yOUR CAPITAL IS AT RISK

Profitable investing can include translating what you see around you into trades in the right sector. If your line of work involves getting a feel for the state of the economy, and people you interact with are being more cautious, then it could be time to invest in defensive stocks. This article will explain what investing in defensive stocks is all about and the reasons why you might want to do it.

- What are the characteristics of defensive stocks?

- Why do people invest in defensive stocks?

- What is sector rotation?

- Are defensive stocks risky?

- Final thoughts

What are the characteristics of defensive stocks?

The Corporate Finance Institute defines a defensive stock as:

“… a stock that demonstrates relatively stable performance regardless of the current state of the economy. Defensive stocks are also called non-cyclical stocks, as they are less prone to the economic cycle of expansions and recessions. Defensive stocks will come with a steady dividend payment and a more constant share price.”

Source: Corporate Finance Institute

Most of the interest in defensive stocks comes about from their low correlation to other sectors and the economic cycle. They offer something different.

Outlining the difference between defensive stocks and ‘growth stocks’ provides more context.

Growth stocks are stocks that offer a substantially higher than market average. As they grow at a faster rate than the average, they generate earnings more rapidly.

It’s worth pointing out that growth stocks can, over time, mature and become more defensive in nature.

There is no long-term list of both types. It’s more a case of identifying stocks that have certain characteristics at any one time.

Reliable returns

As the term ‘defensive’ suggests, the stocks are seen as providing some form of protection. During times of market stress, defensive stocks will have better-protected revenue streams. For the fiscal years ending February 2016 to 2020, UK retailer Tesco plc had a gross profit margin that averaged 5.2%.

That return might not look attractive compared to other firms, but Tesco was able to weather the economic crisis caused by the COVID-19 pandemic because people will always need to buy groceries.

In fact, by December 2020, the UK retailer was in a position to return £585m of government aid related to COVID-19 and still pay a dividend to its investors.

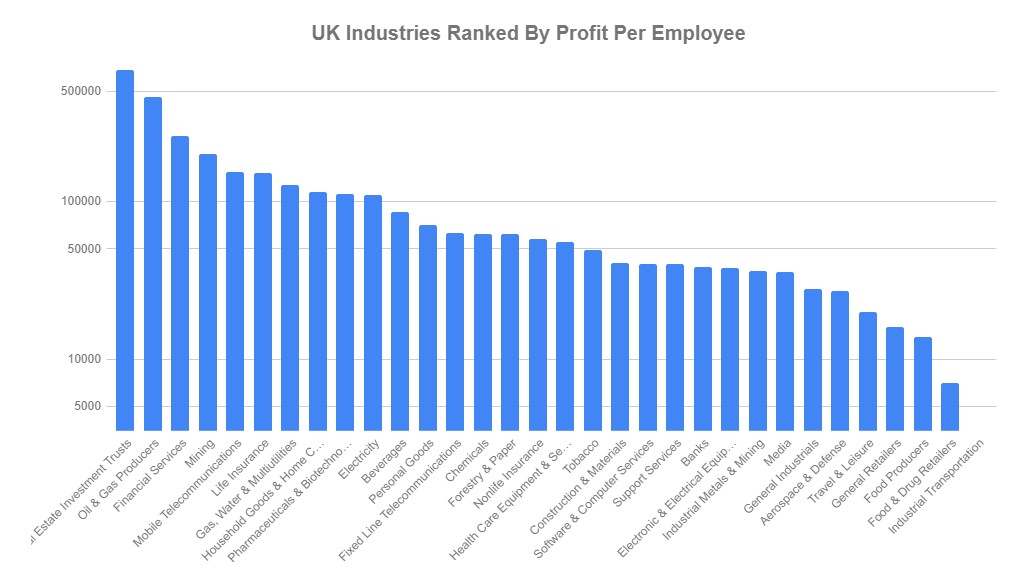

Source: Merchant Machine

Other firms operating in the food and drug sector still managed to make a profit despite normal business activity being suspended for months.

Source: Merchant Machine

Tesco has the third lowest ratio of profit to employees. It’s a labour-intensive operation, and due to geographical restrictions, there is little opportunity to open new stores. However, it can make a profit in even the worst economic slowdown.

The names to the right-hand side of the above chart would typically be associated with the term defensive stocks. There are always outliers, but it includes high street banks such as Barclays, clothes retailer Next, and the other big UK supermarket name, Sainsbury’s.

The characteristics of defensive stocks are the same regardless of the country in which they operate. A transatlantic comparison shows that the story is the same in the US. A report issued by Bloomberg established that in 2018, the average profit margin for US corporations was approximately 11%. More defensive names tend to have profit margins under that average number.

Why do people invest in defensive stocks?

Digging into the detail on defensive stocks and understanding their properties also sheds light on why people might want to invest in them. They’re not necessarily very exciting, and that is actually the appeal.

It’s impossible to tell when the next market shock might occur. As a result, a lot of investors with diversified portfolios allocate a percentage of their capital to defensives.

Buying defensive stocks for their dividends

If the worst-case scenario does occur, then the reliable revenue streams will likely continue to feed through at investor dividends.

One interesting feature of the 2020 coronavirus pandemic was that some stocks that had been seen as defensive scaled back on their dividends. This is a risk that investors need to be aware of.

Source: IG

In April 2020, oil giant Royal Dutch Shell cut its dividend for the first time in its history. Breaking that sacred bond with investors saw its price plummet, with many taking the view that there’s not much point holding a stock that doesn’t offer growth if it doesn’t offer protection either.

Buying defensive stocks in sideways markets

So far, defensive stocks have been considered as protection against a falling market. They also offer something to investors when the price is not trending.

When markets trade sideways for an extended period of time, there can be limited room for profits from share price moves. Even worse, if the market is moving sideways but within a large range because price volatility is high, traders can be stopped out of positions.

In such situations, defensive stocks can be expected to have lower price volatility than growth stocks.

This might lead some to take stop-losses off their positions. This is not necessarily recommended, but taking a buy-and-hold approach about a position in a UK supermarket can insulate you from the risk of getting kicked out of a position to see it then rally.

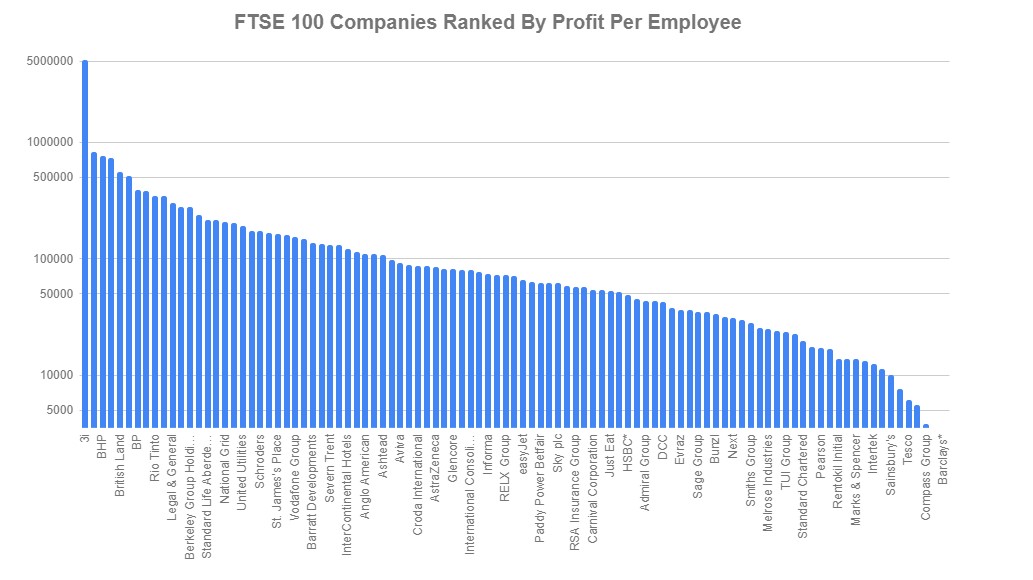

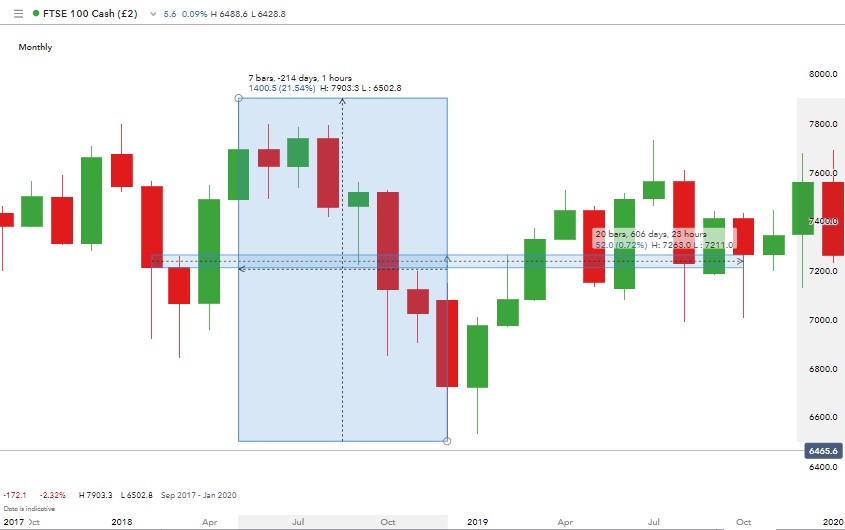

Source: IG

Between 1st March 2018 and 31st October 2019, the value of the FTSE 100 increased by 0.72%. That less-than-1% gain over a period of 20 months would have been a disappointment for holders of growth stocks.

During that period, there was a 21.54% difference in the peak-to-trough range in value.

Not only are defensives a protection against market volatility, but they are also more likely to pay a dividend.

Defensive stocks for entry-level investors

If you’re new to trading, then defensive stocks represent a lower-risk way of building up your trading skills. The fact that price moves are less dramatic means that any errors are likely to be less costly.

The principles of trading remain the same. Technical and fundamental analysis will play a role in helping you to optimise trade entry and exit points. Positions will also be impacted by news flow and economic data reports.

When starting out in trading, it’s important to protect your capital. There is a real risk that you can burn through your funds before you’ve even mastered the basics. Defensive stocks are therefore a good sector for novices and the risk-averse to trade when they first enter the markets.

How to Buy Defensive Stocks

Buying defensive stocks is an easy and straightforward process. Firstly, you will need to have an account with a broker, but if you don’t already, you can check out our reviews of the top-rated stockbrokers here.

Once you have an account, the next thing you will need to do is sign in to the platform and search for the stock you want to buy. One important point to note is that if you are trading CFDs, you won’t be buying the underlying asset, so you will need to make sure you have the correct account to do so.

Once you have found the stock you are looking for, you will need to fill in the details regarding how many shares you want to purchase and then click the ‘buy’ or ‘submit’ button.

Best Brokers to buy defensive shares

eToro: 68% of retail CFD accounts lose money

Take a lookIG: Over 16k stocks to trade

Take a lookFineco: 79% of retail investor accounts lose money when trading CFDs with this provider

Take a lookPlus500 | CFD provider:

Take a lookFrom 0% commission to low trading fees and top-tier regulation, these brokers are best-in-class when it comes to buying and selling defensive shares.

What is sector rotation?

Investors who want to maintain a certain level of exposure to equities but think that the general market is beginning to look overvalued might rotate into defensives. At this point, they might not invest fresh capital but instead sell out of growth stocks to free up funds.

No-one can be certain that the broader market won’t end up going up another 10%. Rotating into defensives is one way to scale back on both risk and return.

Are defensive stocks risky?

A stock may be considered defensive, but it’s still possible to get into a position at too high a price. Market risk applies to all equities. There are other ways that defensives can come undone.

Defensive stocks don’t offer any guarantees

Food manufacturers Del Monte Foods and Parmalat were both considered defensive stocks but were subject to corruption scandals that left their shareholders empty-handed.

Defensive stocks don’t offer complete protection

It’s true that some defensive stocks might rise while the rest of the market goes into meltdown. In February 2020, as the COVID-19 sell-off took hold, stocks that bucked the falling market included the following names:

- Home-schooling material provider Pearson (LSE:PSON)

- Gun manufacturer American Outdoor Brands, Inc. (NASDAQ:AOBC).

- Hand sanitisation and vermin control firm Rentokil (LSE:RTO)

Other defensives such grocery retailers saw their share price fall in line with the market. The relative fall may have not been as great as for the growth stocks. It’s important to note that defensives offer relative protection rather than a silver bullet.

Source: IG

Final thoughts

You know that the markets are having a bad time when the topic of defensive stocks is given more prominence. By that time, you may find that it’s too late to buy into them. A rotation into defensives might have already taken place and the share price moved to a higher fair value level.

Instead, many hold defensive stocks over the long term. They offer some protection, possibly some growth, and usually generate dividend income. It is a sector that is ideal for entry-level traders to develop their skills and potentially also make some profits.