Key points:

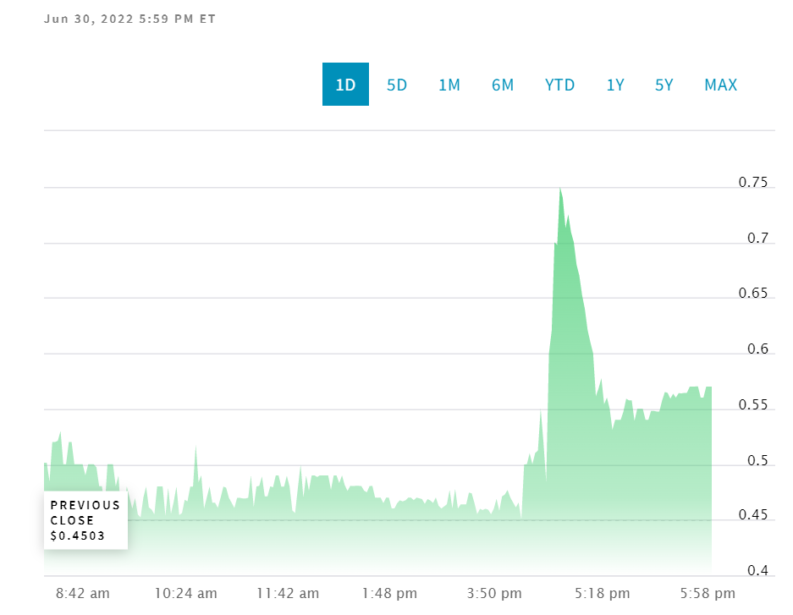

- Quoin Pharma fell 10% yesterday, jumped 80% today

- The big question is why such price moves on no obvious information?

- Only then can we decide how to trade this volatility

Quoin Pharmaceuticals (NASDAQ: QNRX) stock – it's actually an ADR – has soared near 80% premarket this morning on the back of no obvious news. This means we've got to speculate about what the cause is – for only by getting the reason for the Quoin stock price jump right can we work out how to trade it.

There are a number of candidates for the stock price jump although near all of them depend upon a certain leakiness of information where there shouldn't be such leaks. There's really only one that doesn't lead to that conclusion.

We should note that this price rise this morning isn't just the result of thin trade this morning though. There was a big jump immediately post market last night, which then faded, then we're seeing a rise again this morning. This is more than just the one transaction in thin markets that is – and given the corporate valuation at around the $5 million market they are going to be thin markets.

Also Read: How To Buy AstraZeneca Shares

Quoin Pharmaceutical is a specialty pharmaceutical company, working with rare and orphan diseases – this aids in FDA approvals. The lead product is for Netherton Syndrome, others focus on a type of epidermolysis, another on a different rare skin disease. Quoin stock is down 97% over the past year so the recent jump will be of at least some comfort to long term stockholders.

Recent news has included gaining distribution deals in China for two of its product candidates. Those deals only going into effect when approval is gained, of course. There was also a 45% leap in the Quoin stock price when it announced it had gained FDA approval – but that was approval to test that candidate for the Netherton treatment. Approval to test is both nice and necessary but it's still a long way from authorisation to produce and sell.

There's also the technical issue that Quoin has received the near traditional NASAQ notice of not being in conformity with minimum pricing. Trade under $1 and you risk losing the NASDAQ quote altogether, being relegated down to the OTC markets. This was the first warning though, Quoin has until Dec 7th to solve this problem.

All of which leaves us free to speculate about why the Quoin price dropped 10% yesterday before market close, and has now risen 80% between now and then premarket. For none of those issues themselves – given that they've all been known for some weeks – explain why the Quoin stock price jump today.

There are possible theories of course. One that Quoin has decided to solve that NASDAQ problem, possibly with a reverse stock split, or more distribution deals have been signed, or even there's news from the FDA. But all of those would imply – given no formal announcement – that the news has leaked.

The other possibility is simply that we're seeing a change in sentiment in the market. That would imply this is a momentum trade. At which point as traders we need to decide whether it will continue or fade back – choose well.