Shares of Infineon Tech AG (ETR: IFX) soared nearly 4% after the company presented strong sales and revenue outlook amid a faster-than-expected rebound. The management is “cautiously optimistic” about the performance in the year ahead.

The German tech titan said it expects to generate 10.5 billion euros ($12.5 billion) from sales for its full fiscal year ending September 2021. This is 22.6% higher than in the previous fiscal year.

The result margin is expected to grow to 16.5% from 13.7% after the company reported its fiscal fourth-quarter revenue at 2.49 billion euros, up 15% compared to a year ago. A rebound in demand resulted in a higher margin of 15.2%, much better than 10.1% in the third quarter.

“We have proven that our company has a robust business model and continues to develop steadily, even in uncertain times,” Dr. Reinhard Ploss, CEO of Infineon, said in a statement.

“Some of our target markets, especially the automotive sector, have recovered better than expected since the summer. In addition, the structural transformation towards electro mobility is accelerating, particularly in Europe.”

Infineon said it will pay a final dividend of 0.22 euros a share, after proposing a 5% cut.

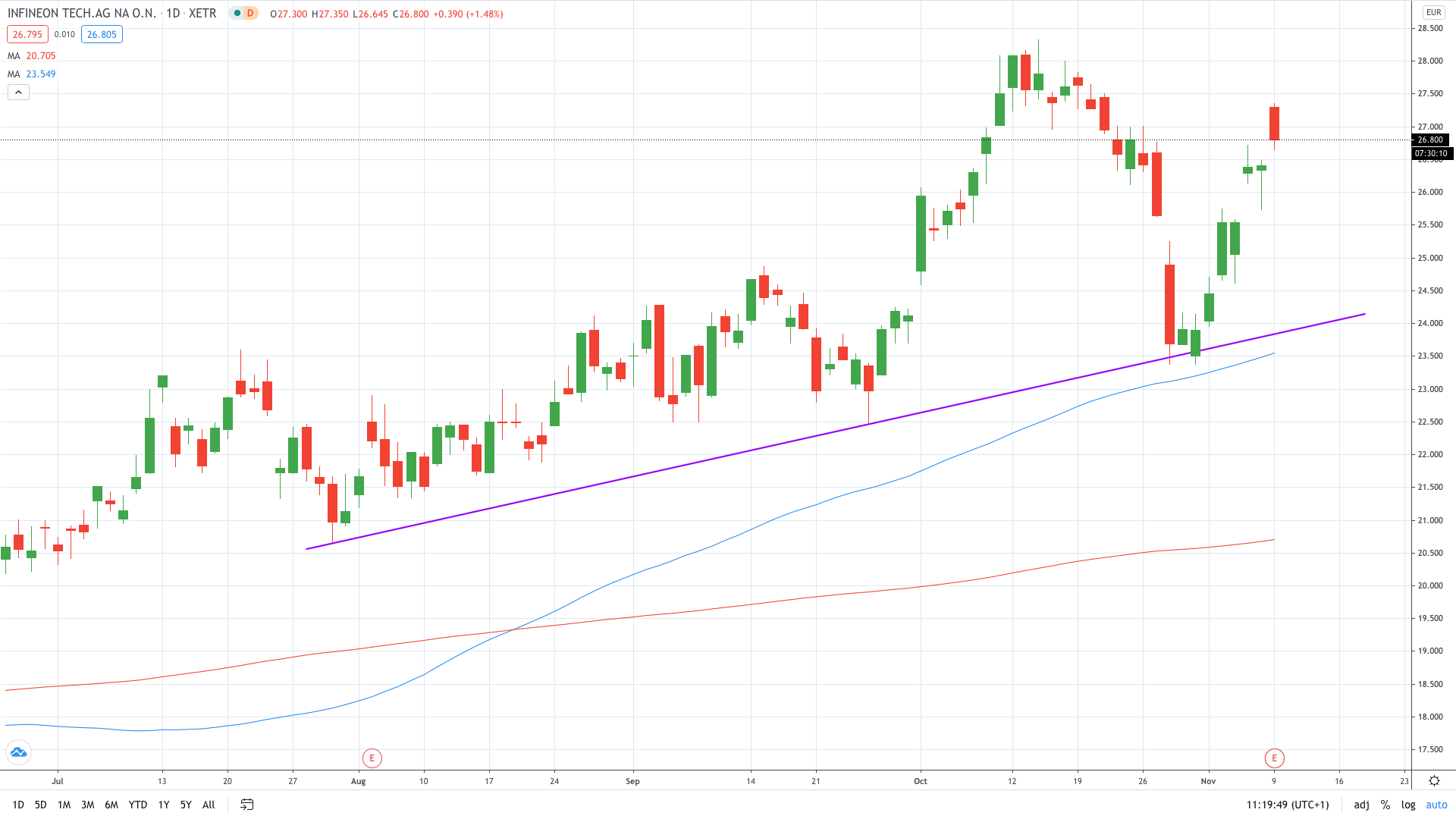

Infineon share price gained nearly 4% initially before failing to hold onto these gains. Shares are now trading at 26.80, or 1.5% higher on the day.

PEOPLE WHO READ THIS ALSO VIEWED:

- BRITISH AIRWAYS: HERE’S WHY IAG SHARE PRICE SOARED TODAY

- Learn more on how to open a demo account

- Learn what is a Pip in trading