With a series of risks threatening the global economy's prospects, investors are turning to defensive stocks that offer security and returns. Identifying trends and trading in the same direction is a fundamental principle of successful investing. While even the best defensive stocks might not necessarily see their price skyrocket, they can protect returns generated during the boom years.

YOUR CAPITAL IS AT RISK

If inflation, interest rate rises, and increased political uncertainty have left you wondering if buying defensive stocks is the right approach right now, you're not alone. A rotation out of growth stocks and into safer sectors is underway, which means trillions of dollars of capital are being shifted from one sector to another. The buying pressure from institutional and retail investors looks set to support the price of the below stock picks. Even without that extra kicker, they are well-positioned to navigate any downturn successfully.

Using fundamental analysis metrics such as dividend income and P/E ratios, we've identified the best stocks for defensive investment strategies that should protect returns even if markets sell off.

Best Defensive Stocks to Buy Now

- Berkshire Hathaway B (BRKB)

- Direct Line Insurance Group PLC (DLG)

- General Dynamics Corp (GD)

- Uranium Energy Corporation (UEC)

- Apple Inc (AAPL)

- Unilever PLC (UL)

- British American Tobacco PLC (BAT)

- J Sainsbury PLC (SBRY)

1. Berkshire Hathaway B – (BRKB)

Berkshire Hathaway stock stands out as one of the best defensive stocks because of its approach to investing and the multi-year track record of sticking true to its aims. Buying shares in BRKB represents an investment in the methodologies of legendary investment guru Warren Buffet and a diversified portfolio of handpicked undervalued stocks with great long-term potential.

An investment of $1,000 in his flagship investment vehicle in May 1992 would, as of April 2022, be worth $15,820. Not only that, but the price volatility as measured in terms of standard deviation was lower than the market average over the last 30 years – 13.10% standard deviation compared with 14.94%.

That relatively low standard deviation comes in handy during market downturns. For example, the peak-to-trough price fall for Berkshire Hathaway during March 2020's Covid pandemic was 28.6%, which compares well to the +34% price fall experienced by the S&P 500 index during the same period.

Berkshire Hathaway B – Daily Price Chart – May 2018 – April 2022

The Beta of BRKB is 0.83, and being below 1.0 means it has lower price volatility than the S&P 500 and any of the passive ‘tracking' funds which try to replicate the performance of the index

2. Direct Line Insurance Group PLC (DLG)

Insurance group Direct Line offers the potential for investors to benefit from a potential triple-whammy. First up is the hugely attractive 7.85% dividend yield. Passive income on that scale just can't be ignored, and the business fundamentals suggest that income payments to shareholders will hold up regardless of the state of the economy. The second attractive feature of DLG stock is that car insurance is a legal requirement in the UK, with the only way of avoiding the expense being to hand over the keys. That puts the insurance sector in a strong position during a cost-of-living squeeze.

The third potential catalyst for Direct Line Group and a reason it is seen as one of the UK's best defensive stocks are the insurance market reforms, which are coming into play. Those changes relating to the pricing of policy renewals will result in winners and losers, and Direct Line has one of the strongest brands in the insurance sector and already has a reputation for transparent pricing. That means the firm could seize the opportunity to expand its market share.

Direct Line Insurance Group – Daily Price Chart – April 2018 – April 2022

The potential for capital growth and a passive income stream is a green light to investors even at the best of times. With an economic downturn increasingly possible, Direct Line's defensive attributes make it a stock that could be too good to miss.

3. General Dynamics (GD)

Given the uptick in geopolitical risk since the start of 2022, one of the best defensive stocks factors in governments expanding expenditure on military hardware. US-based General Dynamics has interests in shipbuilding, defence IT, and tank manufacturing. The share price history points to it being a good stock pick even without increased political uncertainty.

General Dynamics Corp – Daily Price Chart – May 2018 – April 2022

While global stock indices were losing ground during Q1 of 2022, the price of GD shares was heading in the other direction. As of 29th April 2022, General Dynamic stock showed a year-to-date gain of 13.43% compared to the Nasdaq 100 index being down 21.07%.

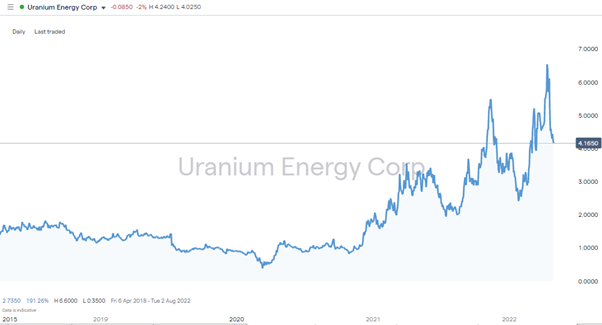

4. Uranium Energy Corp (UEC)

Utility stocks such as those associated with energy supply are considered one of the best ways to navigate a recession. Inflationary pressures can severely impact consumer spending, but heat, lighting, and EVs are among the last items to be scaled back.

Uranium Energy Corp is a US-based uranium mining company which provides raw materials for nuclear power plants which make up 19.8% of the total US power supply. The shift away from carbon-based power has brought nuclear energy back into fashion as it offers base-load capacity to complement solar, wind, and tidal energy supplies.

Uranium Energy Corp – Daily Price Chart – October 2020 – April 2022

Advanced Small Modular Reactors (SMRs) look set to increase in number thanks to governments looking favourably on these smaller nuclear power plants. The technology used by SMRs is similar to that found on nuclear submarines, which have been operating for decades. While nuclear will always have its critics, SMRs have a lower profile than large scale pressurised water reactors (PWRs). Renewable energy sources are weather dependent, and SMRs offer a way to ensure round the clock power supplies, which adds up to increased demand for uranium. UEC is particularly attractive because it benefits from the protection provided by the US Office of Uranium Management and Policy, which stipulates domestic uranium supplies to be a critical resource.

5. Apple Inc (AAPL)

In the three years between December 2018 and December 2021, Apple shares rose in value by a staggering 360% proving defensive stocks aren't necessarily poor performers. The strength of the Apple brand and the ecosystem in which its various products interconnect provides a barrier to entry for any competitors, which results in the firm's revenue streams continuing to expand.

In 2019, 2020, and 2021 the year-on-year increase in annual revenues was 5.51%, 33.26%, and 28.62%, respectively. Inflationary pressures and a cost-of-living squeeze threaten Apple's sales of high-end items such as iPhones. However, due to clever design, it's hard for Apple customers to extricate themselves from the popular range of i-branded goods. The customer retention rate for Apple is, as a result, a highly impressive 92% compared to the 72% retention rate for Android users.

Apple Inc – Daily Price Chart – October 2020 – April 2022

Apple's P/E ratio of 28.9 is relatively low for the tech sector, and the 0.541% dividend yield is a nice-to-have feature for investors, but it's the $2.6Trn market capitalisation and the position of Apple as the world's largest listed firm which cements the firm's place on any list of defensive stocks.

6. Unilever PLC (UL)

One of the best defensive stocks in the UK is the household goods manufacturer Unilever. The multinational has an impressive market capitalisation of £93bn and a diversified customer base in sector and region. The firm's 400+ brands are used daily by 3.4bn people in more than 190 countries.

Unilever isn't immune from the risk of a global recession, but demand for staples such as foodstuffs and cleaning products is relatively inelastic. The firm has well-established sales and distribution networks and a portfolio of top brands ranging from Lipton's tea to Domestos.

Unilever PLC – Daily Price Chart – April 2018 – April 2022

One major challenge facing Unilever is the lack of growth prospects, and the failed £50bn bid for GlaxoSmithKline was a signal to the markets that the firm has limited potential for organic growth. The high-profile nature of that aborted bid put downward pressure on the UL stock price, but the bad news is now priced in. Buying into Unilever currently offers a chance to snap up a large-cap multinational in a defensive sector with a P/E ratio of only 15.6 and a dividend yield of 4.06%.

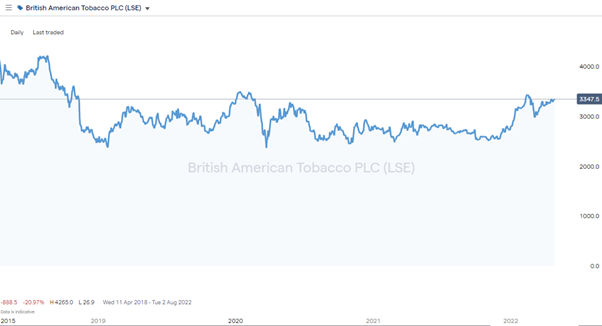

7. British American Tobacco (BAT)

The UK based British American Tobacco has faced numerous challenges over the years but continues to offer a bullet-proof way for investors to navigate turbulent markets. The long-term shifts away from smoking resulted in the firm moving into vaping, glo-related products, and even the Covid-19 pandemic couldn't knock BAT off track. With many expecting sales to fall in 2021 due to heightened health concerns, the firm managed to increase its dividend payment to shareholders by 2.5%.

BAT pays its dividend quarterly, which is appealing to those looking to lock in regular income gains and is known for increasing its dividend payout every quarter for the last 10 years.

British American Tobacco – Daily Price Chart – April 2018 – April 2022

The market cap of £74bn, a P/E ratio of 10.7, and profit margins of 26.7% are fundamentals to dream of and largely come about from institutional investors having to consider the ‘political sensitivities' associated with investing in tobacco firms. For retail investors staring down the barrel of a possible recession but not hindered by corporate governance obligations, buying BAT stock seems to be an obvious way to preserve wealth.

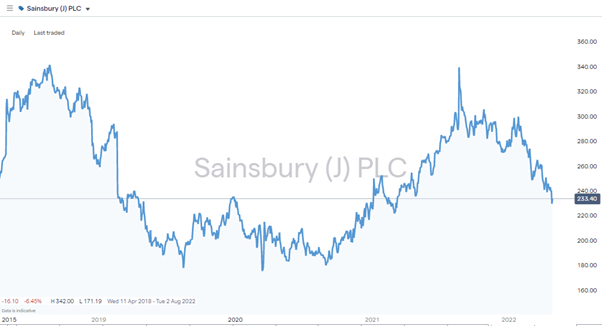

8. J Sainsbury PLC (SBRY)

The UK's second-largest retailer faces many challenges, but the grocery/supermarket sector is a haven in any economic storm. The opening trading sessions of May saw the stock trading near the bottom of its 52-week trading range of 222p – 342p. That means buying Sainsbury's offers exposure to a relatively safe sector and a stock with a P/E ratio of 13.8 and a dividend yield of 3.98%.

J Sainsbury PLC – Daily Price Chart – April 2018 – April 2022

Budget supermarkets look set to prosper as household budgets are tightened, but J Sainsbury PLC has a proven track record of navigating that threat. That is mainly due to the company resisting the temptation to compete on price alone. Sainsbury is the world's largest retailer of Fairtrade products and also captures the current zeitgeist surrounding Corporate Social Responsibility (CSR) and Ethical, Social and Governance (ESG).

The challenges Sainsbury's faces are genuine but look already priced in, making it one of the top picks in UK defensive stocks.

How to Buy Defensive Stocks Online

1. Find a Broker

The reliable online brokers found on this list of trusted brokers have established track records and are regulated by Tier-1 financial authorities. They offer competitive T&Cs, free research and analysis and user-friendly trading platforms.

2. Open & Fund an Account

Registering for an account takes minutes, and onboarding can be done using a handheld or desktop device. Then it's simply a case of wiring funds to your account. Credit and debit cards are popular options as they tend to incur no banking fees and are often instant.

If you're looking to hold your position for more than a few weeks, do check you set up a share dealing account to buy the stock outright rather than as a CFD. While CFDs offer improved functionality, they do incur daily financing charges. They are modest in size but do add up over time.

3. Set Order Types

If you want to optimise your trade entry point and manage risk, then stop-loss, take-profit and limit orders are ways to automate the price levels at which you trade. These allow you to set up your portfolio and then take a hands-off approach to let your money work harder for you.

4. Select & Buy Shares

To buy the shares you have selected, enter the number of shares you want to purchase and click ‘Place Deal'. You'll then exchange an amount of cash for a holding in a defensive stock which will go up and down in value in line with the current market price. Selling out of your position is simply a case of reversing the process and converting it back into cash.

Final Thoughts

Defensive stocks might not offer the potential for stellar returns associated with some of the best growth stocks, but ‘moon shot' style stocks come with their own set of risks. The relative security of the best defensive stocks means they have a place in any portfolio. Investing in them can facilitate a more hands-off approach to investing as there are fewer surprises in store. That also takes some emotion out of trading, which helps develop a successful trading mentality.

If you're new to trading, the main potential downside to basing your portfolio on the defensive sector is FOMO, but slow and steady can win the race, especially during times of uncertainty. With the global economic outlook deteriorating, investing in a sector offering returns that beat sitting on cash looks like a solid move.

Operational risk also needs to be considered; using one of the platforms from this shortlist of trusted brokers will help you deal with a firm that prioritises client security. They also offer the research tools and cost-effective T&Cs to get your trading off to the best possible start.