Blue chip stocks form the largest holding in global equity portfolios. Institutional investors are particularly attracted to the sector because blue chip companies with massive market capitalisations offer an attractive mix of risk and return. They’re unlikely to go bust, have market positions strengthened by new entrants facing barriers to entry and are easy to trade in and out of, even in large size with little risk of them getting ‘caught’ in a position.

YOUR CAPITAL IS AT RISK

Some big funds invest hundreds of millions in a single stock because the market is so liquid. While retail investors may not have that kind of money to invest, the principles that make blue chips appealing are universal. This review will outline how to buy top blue chip stocks in Singapore and provide a step-by-step guide to gaining exposure to one of the most reliable and popular investment strategies.

Table of contents

- What Are Blue Chip Stocks?

- How to Identify Blue Chip Stocks in Singapore?

- The 5 Best Blue Chip Stocks in Singapore

- United Overseas Bank

- Singapore Airlines Ltd

- Jardine Matheson Holdings Limited

- Thai Beverage PCL

- Singapore Telecommunications Ltd (SGX)

- Advantages of Blue Chip Stocks

- Disadvantages of Blue chip Stocks

- How to Invest in Blue Chip Stocks

- Summary

What Are Blue Chip Stocks?

The phrase ‘blue chip company’ is applied to firms that have two main characteristics:

- Large Market Caps – Blue chips are the biggest firms on any exchange. They are well-financed, have established income streams and their management teams are open to public scrutiny. They might not have many new markets to develop or innovative new ideas, but what they do works well and generates profits.

- Reputation, Track Record & Barriers to Entry – It takes time to develop a strong brand and some blue chips have done so over hundreds of years. It’s just hard for a new competitor to compete with that kind of company-consumer relationship.

Blue chips can be found in any sector or country. Blue chip stocks in Singapore, for example, operate in sectors ranging from commercial property to telecoms.

How to Identify Blue Chip Stocks in Singapore?

Many firms that are candidates for ‘blue chip’ status tick the above criteria. When you move away from the very largest firms, establishing if a firm is a blue chip can be a grey area. An alternative way to clarify the situation is to consider what is not a blue chip company.

- Not all large cap Singapore firms are blue chips, but all blue chips do have large market capitalisations.

- Not all UK firms with strong reputations are blue chips, but all blue chips have strong reputations.

If you’re looking to make a blue chip investment in the Singapore market, your target will be a member of the Straits Times Index (STI). That index of 30 stocks contains the largest Singapore listed firms, with even the smallest member of the group currently valued at an impressive S$3.5bn.

The 5 Best Blue Chip Stocks in Singapore

United Overseas Bank

YOUR CAPITAL IS AT RISK

The share price chart for United Overseas Bank (UOB) demonstrates that you might not want to expect the prices of Singapore blue chip firms to sky-rocket. On the other hand, the banking giant, with a market cap of S$43.3bn, is the fourth largest firm in the STI. UOB has successfully weathered the COVID storm and near-zero interest rates and has a share price in line with levels before the pandemic hit.

Banks struggle in low interest rate environments due to their operating margins being squeezed. That makes UOB a good blue chip investment for anyone forecasting rate rises in the future. Even in unfavourable market conditions, it has recorded a dividend yield in the region of 4.47%, which represents a steady and reliable income stream.

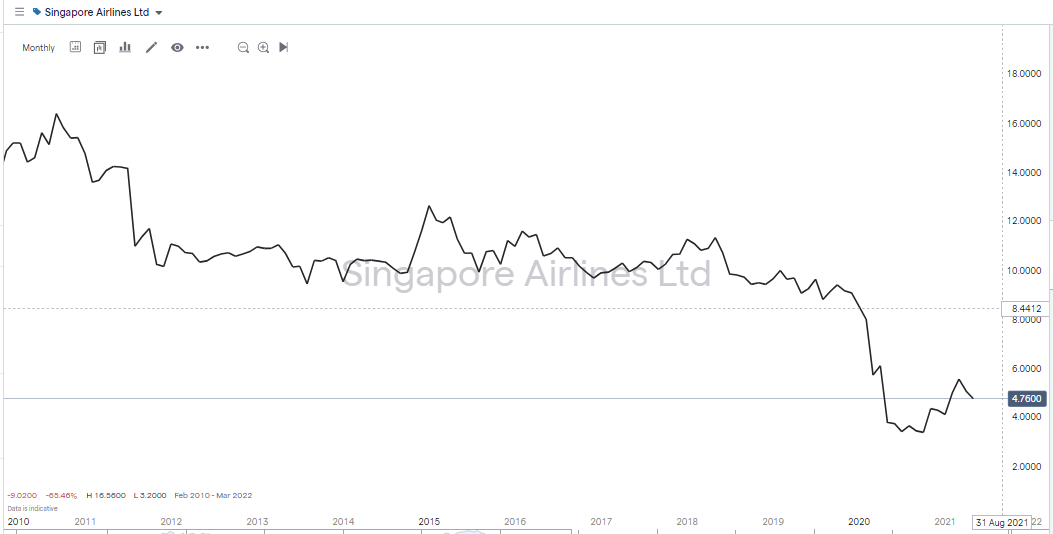

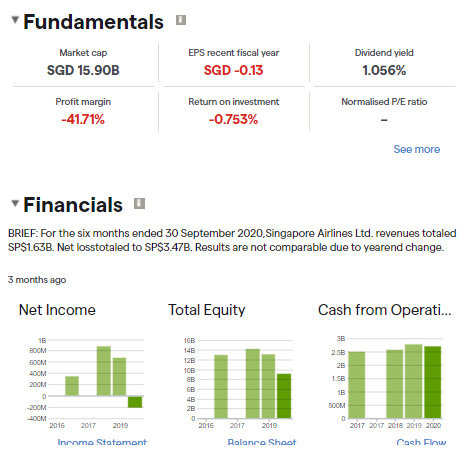

Singapore Airlines Ltd

YOUR CAPITAL IS AT RISK

The airline sector was smashed by the COVID pandemic, but blue chip investing is about the long-haul and a short-term nose-dive can be seen as a buying opportunity. The events of 2020 did leave firms in the airline sector facing the very real risk of going bust and there are still many challenges ahead. On the other hand, blue chips don’t tend to experience price volatility like that seen in Singapore Airlines.

It’s a brave call, but even with the share price at such low levels, Singapore Airlines still has a market cap of S$14.2bn. It’s world-leading brand recognition could come into play as well. If global travel picks up again and some firms don’t survive, then well-run companies like Singapore Airlines could even pick up market share from any rivals that don’t survive.

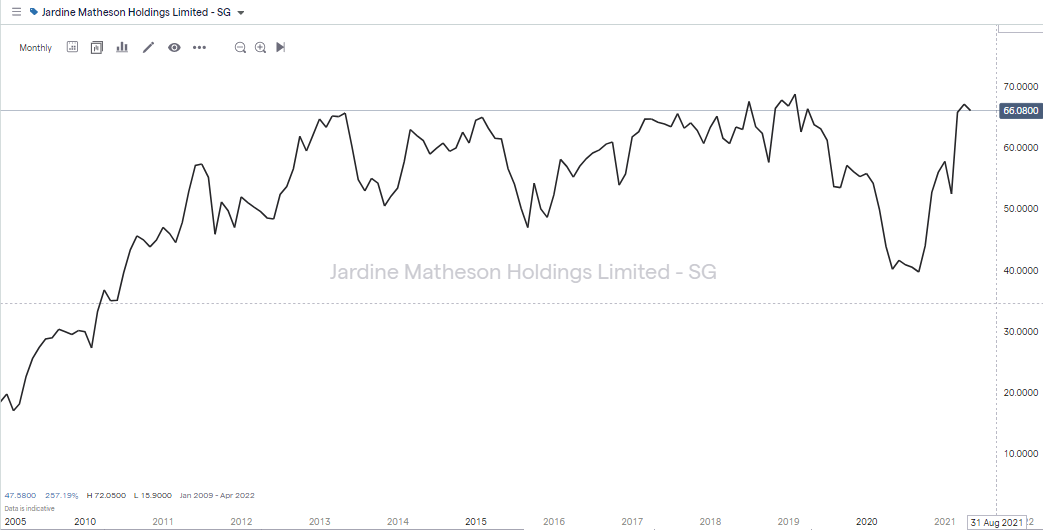

Jardine Matheson Holdings Limited

YOUR CAPITAL IS AT RISK

Jardine Matheson is Singapore’s biggest conglomerate with business interests ranging from automobiles to hotels. As a result, it offers exposure to a wide range of sectors and that diversification can help flatten out bumps associated with general economic booms and busts. The firm is a classic blue chip as it operates businesses with strong brands – some of which have been in existence for more than 100 years – and has a market cap of S$48.2bn. Blue chips aren’t typically associated with dynamic business plans, but there is a re-organisation of the corporate structure taking place, which could act as a catalyst for future growth. In March, JMHL announced it would be buying out sister company Jardine Strategic Holdings in the hope of simplifying the business model and generating better returns to investors.

Thai Beverage PCL

YOUR CAPITAL IS AT RISK

The share price in drinks-maker Thai Beverage posted impressive returns between 2012 and 2017 and has since then been consolidating. The firm has a market cap of S$17.5bn, which is a ‘fair-value’ rating by most valuation models. It’s also worth remembering that a lot of analysts and investors study the firm’s prospects, so there are unlikely to be too many surprises. Over the last five years, Thai Beverage has generated a dividend yield of 2.6–3.6% and it currently has a relatively attractive P/E Ratio, which is under 20%.

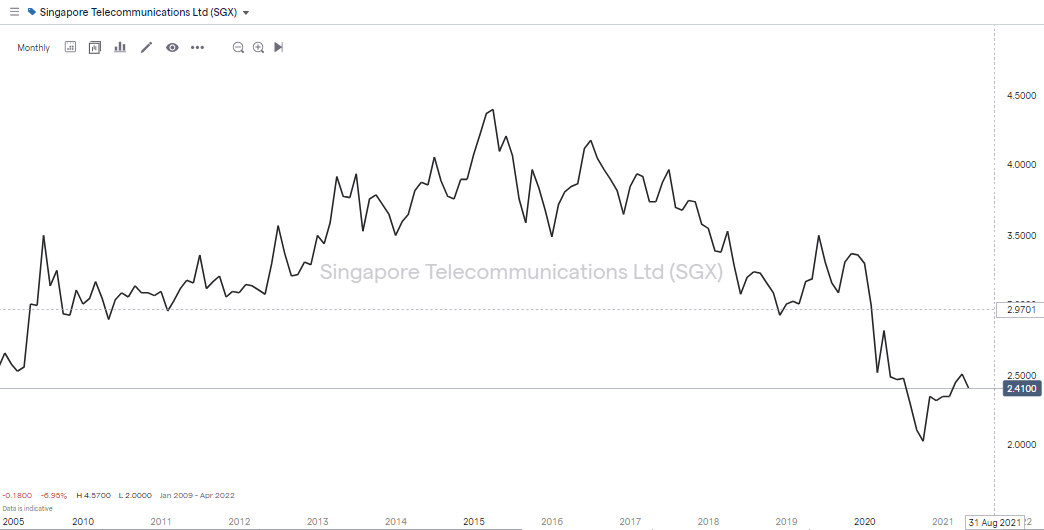

Singapore Telecommunications Ltd (SGX)

YOUR CAPITAL IS AT RISK

Investment banks OCBC and DBS have tipped Singapore Telecommunications (SingTel) as one of their top Singapore stock picks for 2021. The firm has a market cap of S$39.3bn and is predicted to share in the benefits of the economy picking back up post-COVID. Earlier this year it also revealed a new corporate structure, which focuses on ‘capturing new digital growth’ and developing the firm’s 5G business.

On a long-term chart, the Singtel share price is looking relatively cheap. Given the new innovative ideas the firm is proposing, it’s easy to see why many consider it one of the best blue chip investments in Singapore.

Advantages of Blue Chip Stocks

Advantage 1 – Reliability

Firms with a collection of products with well-known brand names can be expected to ride out economic ups and downs. Retail operations such as Jardine’s Dairy Farm supermarkets might not be positioned in the most exciting growth market, but demand holds up regardless of changes to the broader economic climate.

A strong reputation can secure revenue streams and also forms barriers to entry for any newcomers who would be forced to invest heavily in marketing should they want to compete.

Security

Singapore Blue Chips also come under a lot more scrutiny than smaller firms. Retail investors can piggyback off a lot of due diligence work done by institutional investors. The big funds don’t take multi-million-pound positions without kicking the tyres on a firm, so the fact they have invested in a blue chip can be taken as a sign that the firm is credible.

Major shareholders in SingTel, for example, comprise a list of high-grade investment managers and sovereign wealth funds, all of which are already holding sizable positions. These range in size from tens of millions to billions of dollars in size. That kind of investment doesn’t occur without intense and extensive research being carried out.

Advantage 2 – Ease of Access

Online brokers provide markets in most Singapore blue chip shares. The high trading volumes in the market mean that pricing is transparent, spreads are tight and getting in and out of positions isn’t hampered by a lack of liquidity.

Advantage 3 – Free Research & Analysis

As blue chips are so popular with investors, there is a lot of freely available and high-quality research on them. Big banks, third-party research firms and news services all cover the biggest names in any market.

Disadvantages of Blue chip Stocks

Disadvantage 1 – Opportunity Cost

Anything is possible, and some blue chips do from time to time generate spectacular returns to investors, but this is not the norm. Blue chip investments in Singapore are associated with healthy but steady returns. Your money can’t be in two places at once and cash tied up in blue chips might do a job for you in terms of generating a middle-of-the-range return. This does mean you miss out on the opportunity of backing another more exciting growth stock prospect.

Disadvantage 2 – A Perfect Market

The fact that so many people study Singapore blue chip stocks might make it easy for you to carry out your own research, but it’s unlikely that you’ll come across a price-changing catalyst that others haven’t already exposed. Perfect markets, where all participants are up to date and have all the facts to hand, aren’t associated with dramatic price moves.

Disadvantage 3 – Even Blue Chips Go Bust

The fundamental rules of investment and risk management still apply. It’s relatively uncommon, but even market giants can get things wrong.

How to Invest in Blue Chip Stocks

Diversifying your capital across a range of names will mitigate single-stock risk. It can also average out returns because, while blue chips tend to offer a relatively low risk-return option, some investments are more speculative than others.

1. Find a Safe Broker

The most important factor to consider when building a shortlist of brokers is the safety of your funds. For that reason, it is advised to select a broker that is regulated by a tier-1 authority such as one of the below:

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The US Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

2. Choose a Broker That Supports Trading in Singapore Blue Chip Stocks

Most of the established brokers offer markets in the big Singapore names. Firms such as Singapore Airlines, which have a global client base, also attract investors from all over the world. Brokers that specialise in large-cap equities often provide more research, analysis and news, which might be something that is important to you. The functionality of trading platforms is fairly generic, but each broker offers a slightly different take. For that reason, trying out different brokers using a risk-free demo account is highly recommended. It offers a hands-on route to finding a best-fit broker for you and a chance to practise your trading.

Best Brokers to buy Blue Chip Stocks:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookIf you are ready to add some blue chip stocks to your portfolio you'll need a broker that is regulated, has low fees and a user-friendly platform. Finding one can be a daunting task, which is why we've selected some of our favourites that tick all of these boxes to help you get started.

3. Research Singapore Blue Chip Companies Using Fundamental and Technical Analysis

Some traders speculate in blue chip companies using short-term strategies, but the sector tends to attract investors running medium and long-term strategies. Both approaches can take advantage of Technical Analysis and Fundamental Analysis. The former uses market price data to identify short-term pricing anomalies. Fundamental analysis, in contrast, bases investment decisions on a firm’s long-term prospects.

Combining both approaches can help you optimise your trade entry and exit points. Fundamental analysis can establish if a stock merits investment and technical analysis can help you identify the optimal time to take on the position.

Source: IG

4. Open & Fund an Account

Opening an online brokerage account is very straightforward. Brokers require new clients to submit personal information and answer some questions on topics such as ‘trading experience’ and ‘investment objectives’. There aren’t necessarily any right or wrong answers, but going through the process can help you formulate your approach. It also helps the broker build a profile of you and comply with regulatory laws relating to client protection.

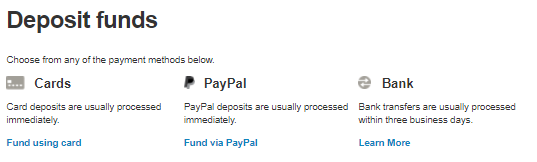

The onboarding process is conducted online and can be done using a desktop or handheld device. Once your account is set up, you can wire funds to it using various payment methods. Credit card, debit card and wire transfer are popular options and some payment methods process the payment instantly.

Source: IG

5. Open and Order Ticket and Select Your Position Size

The user-friendly functionality of online trading platforms makes it easy for clients with all degrees of experience to find the right market. Executing a trade in a Singapore blue chip is as easy as clicking a button or tapping a screen and can be done using a desktop or mobile device.

6. Select & Buy Singapore Blue Chip Stocks

The simplest approach is to enter the amount of shares you want to buy, consider whether you want to add a stop-loss, or take profit instruction, then click ‘buy’. At that point, the system will convert the stated amount of your cash pile into a position in a Singapore blue chip company, which will be valued according to moves in market price.

7. Final Checks After Trading

If your investment is buy-and-hold in nature and something you intend to only check occasionally, it’s important to double-check the details of the trade immediately after executing it. Even experienced traders make ‘fat-finger’ errors and any errors are best corrected before they prove to be costly.

- To check your position, access the portfolio section of the platform and check trade size, direction (buy or sell) and instrument name. It’s also worth monitoring the profit and loss on the trade to ensure it’s in line with what you’d expect to be happening.

- Another check is to ensure your bought shares outright and not as a Contract for Difference (CFD). Most brokers offer both types of instrument and while CFDs have certain advantages, they are less cost-effective if you are holding your position for more than a few weeks. This report offers a more detailed analysis of the pros and cons of both approaches.

Summary

Investing in blue chip Singapore stocks is an ideal way for beginners to start off trading the markets. The familiarity of the brands and a feeling for knowing the products they sell can help even individuals take a view on whether a company is heading in the right direction. There is also the extra comfort gained from knowing big funds also invest in the sector.

Long-term strategies in relatively stable stocks such as blue chips can also remove some of the emotion from your trading decisions. That will help reduce the risk of closing out a position due to short-term price moves. Even those traders who move on to trade higher risk-return strategies, such as growth stocks, often allocate a percentage of their total portfolio blue chips as they can help stabilise returns.