Barclays shares are listed on many different exchanges, so there depending on which one you prefer, the ticker will change. That being said, the ‘primary’ listing for Barclays PLC is on the London Stock Exchange where it trades under the ISIN code GB0031348658 ticker BARC.

Barclays PLC is a holding company. Entities operating under it are divided into two divisions, Barclays UK and Barclays International.

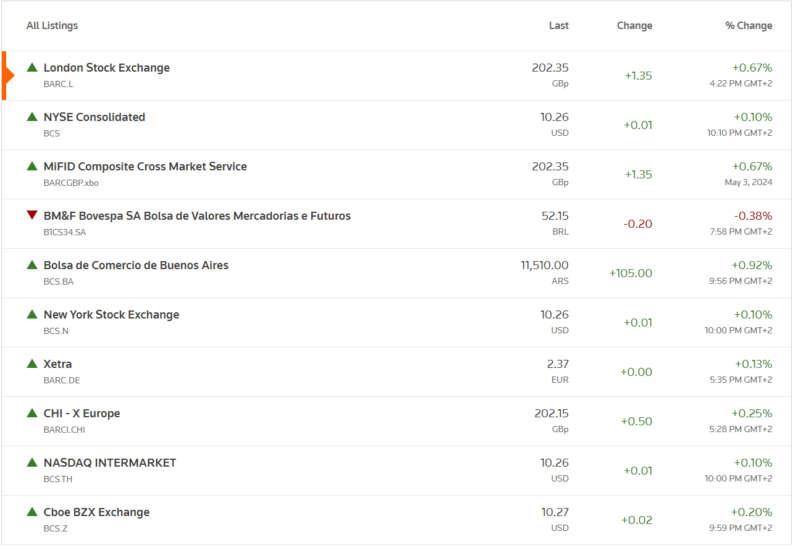

To satisfy international investor demand, Barclays has also set up seven more listings, found on a range of global exchanges, from Buenos Aires to Frankfurt. You can see the various tickers you will need below in the event you are interesting in buying Barclays shares outside of the London Listing. All other aspects of the process will be the same, except the ticker, and potentially finding a broker or platform that supports the listing you prefer.

Source: Reuters

Steps to Buy Barclays shares

Thanks to online brokers, it is now incredibly simple to buy shares in Barclays. The straightforward process involves setting up an account using a desktop or handheld device. The broker platforms have been designed to cater to beginners and have teams of customer service advisors on hand.

The two most popular ways to trade Barclays are CFDs and share dealing. Both methods offer a way of gaining exposure to BARC. In share dealing, you buy the shares outright using a buy-and-hold-style strategy. This can involve greater up-front costs but could be cheaper in the long run.

CFD trading involves setting up a contract with a broker where you pay or receive funds according to which way the BARC share price moves. CFD trading has more functionality. It’s possible to use leverage and sell-short and, therefore, attract traders using short-term strategies.

If you’re looking to hold your position in Barclays for longer than 4–6 weeks, then you may want to consider using the share dealing approach and buying the shares outright. A more detailed breakdown of ways to find out which format is for you can be found here.

1. Research To Be Sure It Fits Your Goals

The first step towards buying Barclays shares is to establish the why, what, when, and how. Your strategy should include entry and exit points, but that doesn’t necessarily mean it needs to be complicated. Buy-and-hold and forget can be as profitable a strategy as any other.

There is lots of free research available online and at Barclays itself.

- Technical analysis — If you’re using short-term strategies, you might want to consider technical analysis. This is the study of historical price data and chart patterns to try to predict future price moves.

- Fundamental analysis — This involves an in-depth analysis of the Barclays business model. You don’t have to do all the number-crunching yourself, as some market participants, such as the brokers, are happy to work through the reports and offer a summary of the state of Barclay’s prospects.

Looking at what market analysts have to recommend about Barclay’s stock is also a good place to start your share buying journey. Often, market analysts will have clear view on whether or not they would recommend buying a certain stock or share. Analysts will also have price targets and predictions of how they envision the price movements of share prices. You may also want to learn how to value stocks to help form your own conclusions.

Below are some general analyst price targets that can give you an indication of the sentiments surrounding BARC.

Steps 2 and 3 can be skipped if you already have a broker or trading platform to move forward with. If this is the case, simply skip to step 4.

2. Find a Trusted Broker That Supports The Stock

The most important aspect when choosing a broker is to use one that is regulated by a strong and trusted regulator. A good place to start is looking for platforms that are licensed by the Cyprus Securities and Exchange Commission (CySec), the Financial Conduct Authority (FCA), and/or the Australian Securities and Investments Commission (ASIC), depending on where in the world you are.

Most brokers will support Barclays shares as an instrument, but that is not a given. There are various that may not hold UK listed stocks, and if this is the case, your options are to consider one of the secondary listings that may be supported, or to find another platform if you are adamant about moving forward.

3. Open & Fund an Account

Online registration can be completed in a matter of minutes. There are some standard questions to answer about your investment objectives and most brokers allow ID documentation to be uploaded using a phone camera.

If you wire funds into your broker account, using a bank or credit card for funding will be almost instantaneous. There are also a variety of other payment methods available.

4. Set Order Types

The trading process is relatively straight forward. After accessing the market for Barclays you’ll be given the option to ‘buy’ or ‘sell’. If you are using a stocks only broker, you will not have the sell option if you do not hold Barclays shares already.

You will see a data field in which to input the amount you want to trade.

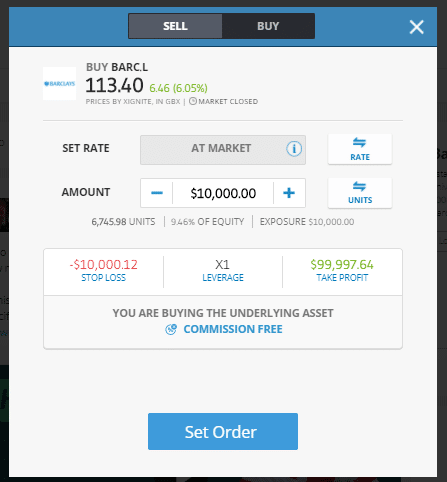

As in the example platform below, if you are trading using derivatives such as CFDs, or Options, you’ll be able to ‘sell short’ Barclays shares. It is also possible to set leverage levels when trading derivatives.

Depending on whether you are using a desktop or handheld device, you will then be just one click, or one tap, away from putting on a trade.

This stage of the process is where you can input automated instructions to close your position at certain price levels. ‘Stop-loss orders’ and take-profit instructions are neat risk management tools that mean you don’t have to be watching the markets all the time. They can be added at the time of the trade, or at a later stage in the trade life-cycle.

Source: eToro

5. Select and Buy Barclays Shares

With the order details built, there is one last chance to double-check the instruction.

The final click or tap will be on a button, which, depending on your broker, will have a name like ‘Place Order’, ‘Open Trade’ or ‘Place Order’. At this point, your cash account will be debited the amount of cash needed to buy the designated number of Barclays shares.

The value of the holding will fluctuate in your portfolio screen along with the market price. Monitoring the performance of your BARC holding will be possible via the ‘portfolio’ monitor. It will also be possible to manually close out of your position from this part of the site.

Fees When Buying Barclays Stock

The fees associated with trading and holding Barclays stock need to be factored in. They can eat away at trading profits.

A lot of brokers offer ‘commission-free’ trading and instead make their money on the bid-offer spread. Keeping an eye on spreads and making sure they aren’t too wide is, therefore, a good move.

Daily overnight financing charges will also apply if you are trading using CFDs. Inactivity fees and bank charges on cash transfers are other risk-free costs, which can be minimised if you carry out some basic research on broker T&Cs.

Fee calculations need to factor in the likely holding period of your position. One question will be whether to trade using CFDs or Shares.

| eToro | Plus500 | Markets.com | |

|---|---|---|---|

| Inactivity Fee | Yes | Yes | Yes |

| Inactivity Fee details | $10 per month. After 12 months | $10 per month. After 3 months | $10 per month. After 3 months |

| FX Conversion | Yes – on non-base currency trades | Yes – on non-base currency trades | Yes – on non-base currency trades |

| Fund withdrawal fees | Yes – $5 | Applied on some payment methods | Yes – $5–$100 |

| Trading commissions | Included in spread | Included in spread | Included in spread |

| Overnight Financing | Yes, on CFDs | Yes, on CFDs | Yes, on CFDs |

YOUR CAPITAL IS AT RISK