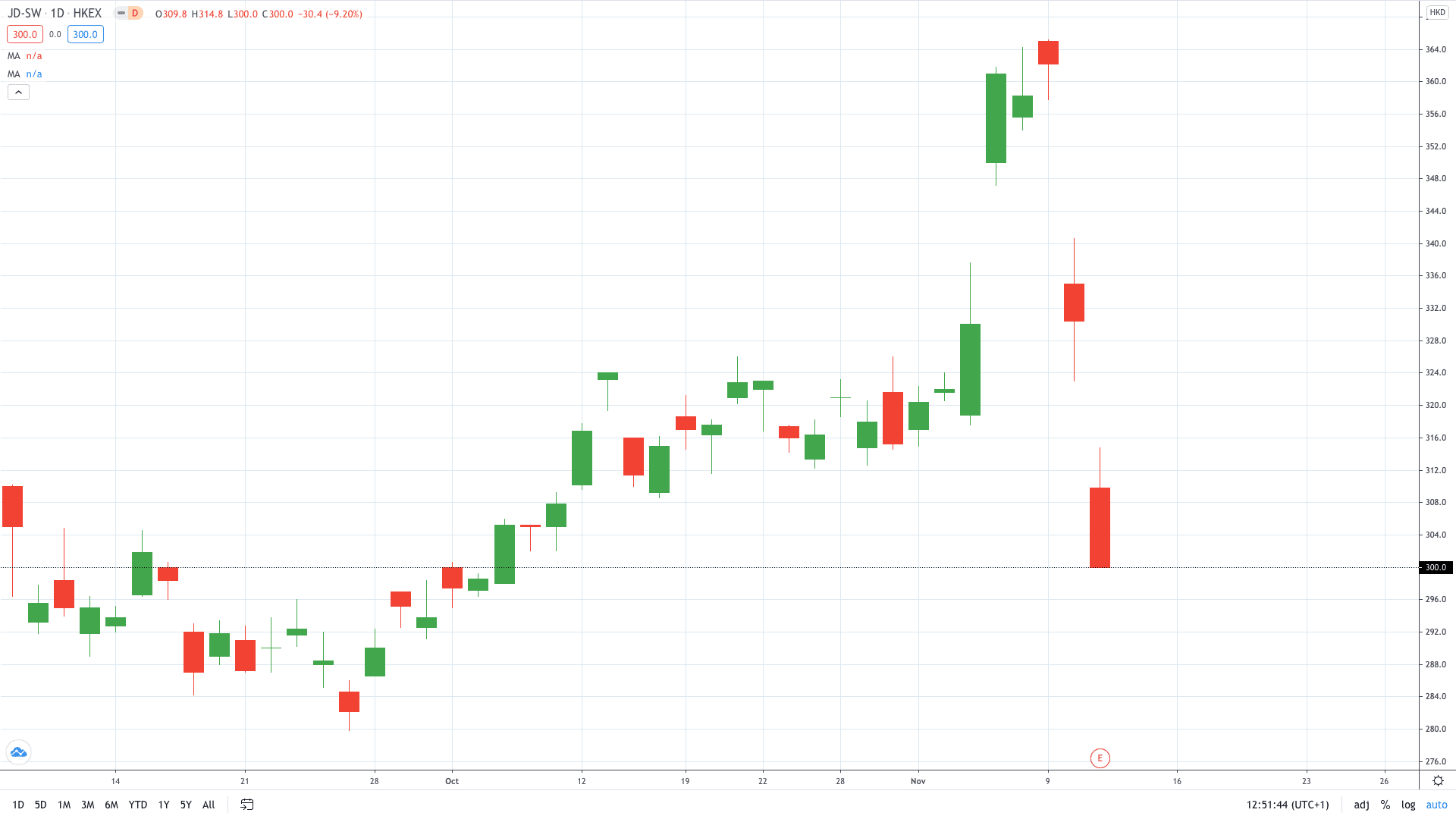

Shares of China’s e-commerce titan JD.com (HKG: 9618) crashed 9.2% today to join the other top tech firms in a trip lower as regulatory concerns continue to mount.

Yesterday, China’s regulatory bodies introduced new regulations focused at limiting the power the biggest internet companies, such as Alibaba, JD.com, Tencent, Ant Group and Meituan.

The release of these guidelines comes just a week after Hong Kong and Shanghai stock exchanges blocked the world’s biggest IPO of Ant Group.

“Potential implementation of new antitrust regulations is negative for most major Internet companies, particularly in e- commerce and food delivery – although competition has already intensified with reduced market dominance across segments in recent years, which could be a mitigant,” Morgan Stanley analysts wrote in a note sent on Wednesday.

Alibaba saw its stock price close 9.8% lower on Wednesday, while Tencent recorded a drop of 7.39%. Shares of Meituan – the biggest on-demand delivery services company in China – fell by 9.67%. Overall, Hang Seng Tech index tumbled 6.23% today.

JD.com share price also moved lower to close 9.2% in the red and extend this week’s losses to over 16%.

PEOPLE WHO READ THIS ALSO VIEWED:

- BRITISH AIRWAYS: HERE’S WHY IAG SHARE PRICE SOARED TODAY

- Learn more on how to open a demo account

- Learn what is a Pip in trading