, so comparing them and doing live tests to find the best fit can pay off in terms of your trading bottom line.

PEOPLE WHO READ THIS ALSO READ: