Shares of Aveva Group PLC (LON: AVV) dipped about 4% on Friday after the software provider announced plans to raise around £2.84 billion in a fully committed and underwritten rights issue.

Funds will be used to support the purchase of OSIsoft, a data management software firm. A takeover was agreed in August for an amount of $5 billion, out of which $4.4 billion will be paid in cash.

Aveva will issue 125.7 million shares at 2,255p per piece while Schneider Electric which indirectly has a 60% stake in the company, decided to take up its rights in full on a pro-rata basis.

The provider of software solutions also agreed a £250 million credit facility in addition to a $900 million loan from Scheider in August to support the OSIsoft purchase.

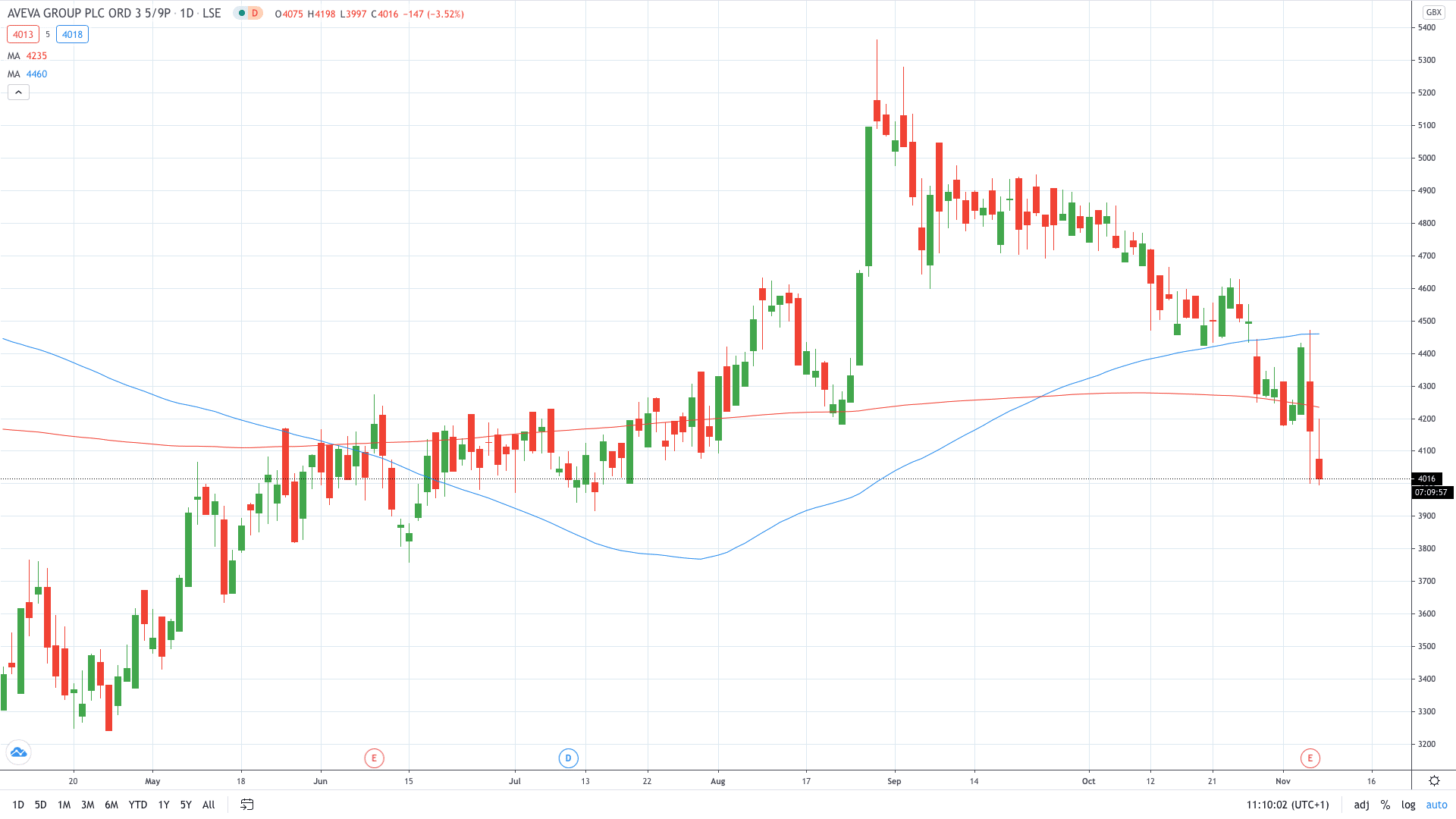

Aveva share price fell nearly 4% to trade below 4000p for the first time since July.

PEOPLE WHO READ THIS ALSO VIEWED:

- BRITISH AIRWAYS: HERE’S WHY IAG SHARE PRICE SOARED TODAY

- Learn more on how to open a demo account

- Learn what is a Pip in trading