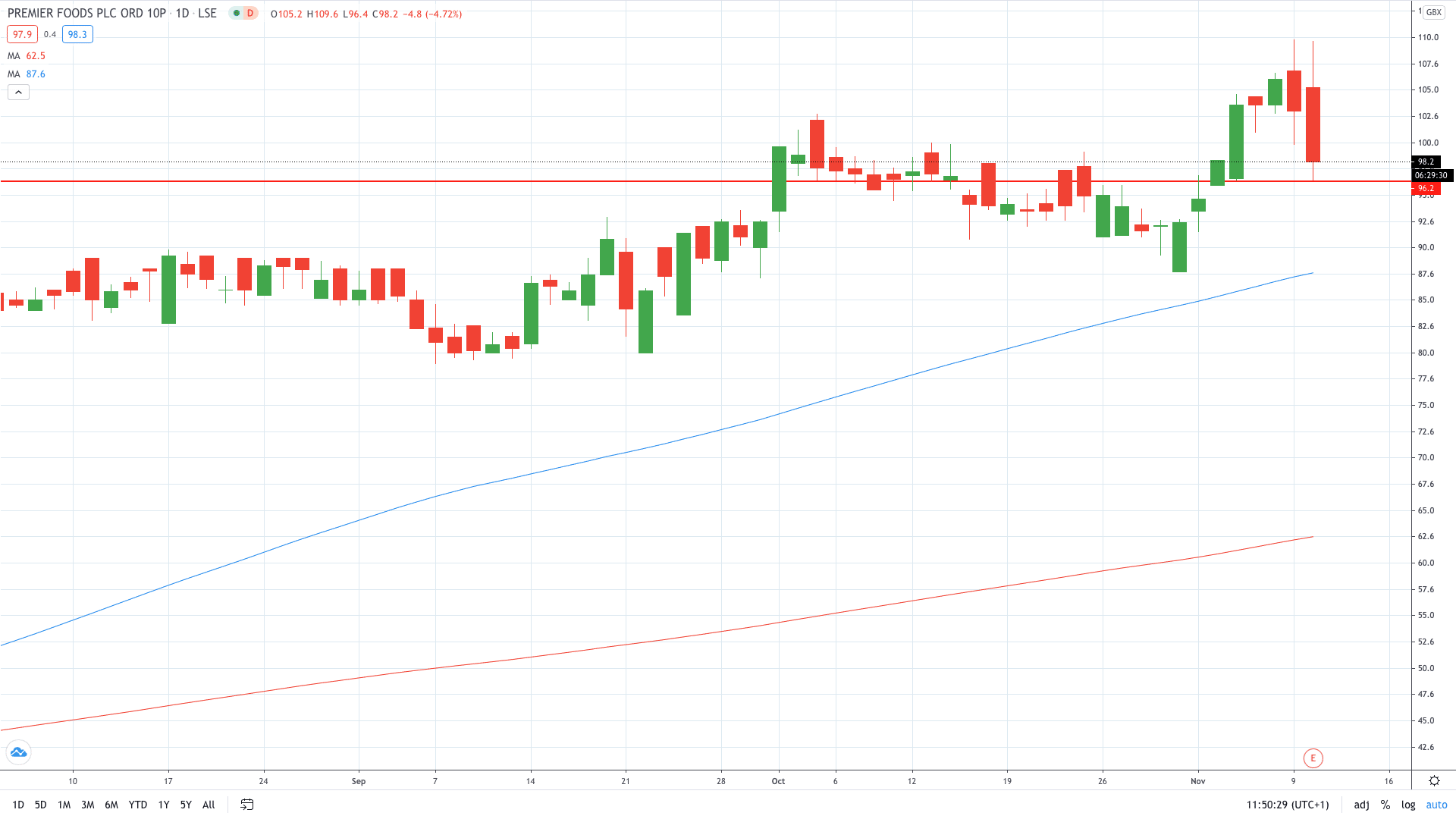

Shares of Premier Foods PLC (LON: PFD) plunged more than 6% on Tuesday despite upgraded full-year profit guidance from the owner of Mr Kipling and Bird’s Custard.

Premier Foods announced that its revenue rose 15% to £421 million with profit before tax skyrocketing 70% to £50 million. As a result, net debt was slashed by 18% to £403 million.

The company benefited immensely from lockdowns as people confined at home spent more time on home-cooking and groceries. Given yesterday’s news about the Covid-19 vaccine, investors are slightly worried that the normalization will lead to people returning to eat outside.

Analysts at Peel Hunt increased the price target on Premier Foods to 125p from prior 120p.

“The renewed lockdown is likely to extend the positive performance in the short-term, but we see potential for some of the themes to be longer lasting, with more people working from home, increase in cooking from scratch, greater online penetration and a stronger base for growing International.”

Premier Foods share price dipped below the 100p mark today to extends yesterday’s losses.

PEOPLE WHO READ THIS ALSO VIEWED:

- BRITISH AIRWAYS: HERE’S WHY IAG SHARE PRICE SOARED TODAY

- Learn more on how to open a demo account

- Learn what is a Pip in trading