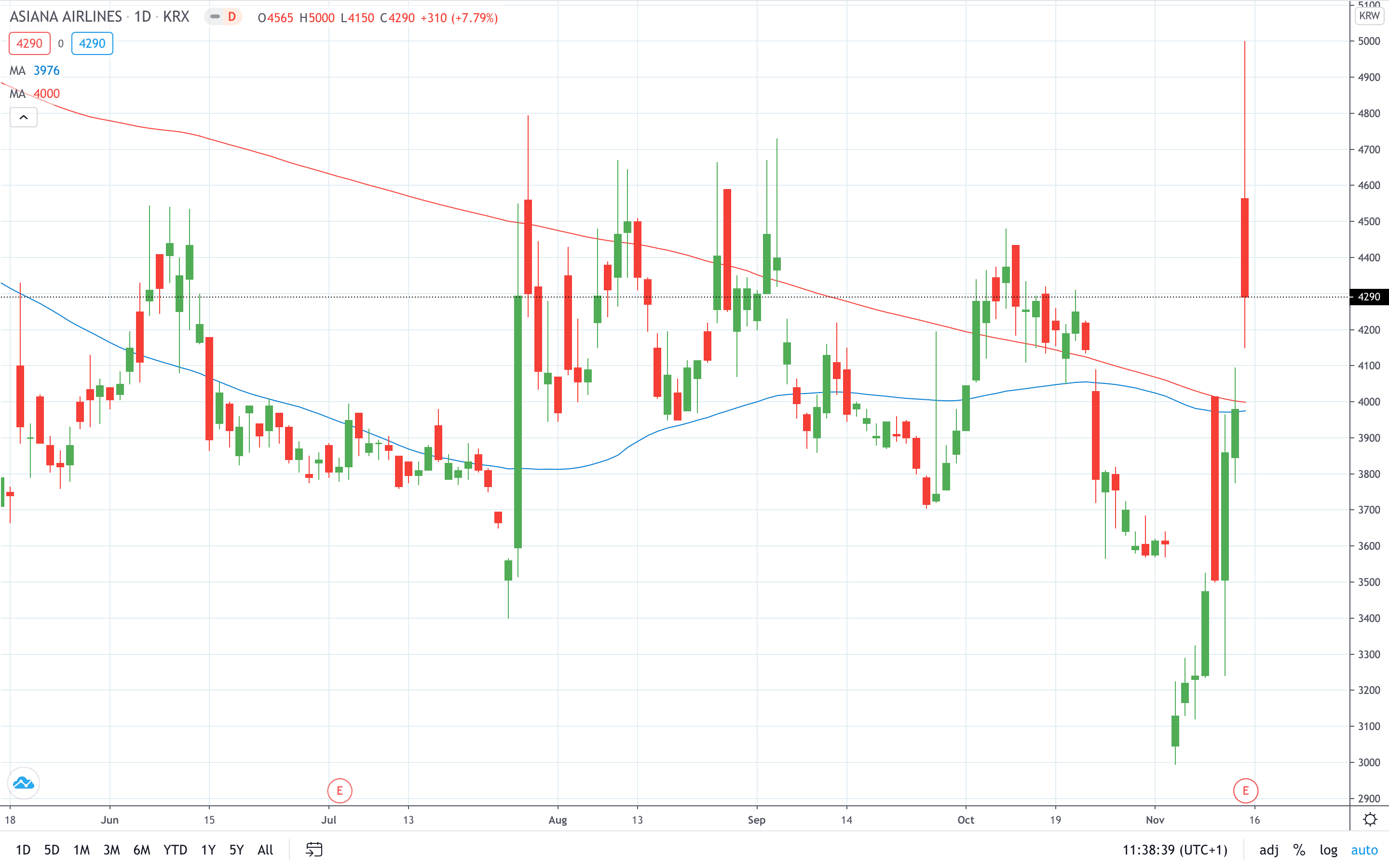

Shares of Asiana Airlines (KRX: 020560) rose as much as 25% on Friday on media reports that the carrier may be sold to Hanjin Group, which already owns Korean Air Line.

According to the report in Korea Economic Daily on Friday, the Korea Development Bank (KDB) – Asiana’s main creditor – is considering selling the embattled airline.

Analysts believe that this setup would be perfect for both sides as the deal would save Asiana while providing Hanjin with a great and reliable partner in state-run KDB.

“From Hanjin Kal’s standpoint, it could find no better ally than KDB,” said Um Kyung-a, an analyst at Shinyoung Securities, to Reuters.

“And if the two airlines merge, the country’s aviation industry also benefits from the consolidation as too often there has been more supply than demand,” she added.

Shares in Korean Air fell about 3% on Friday given that a potential merger with Asiana is not well-received from the side of investors.

Asiana share price closed the day 7.8% in the green after failing to sustain the majority of earlier gains.

PEOPLE WHO READ THIS ALSO VIEWED:

- BRITISH AIRWAYS: HERE’S WHY IAG SHARE PRICE SOARED TODAY

- Learn more on how to open a demo account

- Learn what is a Pip in trading