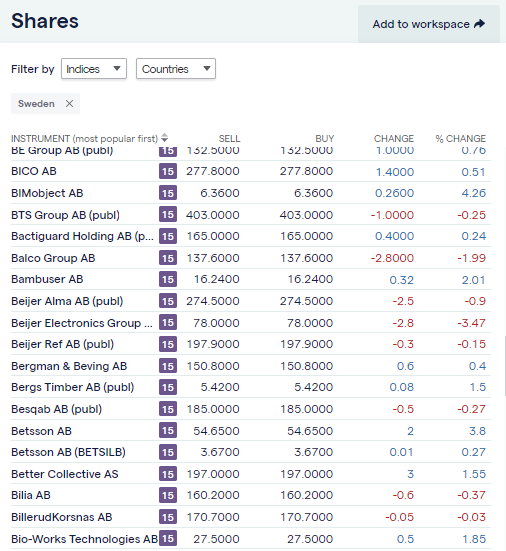

The diverse range of investment opportunities thrown up by Sweden stocks have for a long time made the Stockholm stock market a happy hunting ground for domestic and international investors. It's possible to choose between heavy industry stocks which take advantage of cyclical moves in the global economy, world-leading multinationals, or dynamic tech stocks. The diversity across the sectors makes it easy to follow established investment advice and build a balanced portfolio containing several firms to smooth out returns.

YOUR CAPITAL IS AT RISK

Exciting opportunities and potential returns are only part of the appeal of Sweden stocks. The financial market is well regulated, and the Swedish Financial Supervisory Authority (SFSA) is a well-respected Tier-1 regulator. The Stockholm Stock Exchange, recently rebranded as Nasdaq Stockholm, is the main stock exchange of Sweden and was founded in 1863. Swedish corporations are also sticklers for good governance and offer a reliable way for investors to gain exposure to domestic, European and global markets. There are, of course, some potential pitfalls to avoid, and the below step-by-step guide offers insider tips on how to trade safely and optimise returns. It draws on the experiences of seasoned traders who have used technical and fundamental analysis to identify the five best Swedish stocks.

Best Swedish Stocks To Buy

1. Nordea Bank Abp

Long-term investors looking for a high-quality Swedish dividend stock could do worse than Nordea Bank Abp. The Helsinki headquartered firm is listed on Nasdaq Stockholm under the ticker (NDA). It leverages off its strong position in the Scandinavian market to offer banking services to a global client base. It has offices in locations ranging from Chile to China.

Nordea offers banking, financial and related advisory services, including financing and deposit services, savings and asset management, insurance products, investment banking, securities trading, cash management and mobile banking. The firm's mission statement describes the one-stop-shop approach as “Universal Banking”. Its services mean it is well-positioned to benefit from growth in the different corners of the financial services industry. The client base is also diversified and includes private individuals, corporations, institutions, and the public sector.

With a rise in global interest rates expected the banking sector as a whole is tipped to prosper from enhanced profit margins. It's challenging for bankers to generate returns when base rates are near zero. A glance at Nordea Bank's dividend history shows that between 2014 and 2018, the dividend yield was between 6.13% and 9.49%. More impressively, between 2011 and 2020, there was only one year (2019) when the firm didn't manage to increase its annual payments to shareholders.

A €2bn share buyback programme announced on the 20th of October 2021 will offer further support for the share price that between the 25th of January and the 27th of September 2021 increased by 66%.

Nordea Bank Abp – Weekly Price Chart 2020 – 2021

Source: IG

Nordea Bank Technical Analysis

In recent months, the bull-run in the Nordea Bank share price levelled off, but this appears to be a consolidation pattern rather than a cause for concern, and dip-buyers will note the support offered by the 20 SMA on the Weekly price chart. The SEK 100 price level is a psychologically important one that provides significant support for a stock that offers both potential capital returns and a steady income stream.

A break above the 20-year price high of SEK 115.14, recorded in May 2017, could trigger further NDA share price gains. Should that resistance level be breached, few technical restraints remain on further upwards movement.

Nordea Bank Abp – Weekly Price Chart 2000 – 2021

Source: IG

Nordea Bank Technical Analysis

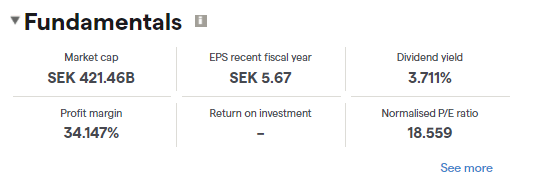

Operating profit margins of 34% back up the attractive dividend yield, and the market cap of SEK 421 billion indicates the security offered to investors by the firm's size and the sector it operates in.

Nordea Bank Nbp– Strong Fundamentals

Source: IG

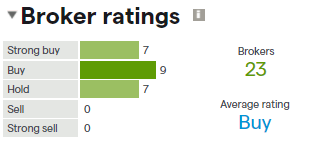

The broker community are fans of the stock, with the average rating of 23 analysts being that the stock is a ‘Buy' and none of the 23 tipping it at anything lower than a ‘Hold'.

Nordea Bank – Rated a ‘Buy'

Source: IG

For the nine months ended the 30th of September 2021:

- Nordea Bank Abp interest income decreased 6% to €73bn

- Net interest income after loan loss provision increased 46% to €63bn

- Net income applicable to common stockholders increased 84% to €79bn

- Net interest income after loan loss provision reflects Business Banking segment increase of 93% to €23bn

- Corporates & Institutions segment increase of 85% to €

Source: IG

2. Getinge AB

Medical equipment manufacturer Getinge AB has had a good pandemic. Between November 2020 and October 2021, the Getinge stock price rallied by more than 130%, but it's not just a COVID stock.

Out of its Gothenburg headquarters, the firm develops, manufactures and sells products and services for operating rooms, intensive-care units, hospital wards, sterilisation departments and elderly care institutions. Getinge's Infection Control division was well-positioned to benefit from the COVID pandemic. The other operating segments, Medical Systems and Extended Care, are also well-positioned to profit from the medical needs of the ageing populations of the United Kingdom, France, the US and Australia, where the firm has operations.

Getinge AB – Price Chart 2015 – 2021

Source: IG

Getinge AB Technical Analysis

After bursting through the resistance level of SEK 243, which marked the previous share price high of July 2013, the Getinge share has continued to show strength. A recent pullback looks more like a chance to get into a position rather than a trigger to sell up. Price has since December 2018 found support at the level of the Weekly 20 SMA, and that remains a key technical indicator to look out for.

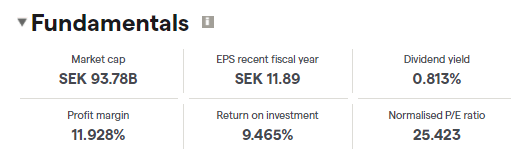

Getinge AB Fundamentals

The impressive recent run in the Getinge share price has had a knock-on effect on the dividend yield and P/E Ratio. It might take a while for the predicted surge in revenue to come through the pipeline, but the P/R Ratio of 25.42 is by no means out of line with the medical sector or growth stocks as a whole. As of the 30th of June 2021, Siblis Research quoted the P/E Ratio for global stocks to be 25.15 and for stocks in developed economies to be 27.05.

Getinge AB – Fundamentals

Source: IG

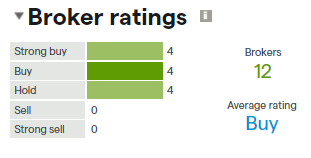

Getinge might not be as big as some of the largest global operators but still has a market capitalisation close to SEK 100bn. As a result, 12 institutional brokers have analysts covering the stock. The consensus rating of that group being ‘Buy'.

Getinge AB – ‘Buy' Broker Rating

Source: IG

For the nine months ended the 30th of September 2021:

- Getinge AB revenues decreased 9% to SEK 19.06bn

- Net income applicable to common stockholders increased 3% to SEK 2.2bn

- Revenues reflect Acute Care Therapies segment decrease of 15% to SEK 11.3bn

- Surgical Workflows segment decrease of 6% to SEK 5.25bn

- EMEA segment decrease of 17% to SEK 7.03bn

- America's segment decrease of 7% to SEK 7.55bn

Source: IG

3. Volvo AB (B)

Between the March 2020 lows and March 2021, vehicle manufacturer Volvo (STO:VOLVB) saw its stock rally by more than 130%. Even before the subsequent dip in the share price, it attracted investors willing to get on board a company that is still undervalued according to many metrics.

The Volvo Group is a manufacturer of cars and trucks, buses, construction equipment, diesel engines, and marine and industrial engines. The Company's brand portfolio consists of Volvo, Volvo Penta, UD, Terex Trucks, Renault Trucks, Prevost, Nova Bus and Mack. The exposure to the heavy plant market puts the firm in an excellent position to benefit from an uptick in business from the mining sector. With a global commodity super-cycle predicted by many, extra revenues from that division could act as a catalyst for further share price growth.

Volvo AB (B) – Share Price 2020 – 2021

Source: IG

Volvo AB (B) Technical Analysis

Volvo has spent most of the last five years trading above the 100 Weekly SMA, which currently sits at SEK 185. Even if the ‘big number' support of SEK 200 doesn't hold, then it would take a break of SEK 185 to occur before a bearish price pattern could be argued. Using the monthly price chart, long-term investors will note that over a longer timescale, the 20. 50 and 100 SMAs are aligned in a bullish pattern.

Volvo AB (B) – Monthly Share Price Chart 2005 – 2021

Source: IG

Volvo Fundamentals

Volvo's track record of matching consumer appetite stems from its pioneering of improved passenger safety and has moved onto the current trend for environmentally sensitive transport. Its move into Electric Vehicles is matched by its Green Steel initiative and market-leading ESG policies. Volvo started publishing ESG reports back in 2007, before most of its rivals and years before Tesla Inc was even a thing.

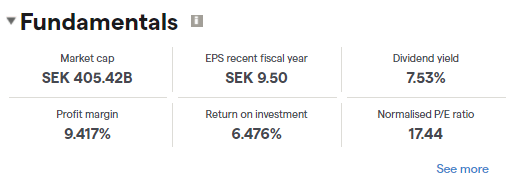

Volvo AB (B) – Fundamentals

Source: IG

The dividend yield of 7.53% will be attractive to many, and the P/E Ratio of 17.44 leaves room for capital gains as well.

For the nine months ended 30 September 2021:

- Volvo AB revenues increased 12% to SEK 269.84bn

- Net income applicable to common stockholders increased from SEK 10.12bn to SEK24.79bn

- Revenues reflect Trucks segment increase of 12% to SEK 163.72bn

- Construction Equipment segment increase of 16% to SEK 70.22bn

- Volvo Penta segment increase of 21% to SEK 10.8bn

- Europe segment increase of 20% to SEK112.89bn

- North America segment increase of 20% to SEK 70.46bn

Source: IG

4. Stillfront Group AB

Gaming firm Stillfront Group AB posted spectacular trading figures in 2020 due to global lockdowns drawing in more customers to the company's extensive suite of online platforms. Investors who experienced FOMO when the share price skyrocketed by more than 200% can take comfort from recent share price weakness. The fundamental strengths of the firm remain intact and make Stillfront the pick of the Swedish tech sector stocks.

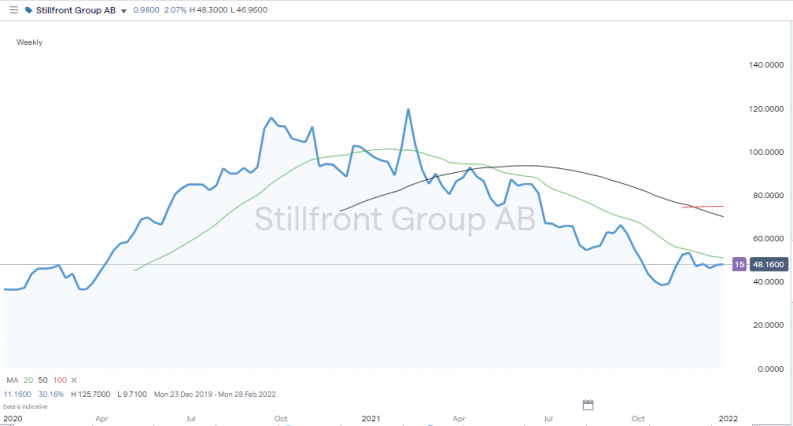

Stillfront AB Share Price Chart – 2020 – 2021

Source: IG

Stillfront Group Technical Analysis

Stillfront Group shareholders have experienced something of a rollercoaster ride since the firm first listed in 2015 at an IPO price of SEK 38. Anyone that failed to lock in some profits when the price got as high as SEK 125 in February 2021 will be disappointed with the subsequent price slide. This could be an opportune time to buy in for investors new to the stock.

As long as the key price support level of SEK 38 holds, there is a limited downside for those looking to pick up a bargain. With price trading below the 20, 50 and 100 SMAs, those metrics may provide resistance to upward momentum. However, potential catalysts for such a move include the risk of a virulent strain of Covid requiring further lockdowns.

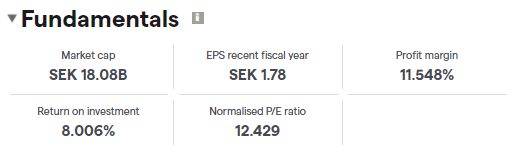

Stillfront Group Fundamentals

Stillfront Group is a leading player in the largest and fastest-growing entertainment market. It offers users a diversified portfolio of free games developed in-house or through acquisitions. The games are designed to have broad appeal to gamers all over the world, and despite the share price more than halving in value between February and October of 2021, the firm still has a market capitalisation of SEK 10.08bn

Stillfront Group Fundamentals

Source: IG

The gaming sector is a high risk-return proposition for investors, and there is enough juice in trades in the sector without targeting the more volatile stock names. Stillfront Group has positioned itself at the more cautious end of the sector. Its strong financial position, relatively low leverage and healthy profit margins being based on a diverse range of income streams.

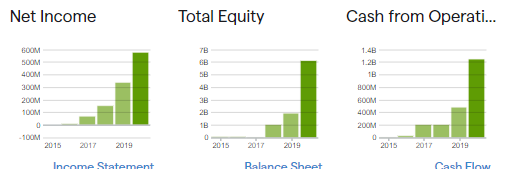

Stillfront Group Balance Sheet

Source: IG

Confirming its position as a growth stock, Stillfront Group instead has announced that share buybacks and dividends are off the radar until 2023 at least. Instead, profits are re-invested in the core business activities and M&A activity, and so returns to investors will come from capital gains rather than income streams.

Stillfront Group Broker Ratings

Source: IG

For the nine months ended the 30th of September 2021:

- Stillfront Group AB (publ) revenues increased 38% to SEK 4.01bn

- Net income applicable to common stockholders increased 1% to SEK 420m

- Revenues reflect an increase in demand for the company's products and services due to favourable market conditions

- Net income was partially offset by User acquisition costs increase of 95% to SEK 1.03bn (expense).

Source: IG

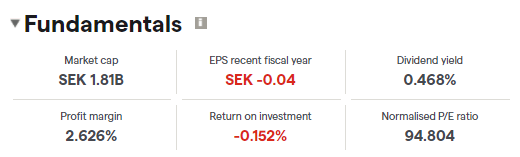

5. Hanza Holding AB

Headquartered in Kista on the outskirts of Stockholm, Hanza Holdings epitomises a lot of the characteristics of the best of the Sweden stock picks. The firm is an innovative ‘solutions provider' and ‘knowledge-based manufacturing company. It has interests ranging from traditional heavy industries to the forward-looking areas of the electronics sector. It has a robust domestic base but is aggressively moving into other European markets and is not shy of engaging in M&A activity to supplement its organic growth.

It also ticks the box in terms of ESG credentials. Founded in 2008, Hanza has managed to avoid legacy issues relating to bad business practices. Its core business operations create shorter lead times, more environmentally friendly processes and increased profitability for our customers. As the firm's website says, “This means we are contributing to a better and more sustainable future” (source: Hanza).

The company has operations in Sweden, Germany, Finland, Estonia, Poland, the Czech Republic and China and recently reported sales exceeding SEK 2bn. The client base comprises leaders in their sectors and includes companies such as ABB, Epiroc, Getinge, Oerlikon, Saab and Siemens.

Hanza Holding AB Daily Price Chart – 2020 – 2021

Source: IG

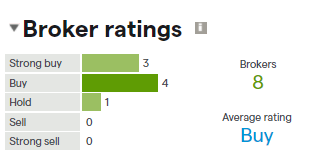

Hanza Holdings AB Technical Analysis

In terms of price action analysis, the current charts suggest the path of least resistance is upwards. In the last quarter of 2021, the stock almost doubled in value, which leaves potential room for a short-term pullback. But given the move was associated with a significant increase in trade volumes, there are signals that the multi-month bullish momentum has widespread support.

Hanza Holding AB Daily Price Chart – 2020 – 2021 – Increased Trade Volumes

Source: IG

Hanza Holdings AB Technical Analysis

One reason for the recent extra interest in Hanza is the firm's October purchase of Helmut Beyers GmbH (‘Beyers') – an electronics manufacturer in Monchengladbach, Germany, which has a workforce of approximately 150 people. The deal marks a kickstart of Hanza's planned expansion into Europe's largest economy and the continent's engineering hub. The development was put on hold by the COVID pandemic, but the clear signal that Hansa is back in the game was a catalyst for the share price exploding.

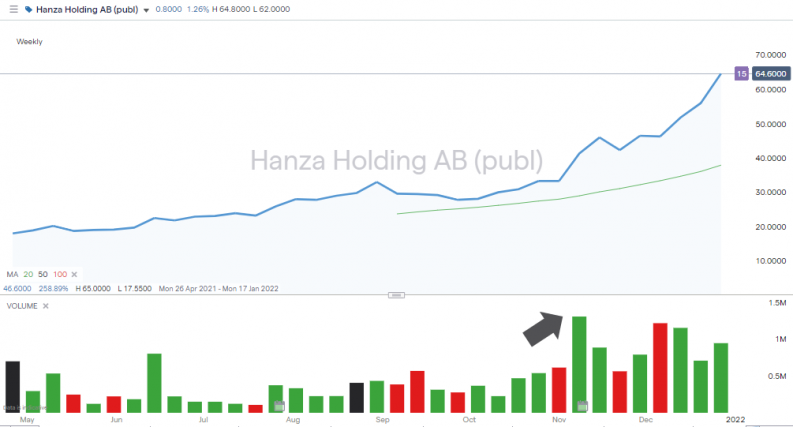

Hanza Holding AB- Fundamentals

Source: IG

The purchase will do little to ease one potential concern relating to whether or not to buy Hanza – the significant debt on the balance sheet. Investors have so far signalled that concerns about borrowing levels are a matter for another day. With green firms being a hot topic at the moment, the attractive eco-credentials of the company appear to be dominating the investor decision making process.

For the nine months ended the 30th of September 2021:

- Hanza Holding AB revenues increased 8% to SEK 1.8bn

- Net income totalled SEK 55m vs loss of SEK 6.6m

- Revenues reflect the rest of the world segment increase of 12% to SEK 843.7m

- Nordic segment increase of 5% to SEK 954.9m

- Net income reflects Nordic segment income increase from SEK 30.6m to SEK 71.9m

- The rest of the world segment income totalling SEK 34.6m vs loss of SEK 700k.

Source: IG

How to Buy Stocks in Sweden

Buying stocks in Sweden requires setting up a brokerage account, which can be with a local or global broker. The good news is that it takes a matter of minutes to set up an account and good brokers allow new clients to complete the process entirely online, using a desktop or handheld device.

Local investors with an existing relationship with a Swedish bank might find they also offer share dealing services. While this approach can be more convenient, domestic broker fees can be higher than those of international brokers who benefit from economies of scale and operate in highly competitive markets. International brokers tend to be more cost-effective and offer a more comprehensive range of markets should investors want to branch out into new ones.

Below are the simple steps to take to avoid slip-ups, manage risk, and find the optimal entry and exit points on trades.

1. Choose a Broker

The crucial factor to consider when setting up a new broker account is the safety of funds. There are, unfortunately, scammers operating in the market, but following some basic rules can help avoid them. One of the easiest ways to locate a legitimate broker is to select one regulated buy a Tier-1 authority, such as one of the below:

- The Swedish Financial Supervisory Authority (SFSA)

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The US Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

Additional due diligence checks can include visiting the regulator's site (such as this one here, SFSA) and cross-referencing any claims made by a broker that they are regulated. Selecting one of the big international brokers is another top tip.

Firms such as IG and eToro have been operating for years and are incentivised to do what it takes to protect their reputation in the investor community. As a result, they are very conscious of the need to look after their account holders and often offer additional client protection services.

Other criteria by which to judge brokers include the functionality of the trading platform and terms and conditions. Getting a good fit on these items can directly improve financial returns. Some brokers specialise in particular sectors and markets, while others offer more research and analysis tools.

Demo accounts are free to use, take moments to set up and offer an excellent way to get a feel for a particular broker. As the funds used in them are virtual, they provide a risk-free way to test new strategies or practise trading a market before going live with real cash. Demo accounts use live price data, so running test trades can also help those who are still finalising their selection and determining what Sweden stocks to buy right now.

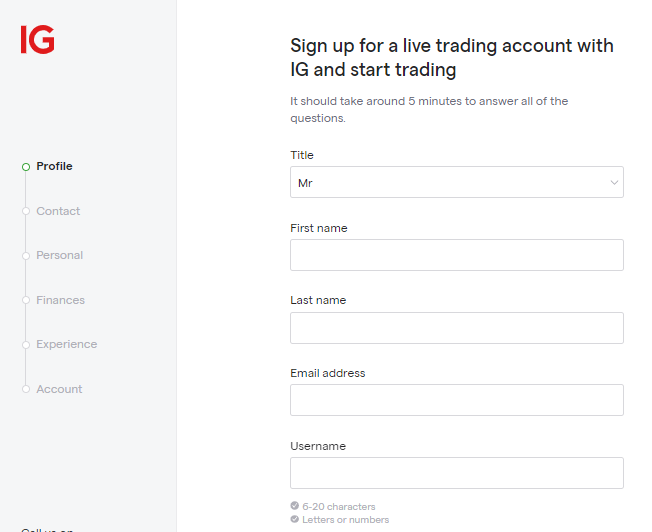

2. Open and Fund an Account

Online broker accounts are similar to online bank accounts, with the difference being that stocks, cash and other assets can be held in them. The process of setting one up is, therefore, similar to setting up an online bank account with new users being required to provide proof of identity and other KYC (Know Your Client) style material.

After the onboarding process is completed, you, and only you, will have access to the account. Exact rules and regulations differ according to which regulator oversees the broker's activity but make the right choice and you'll also be covered by Anti-Money Laundering (AML) laws. They are designed to clamp down on international crime by restricting the option of forwarding funds to another account but have the side effect of providing an extra layer of security for retail investors.

Source: IG

The onboarding process typically takes less than 10 minutes to complete, and the next stage is wiring funds to your new account. Modern brokers offer a range of payment processing options, including debit and credit cards, wire transfer and e-payment options.

Most deposits are free of commissions, but some brokers charge for withdrawals and some payment methods take longer than others. Checking the T&Cs beforehand can help new traders avoid experiencing unnecessary costs or inconvenience.

3. Open an Order Ticket and Set Your Position Size

Due to the popularity of Swedish stocks, most broker sites offer a good selection of names. If you know your target stock already, using the search function will take you to that market or filter the stock database by country.

Buy-and-hold style investors need to check they are buying shares in the firm, not trading them in CFD form. CFDs are popular with traders running shorter-term speculative strategies, but they come with daily financing charges, which can stack up over time and reduce returns.

Source: IG

Clicking on any of the listed stock names will take you through to the dashboard for that stock. This is where it's possible to get an up-to-date picture of how it is trading and the latest news and research. Buying the best stocks to buy now in Sweden is then as simple as entering the quantity of the stock you want to buy into the trade-execution interface and clicking or tapping ‘Place Deal'.

Trading Dashboard for Volvo AB (B)

Source: IG

4. Set Your Stops & Limits

Risk management is a vital part of successful trading, and two tools to consider using are Stop Loss and Take Profit instructions. These are orders built into the system and automatically instruct the broker to automatically sell some or all of a position if price reaches a certain level. Stop losses are activated if price goes against you and cuts the losses on a losing position. Take profits work in the opposite direction and lock in gains if price rises as expected.

Some long-term investors choose not to use these tools. They take the view that a short-term price crash could kick them out of a position. That would crystalize losses on a position that might ultimately come good. Take profits also put a cap on the upside.

There is also ‘gapping risk' to consider, which occurs when a stock moves from one price level to another overnight. The Nasdaq Stockholm exchange has set opening hours, and if price jumps from one level to another when the exchange is closed, then the level at which your stop comes into play could be lower than what was input.

Other risk management techniques include diversifying your holdings to minimise single-stock risk and iron out returns. Standard investment advice also includes investing in small size to take the emotion out of trading.

5. Make Your Purchase

The last stage of buying Swedish stocks involves clicking or tapping ‘Buy'. At this point, cash in your account is converted into a stock position, the value of that position from then on being 100% dependant on market price.

The P&L (profit and loss) report in the Portfolio section of the broker's platform can help traders follow the performance of their positions. This area of the site is where any stop losses can be adjusted and where busy traders can set price alerts so that they are messaged about significant price moves.

Selling out of positions is as straightforward as accessing the Portfolio screen and clicking ‘Sell' instead of ‘Buy'.

There is one final check to make on new trades. That is to double-check that your executed transaction matches what you intended to trade. Even experienced traders make ‘fat finger' errors, and any errors such as buying instead of selling, or entering the wrong quantity, are best corrected immediately.

Summary

The Swedish financial market continues to throw up a range of interesting and profitable investment opportunities. An additional incentive to invest in the best Swedish stocks is that the governance of the firms and stock exchange are of the highest level.

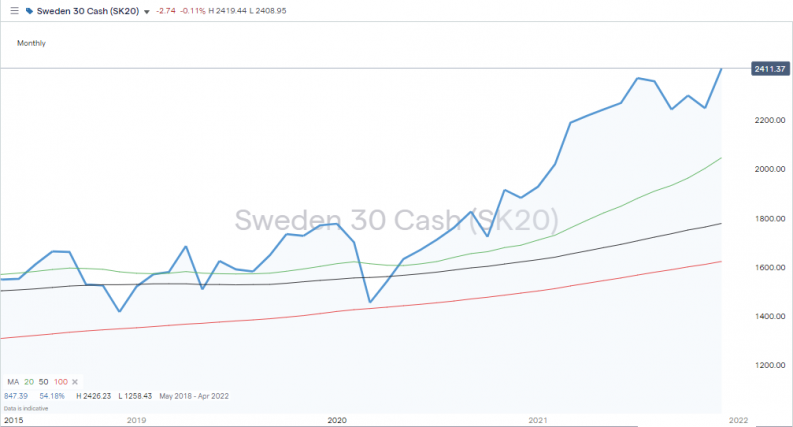

It is worth investing some time researching and identifying the best stock picks in Sweden as there is considerable divergence in the individual stocks' returns. While some of the above names have doubled in value over a matter of months, the SEK 30 benchmark index of the largest Swedish stocks was up ‘only' 28.8% in 2021.

Sweden 30 Stock Index – Up 28.8% in 2021

Source: IG

Most of the hard work required to be a successful investor is carried out at the research and analysis stage. But once that is done, investing in Sweden stocks is simply a case of following the simple guidelines designed to mitigate operational risk and optimise returns.