The global pandemic of 2020 has shaken the market up so much that some of the below property stocks currently look undervalued and positioned to offer returns in terms of share price gains as well as dividend yield. This double-whammy of potentially good news, income streams and capital growth is creating a buzz around Singapore property stocks.

As with any building project, getting the foundations right is crucial. As well as identifying target stocks, this review will also outline how to go about turning your ideas into action and invest in them using a safe and trusted broker.

5 Best Property Stocks in Singapore

- CapitaLand Limited

- CDL Hospitality Trusts

- Mapletree North Asia Commercial Trust

- Tuan Sing Holdings Ltd

- APAC Realty Limited

1. CapitaLand Limited

CapitaLand makes the short-list because not only does it offer the consistent if somewhat steady returns offered by property investments, but the company’s statement of 22nd March was full of the buzzwords that investors love to hear.

“CapitaLand proposes restructuring to sharpen business focus and unlock shareholder value.” (Source: CapitaLand)

The reorganisation will require analysts to review their valuations of the firm, with many predicting the new target prices will be higher. For existing shareholders, the good news is they’ll receive an implied consideration of S$4.102 per share. This will be in cash and scrip, including a one-for-one equivalent stake in the new listed entity, which means they are well-positioned to benefit from the shake-up.

The lodging and fund management divisions will be amalgamated and listed as one entity on the Singapore Stock Exchange, while the property development business is taken private. When announced, CapitaLand shares jumped as much as 20% as investors welcomed the proposal.

Source: IG

CapitaLand (CLIM) will be a big deal. It is expected to have S$115bn of property assets under management, making it the largest real estate investment manager (REIM) in Asia – the third-largest listed REIM globally.

- 2020 – Reported dividend amount per share: 3.28%

- 2019 – Reported dividend amount per share: 3.28%

- 2018 – Reported dividend amount per share: 3.28%

- 2017 – Reported dividend amount per share: 2.73%

Source: Dividends

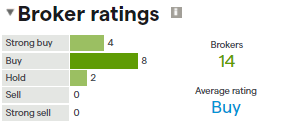

2. CDL Hospitality Trusts

CDL Hospitality Trusts has been listed on the Singapore Stock Exchange since 2006 and grown into a S$1.45bn property giant specialising in the hospitality, retail and restaurant sectors. The CDL share price has bounced back after facing a perfect storm in 2021’s COVID pandemic.

The firm takes a dynamic approach to overhauling properties in its portfolio and is very happy to sell on specific assets at a profit in order to generate dividends for investors. The firm’s 4.7% dividend yield is one of the highest on the Singapore Stock Exchange.

Tipped by many analysts to be ready for a share-price rise, CDL is forecast by investment bank DBS to post ground-breaking revenue figures for 2021. The firm is expected to put the disastrous 2020 behind it and even beat earnings returns from 2019.

Source: IG

- 2020 – Reported dividend amount per share: 5.54%

- 2019 – Reported dividend amount per share: 7.92%

- 2018 – Reported dividend amount per share: 8.20%

- 2017 – Reported dividend amount per share: 8.39%

Source: Dividends

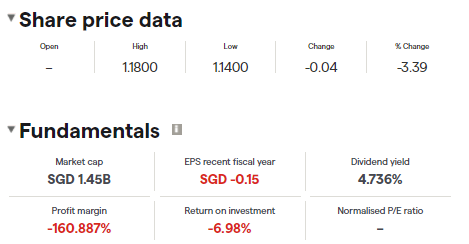

3. Mapletree North Asia Commercial Trust

Property giant Mapletree manages a selection of real estate investment trusts (REITs) but the North Asia Commercial Trust catches the eye due to its focus on Hong Kong and China.

The last couple of years have seen political differences between Hong Kong and China spill over into unprecedented street protests in the HK territory. MNACT properties such as the Festival Walk shopping mall were not only closed as a result, but were also damaged after they became a target of demonstrators. This led to credit agency Moody’s Investor Services downgrading the outlook for the MNACT REIT to ‘negative’.

The COVID pandemic was also bad for business, but one side-effect of the viral outbreak is that it cleared the streets and in doing so provided a fire break to the China-Hong Kong unrest. The Hong Kong economy is now returning to something more like normal activity and the bounce in the MNACT share price points to investor appetite returning.

Source: IG

Festival Walk accounts for more than 55% of MNACTs total revenues and if the shock events of unrest and COVID can be negated, there’s every chance the stock could carry on its upwards trend and meet the DBS target price of $1.20. Even if that takes some time, the generous dividends paid out provide a welcome source of income and mean that the stock is not only one of the best property stocks in Singapore but one of the best dividend stocks in the country as well.

- 2020 – Reported dividend amount per share: 5.93%

- 2019 – Reported dividend amount per share: 7.54%

- 2018 – Reported dividend amount per share: 7.35%

- 2017 – Reported dividend amount per share: 7.23%

Source: Dividends

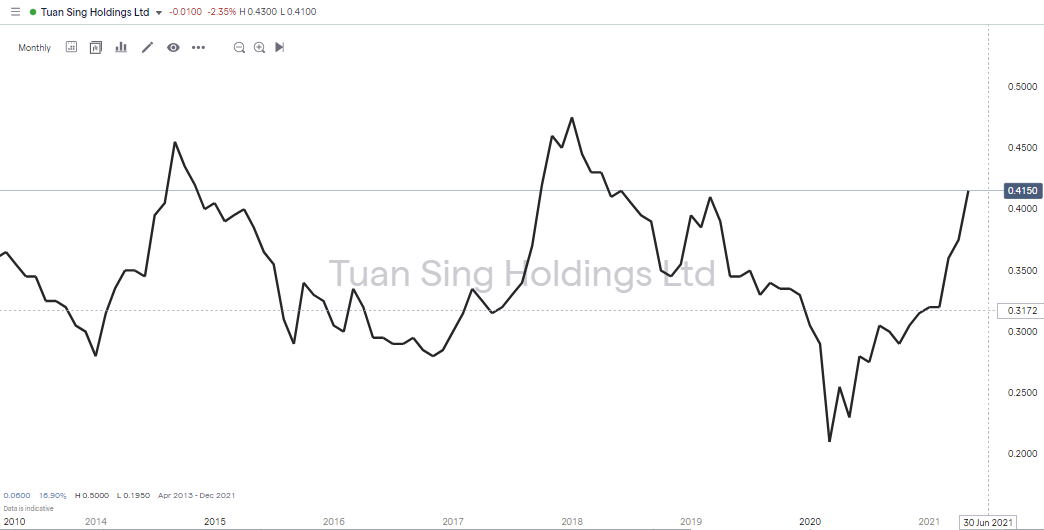

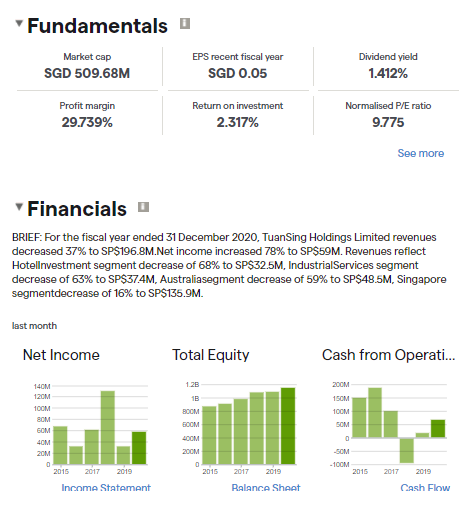

4. Tuan Sing Properties Ltd

Tuan Sing Properties’ share price is already on the move, but analysts at DBS Group Research forecast it still has some way ago. On 5th May 2021, DBS increased its target price for the stock from $0.46 to $0.54.

The group focuses on the premium end of the market, in countries including Singapore, Australia, Indonesia and China. It has a solid track record of developing and investing in prime locations and has exposure to residential as well as commercial projects.

Tuan Sing also manages non-property investments, which from time to time kick in and trigger a share price move. News in May 2021 reported that the electronics firm Gultech China, which it has a 44.5% stake in, might be spun out and listed in China – a good example of the extra juice this company offers investors.

Source: IG

Compared to the other property on our shortlist of the best property stocks in Singapore, Tuan Sing is more about share price growth than dividend returns. It does pay a dividend but takes the view that investors will be better rewarded by the firm reinvesting profits in future projects.

- 2020 – Reported dividend amount per share: 1.43%

- 2019 – Reported dividend amount per share: 2.14%

- 2018 – Reported dividend amount per share: 1.43%

- 2017 – Reported dividend amount per share: 1.43%

Source: Dividends

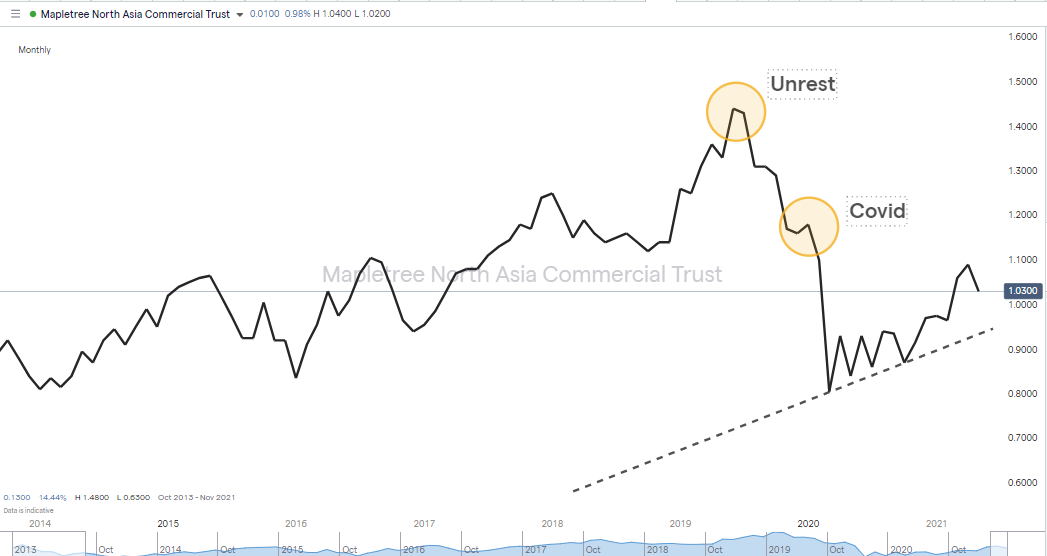

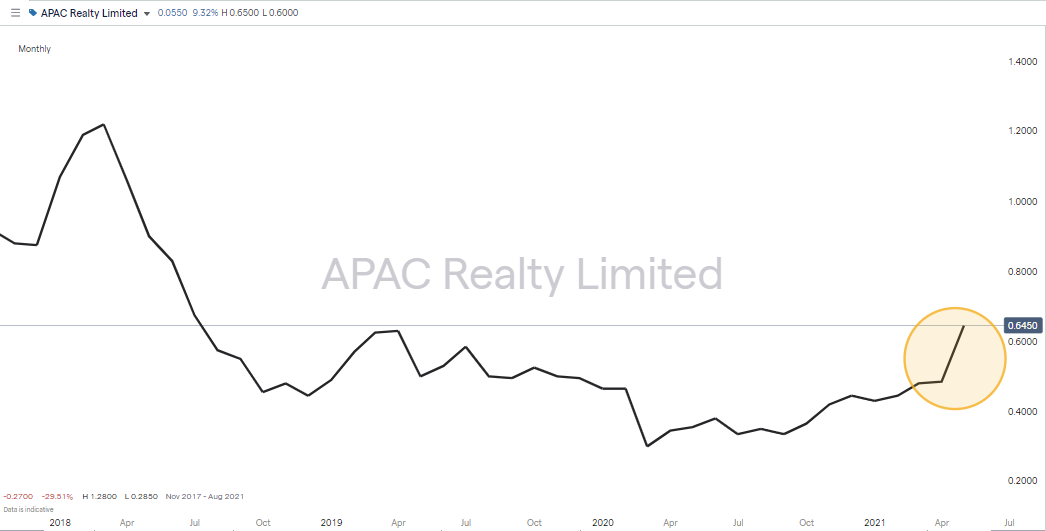

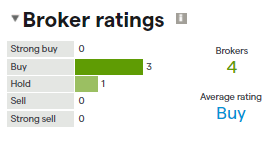

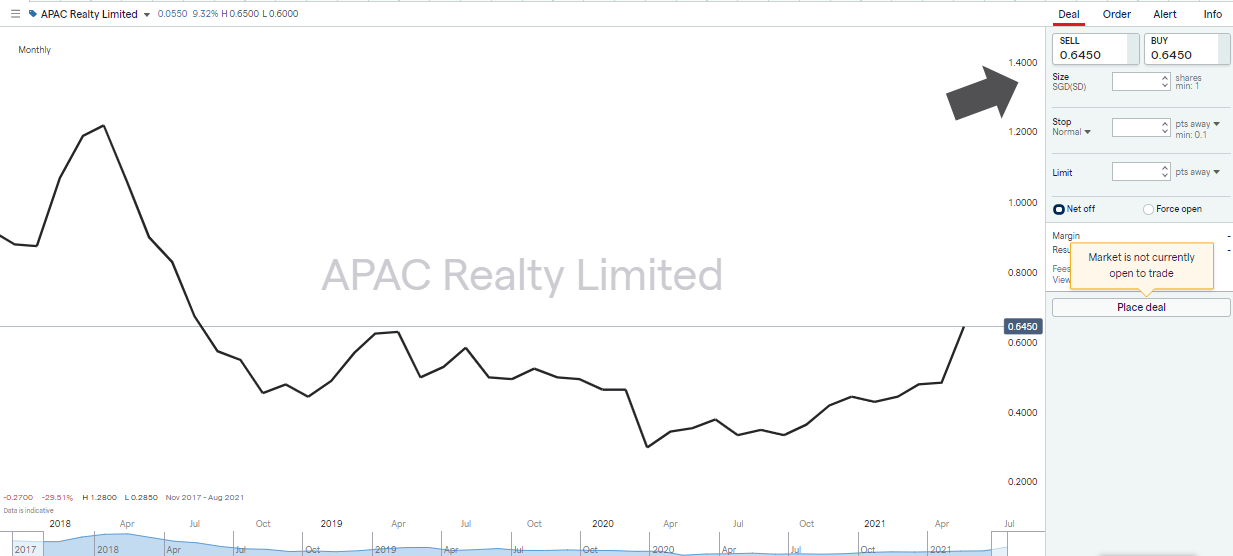

5. APAC Realty Limited

APAC Realty offers a different route into property investment. The firm is the leading real estate services provider in the region. It holds the exclusive ERA regional master franchise rights associated with 17 countries, spanning the Asia-Pacific and has one of the largest brand footprints in Asia. The firm has more than 18,000 sales staff, 646 offices and demonstrates a willingness to invest in innovative software tools. The stock looks well-positioned to profit from the easing of regional COVID restrictions and has begun to show strength in recent months.

The fundamentals of the business look strong. Its core business is real estate brokerage services, but it has developed other revenue streams as well, including franchise agreements, training, valuation and ancillary services. Even if one of these divisions within the firm doesn’t come alive in 2021, the diversification of the operations means the firm could see a significant increase in annual revenues. The DBS Singapore Stock Picks team forecasts revenue in 2021 could increase to S$508m, up from S$395m in 2020.

Source: DBS.com

Source: IG

- 2020 – Reported dividend amount per share: 3.10%

- 2019 – Reported dividend amount per share: 5.04%

- 2018 – Reported dividend amount per share: 6.20%

Source: Dividends

How to Buy Stocks in Singapore

Once you’ve established which Singapore property stocks you want to invest in, there are a few common-sense guidelines to consider in order to turn that idea into a reality. You are after all putting real cash to work, so broker security and reliability are obvious priorities. There’s also the process of actually going about buying shares – this step-by-step guide will show you how.

1. Choose a Broker

As you’re setting up a new account and transferring funds into it, rule number one is to make sure you sign up with a trusted broker. Property investments can often be medium or long-term propositions, so choosing a strong broker will help you avoid sleepless nights.

Financial authorities that regulate the markets can help here – they are ultimately out to protect the little guy. Regulators provide licences to brokerage firms that meet certain stringent criteria. These licences are not easy or cheap for brokers to obtain and there are also ongoing reporting requirements such as independent audits. If your broker is regulated by one of the below Tier-1 authorities, it’s invested a lot of time and effort in making sure it’s compliant with all the latest regulations.

- The Monetary Authority of Singapore (MAS)

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The US Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

As property investments can take months or years to come good, you might want to also consider the track record of the brokers on your short-list. Those that have been around for several years are likely to have established what clients do and don’t want, and that puts them in a stronger position. A little research can help you find the best fit. The pros and cons of some recommended and regulated Singapore brokers are discussed here.

Another aspect to consider when choosing a good broker is the functionality of trading platforms. There are subtle differences to the layout, markets on offer, and T&Cs. Some offer more research than others, some operate notification systems where price alerts are sent to you via SMS messaging services. To establish what works for you, it’s worth taking a few moments to sign up for a demo account. These simulation accounts use virtual funds to trade the markets but everything else is the same as live trading. Demo accounts also offer the chance to practise trading and work through any beginner errors using virtual, not real cash.

Best Brokers to buy Property Stocks in Singapore:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookIf you are ready to add some property stocks to your portfolio you'll need a broker that is regulated, has low fees and a user-friendly platform. Finding one can be a daunting task, which is why we've selected some of our favourites that tick all of these boxes to help you get started.

2. Open and Fund an Account

It’s easy to upgrade your demo account to a live one, or alternatively, you can complete the onboarding process from scratch. It’s all done online, and regulated brokers follow a standard template. They are required to take certain personal details, verify your ID and build a profile for you based on your trading knowledge and experience. The whole process can be done using a desktop device or a mobile handset and takes a matter of minutes to complete.

One other nice-to-have security feature found at the best brokers is their commitment to complying with anti-money laundering (AML) laws. These stipulate that any funds paid into a brokerage account can only be returned to the account from which they came. This cuts down the risk of someone accessing your account and forwarding your funds to a scam account.

Source: IG

The next step is sending funds to your new account. Two of the fastest and most popular payment methods are debit or credit card. Once the funds hit your account, you’re ready to trade.

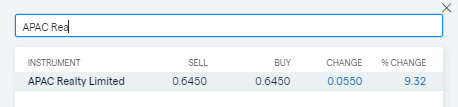

3. Open an Order Ticket and Set Your Position Size

Having used technical analysis and fundamental analysis to identify your target stock, it’s simply a case of searching the platform for that particular market. Depending on which broker you opt to use, you might be able to filter by country and sector and bring up all Singapore property stocks, or you can use the search function.

Source: IG

The most direct way to trade is to click on your target to bring up the trading dashboard, input the amount you want to purchase and click ‘buy’. There are some additional features worth considering as they can help you with risk management.

Source: IG

4. Set Your Stops & Limits

Stop-loss instructions and take profit orders are risk-management tools you can build into the system to manage your positions even if you’re getting on with your day job. They automatically trade you out of some or all of your position if price reaches a certain level, one that you determine.

Stop-losses close out your position if price moves against you. This caps your losses and allows you to fight another day. Take profit orders lock in gains by selling part or all of your position if price reaches your target level.

These two tools are often recommended for beginners but there is an alternative view. Buy-and-hold investors with a long-term view might not use them. Their view is that a short-term price slump might lead to them being kicked out of a position that ultimately comes good. They’d rather ride out the short-term noise.

The Singapore stock exchange has set operating hours, which means you will either need to trade while it’s open or set a limit order. These are binding contracts built into the system to buy at a certain price. They will become live the next time the market opens and if the share price does reach your target level, you’ll be ‘filled’ on your order.

5. Make Your Purchase

Once everything’s been checked and double-checked it is simply a case of clicking or tapping ‘buy’ depending on whether you’re using a PC, tablet or phone. At that point, cash in your account will be converted into a Singapore property stock position and you’ll be positioned to watch how it performs over time. While your trade is live you can make adjustments to any stop loss or take profit orders by accessing the ‘Portfolio’ section of the platform. This is also where you’ll be able to watch the P&L (profit and loss) of that holding fluctuate in line with the live market price feed.

Before leaving your trades and strategy to run their course, it is essential to run some final checks. Even experienced traders make ‘fat finger’ errors, so checking the portfolio screen and reviewing your position is crucial. An erroneous extra zero, for example, can scale up your position size to a level that is far in excess of what you might be comfortable with. Any errors are best rectified before price moves too far from where you traded.