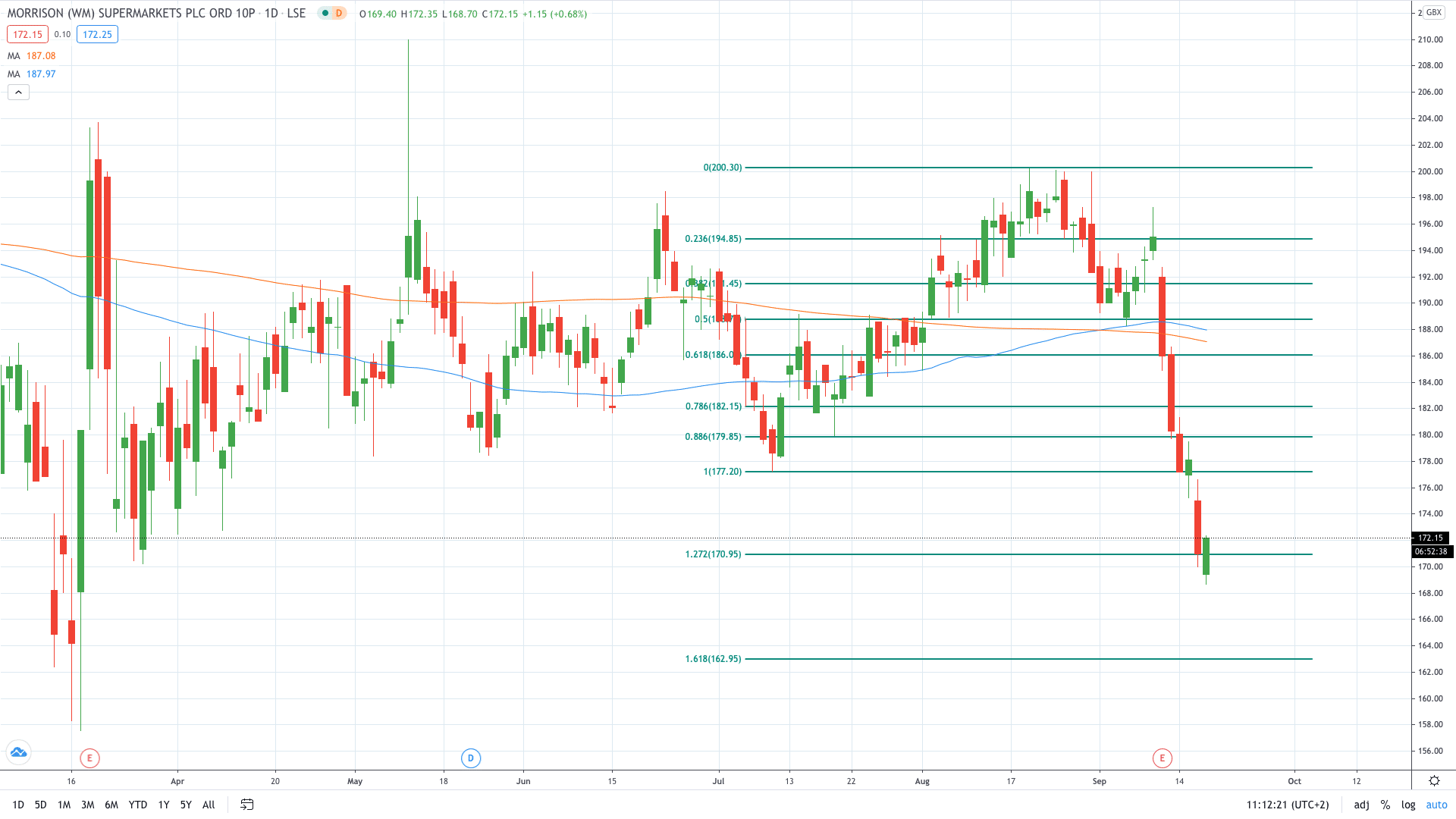

Shares of Morrisons (LON: MRW) closed 4% lower yesterday after JP Morgan downgraded the stock. Moreover, the bank slashed price target for MRW and advised investors to stay away from UK supermarkets.

JP Morgan cut MRW rating from “Neutral” to “Underweight”, in addition to decreasing the targeted share price to 160p from 175p. The banking giant has a bleak view of the sector and the company's own prospects.

“We see momentum slowing down combined with little further self-help,” JP Morgan's analyst Borja Olcese said.

“This should trigger an inflection in capital returns. We sit below the market and believe shares are expensive … We would continue to avoid the UK.”

Olcese believes that we are seeing a shift to online shopping, which will only increase costs for Morrisons. The analyst also notes that Morrisons has fewer employees per square foot than competitors.

Morrisons share price closed 4% in the red yesterday, which also pushed the stock to gap 1% lower this morning. This morning’s low of 168.70p is the lowest the stock traded in 6 months.

- PEOPLE WHO READ THIS ALSO VIEWED: ASTON MARTIN SHARE PRICE UP 15% IN TWO DAYS. HERE’S WHY

- Learn more on how to open a demo account

- Master trading with Bollinger Bands