YOUR CAPITAL IS AT RISK

It all comes down to timing, and for some, the time to buy the FTSE 100 is now. A combination of factors is making the index of UK flagship equities look undervalued. This article will outline the following ideas behind the strategy and ways to implement it:

- What is the FTSE 100?

- FTSE 100 performance over time

- The role of sterling

- Is now a good time to buy the FTSE 100?

- Ways to invest in the FTSE 100

- Next steps to trading

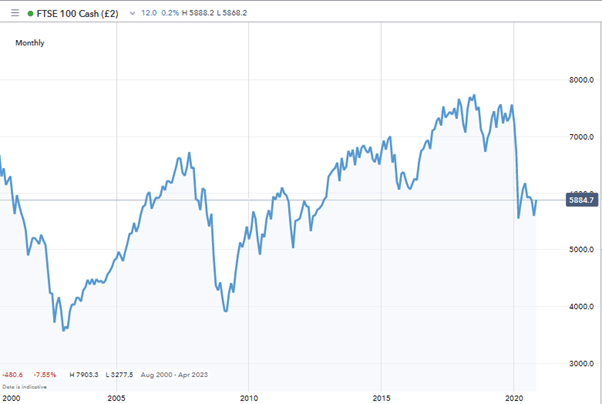

FTSE 100 2000–2020

Source: IG

What is the FTSE 100?

As with other equity indices, the FTSE 100 is a basket of different stocks. It takes the top-100 firms listed on the London Stock Exchange, calculates their combined market capitalisation and converts that into an index price.

If the value of the constituent firms increases, so does the value of the FTSE 100 index, and vice versa.

Rather than buy each of the 100 firms individually, investing in the FTSE 100 index is a more convenient way to gain diversified exposure to UK stocks.

FTSE 100 performance over time

The 20-year price chart for the FTSE 100 details the range that large-cap UK equities have been trading in over the long-term. The year 2000 did mark the peak of the dot-com bubble, but investors would still be disappointed to see current prices still below the starting level.

Other indices such as the German Dax (+58%) and Dow Jones (+147%) in the US have outperformed the FTSE 100. The tech-heavy Nasdaq 100 has, over the same time, increased in value by more than 200%. This has left many investors in the FTSE wondering ‘what might have been’.

The underperformance in the FTSE reflects the make-up of the index. It contains stocks from sectors that are, arguably, unfashionable.

- Banking stocks have struggled ever since the 2007 financial crisis.

- Mining companies, oil & gas firms and tobacco giants are facing a head-wind associated with changes to consumer behaviour. People just don’t want to buy what they are selling.

- Unicorns — The index lacks the lure of tech-start-ups, which can be found in other global indices. The UK index just doesn’t contain any equivalents of Amazon, Netflix or Apple.

The full list of FTSE 100 constituents can be found here. The Top 10 still contains firms such as BP and Royal Dutch Shell, which are fighting losing battles. The absence of newer firms coming through to take their place in the charts is a sign of the problems facing the FTSE100 right across the board.

FTSE 100 — Top 10 by Market Size (4th November 2020)

| Ticker | Name | Ccy | Market Cap (m) | Price |

| AZN | ASTRAZENECA PLC ORD SHS $0.25 | GBX | 104,499.04 | 8,511.00 |

| HSBA | HSBC HLDGS PLC ORD $0.50 (UK REG) | GBX | 70,644.99 | 332.45 |

| GSK | GLAXOSMITHKLINE PLC ORD 25P | GBX | 68,035.61 | 1,415.00 |

| DGE | DIAGEO PLC ORD 28 101/108P | GBX | 59,813.03 | 2,649.00 |

| BATS | BRITISH AMERICAN TOBACCO PLC ORD 25P | GBX | 57,092.20 | 2,576.50 |

| RIO | RIO TINTO PLC ORD 10P | GBX | 56,086.86 | 4,440.50 |

| ULVR | UNILEVER PLC ORD 3 1/9P | GBX | 53,203.20 | 4,663.00 |

| RB. | RECKITT BENCKISER GROUP PLC ORD 10P | GBX | 49,246.95 | 7,092.00 |

| BP. | BP PLC $0.25 | GBX | 42,551.85 | 208.75 |

| RDSA | ROYAL DUTCH SHELL PLC ‘A' ORD EUR0.07 | GBX | 42,119.73 | 1,031.80 |

| RDSB | ROYAL DUTCH SHELL PLC ‘B' ORD EUR0.07 | GBX | 36,487.38 | 988.70 |

Source: London Stock Exchange

The role of sterling

A large percentage of firms in the FTSE 100 have UK listings but multi-national business models. This introduces an interesting forex twist to the equation, used to value the index.

If Rio Tinto (LSE:RIO) for example, registers identical trading profits over two time periods, then despite those being equal, the profits in GBP terms might still cause a change in the RIO share price. But what if payments from its customers are made in USD, and USD weakens against GBP? Then each dollar’s-worth of trading profits will be reflected as less in GBP cash terms. It would then be expected that the share price of RIO will fall.

Any company with non-base currency income streams will have a share price that is exposed to currency moves. It’s just worth noting that the FTSE 100 has more exposure than most global equity indices.

Is now a good time to invest in the FTSE 100?

The doom and gloom surrounding FTSE 100 investment-returns offers up a range of possibilities. Investors who hold positions in it may be underwater, but new entrants might be able to take advantage of buying a dip.

The Sunday Times reported in October 2020:

“This could be the best time in 40 years to be buying British shares.”

Source: The Times

The underperformance of the FTSE 100 compared to the DAX, Dow Jones and Nasdaq 100 is seen as a buying opportunity. It’s argued that the challenges facing the UK stocks have been overplayed and that price divergence is ultimately followed at some point by convergence.

Ways to Invest in the FTSE 100

There are multiple ways to gain exposure to the FTSE 100. Using a regulated online broker is one of the most user-friendly and cost-effective routes to try. To establish which method might work best for you requires establishing what your investment time horizon is.

Buying a short-term position in the FTSE 100

CFDs are a very popular way of taking part in short term trading of the FTSE 100 index. The mechanics and pros and cons of this instrument type are discussed in more detail in this article. The summary is that CFDs allow traders to sell-short the index as well as just go long.

- Short-selling involves betting that a market will fall in price, even if you don’t already have a position in it. It is ideal if you think the enthusiasm of the bulls has gone too far. Maybe your interpretation of the threats to the economy posed by COVID-19 or Brexit means that prices will soon head south?

- You can also use leverage. This means your trading position will be greater than your initial cash deposit. It multiplies risk / return and isn’t recommended for beginner traders, but is a trading feature that many like to use to scale up their trading size.

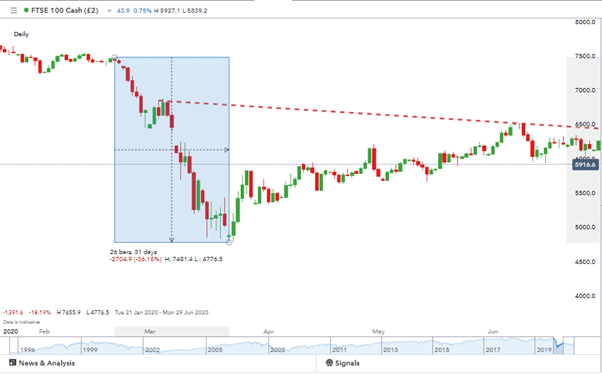

While the ‘long-terms’ on the FTSE 100 have been disappointing, the short-term volatility in prices means that CFD trading of the FTSE 100 index can provide considerable returns.

A short position in the FTSE 100 placed on 26th February 2020 could have posted a return of 36% in 31 days.

Source: IG

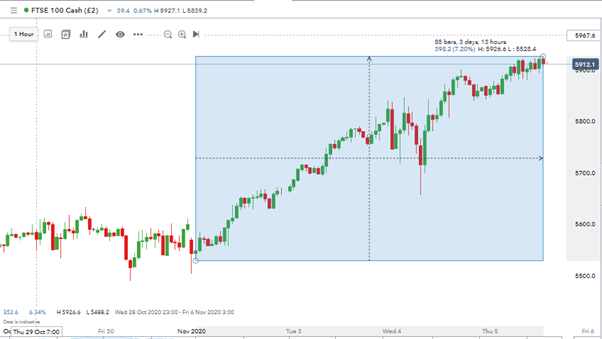

It is also to possible to make a profit in a rising market using CFDs. A long position placed on 2nd November 2020 would have generated a return of 7.20% in less than four days.

Source: IG

Most brokers provide a CFD market in the FTSE 100 trades on a 24/5 basis. This means you can trade around the clock. There is also some additional risk management offered by this approach as ‘gapping risk’ is mitigated.

Buying a long-term position in the FTSE 100

CFDs do come with additional costs such as overnight financing charges. Although they are small in relation to the overall profit / loss from market price moves, over a period of weeks, these can start to stack up.

If you’re looking to implement a buy-and-hold strategy over a period of weeks, months or years, then there are more cost-effective routes.

The whole point of the FTSE 100 index is that it gets away from having to buy shares in 100 different firms. It is of course technically possible to buy a small holding in each constituent firm, but this would be costly, time-consuming and would invite operational risk into your trading.

Exchange traded funds (ETFs) solve that problem. These involve a reputable firm doing all the hard work of manging a hundred different positions. As they do it for thousands of clients, the costs are spread out, meaning investors can get a better deal.

ETFs are passive funds. They aim to mirror the performance of an index, such as the FTSE 100. Unless the investment manager gets something horribly wrong, your holding will perform in line with the underlying index.

Next steps to trading

Given that there are different ways of investing in the FTSE 100, high-quality, online brokers tend to offer their clients each option. With one account at brokers such as IG, eToro and Plus500, you can trade either, or indeed, both strategies.

A more detailed analysis of the relative strengths of ETFs can be found here.

Finding the right broker for you is perhaps the most important part of the process. While you can invest in the FTSE 100 with most brokers on the market today, not all brokers are created equal.

Best Brokers to trade the FTSE 100:

eToro: 68% of retail CFD accounts lose money

Open AccountIG: Negative balance protection

Open AccountPlus500 | CFD provider: 82% of retail investor accounts lose money when trading CFDs with this provider

Open AccountIf you're ready to trade FTSE 100, you'll need to use a broker that is FCA regulated, has low trading commissions and a reliable trading platform. Finding one can be an arduous and daunting task, which is why we've hand-picked favourites that tick all of these boxes to help you get started.

It’s worth setting up demo accounts with a few brokers to see which suits you best.