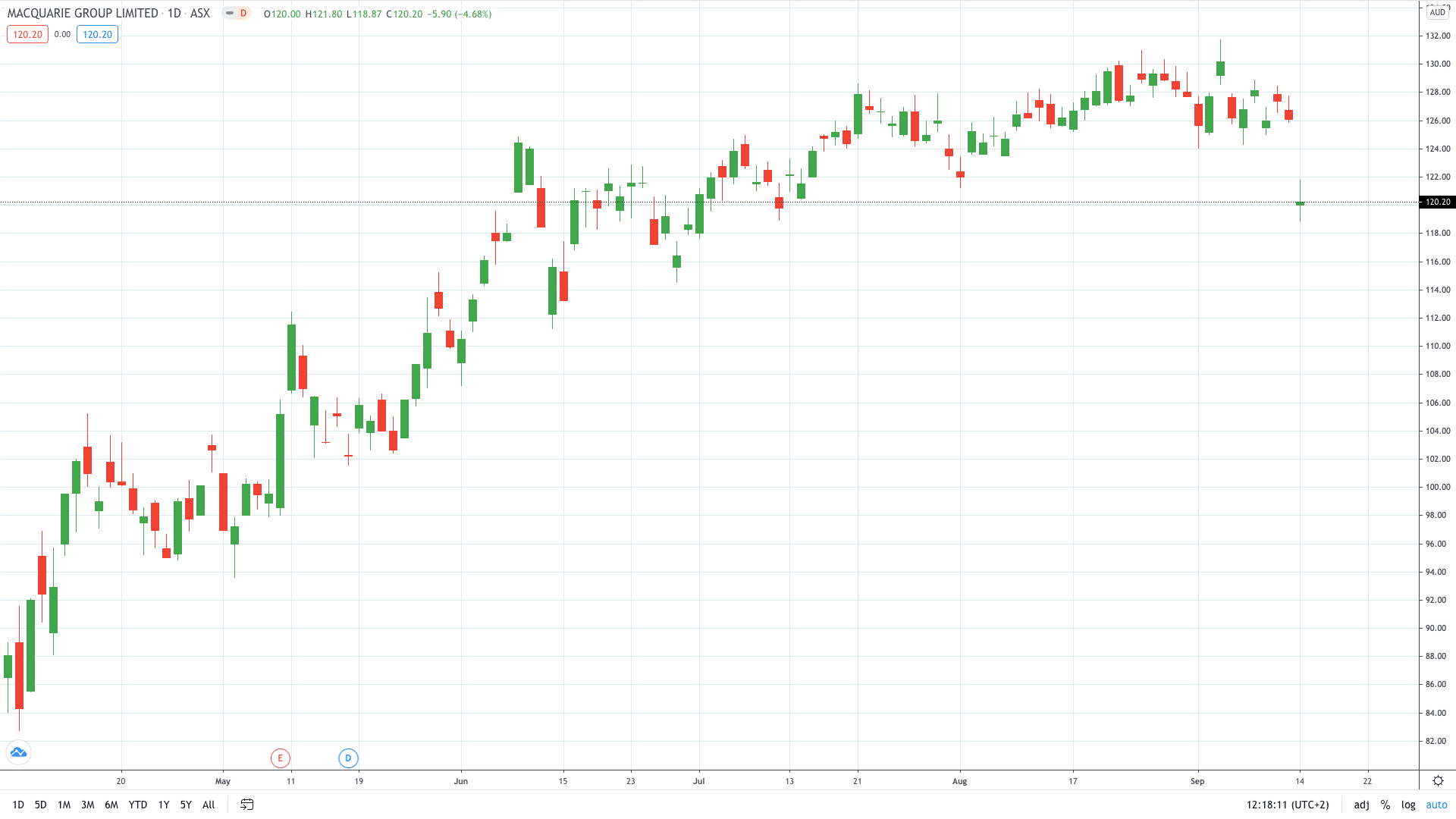

Shares of Macquarie Group (ASX: MQG) tumbled over 5% today in Sydney after the group said it expects earnings to drop by 25% for the six months ending September 30.

This is a comparison with the six months ended March 31, while first-half financial results are likely to tumble 35% compared with a year-ago period.

“Market conditions are likely to remain challenging, especially given the significant and unprecedented uncertainty caused by the worldwide impact of COVID-19 and the uncertain speed of the global economic recovery,” the investment bank said.

As things stand, profits are likely to fall to about $955 million from $1.275 billion. The bank blames a combination of factors for the plunging profit – increased provisions for souring loans, lower transaction volumes and investment income.

“The extent to which these conditions will adversely impact our overall FY21 profitability is uncertain, making short term forecasting extremely difficult,” the bank added in a trading update.

Macquarie share price plunged more than 5% to trade below AUD$120 for the first time since July.

- PEOPLE WHO READ THIS ALSO VIEWED: ASTON MARTIN SHARE PRICE UP 15% IN TWO DAYS. HERE’S WHY

- Learn more on how to open a demo account

- Master trading with Bollinger Bands