Shares of Wizz Air Holdings PLC (LON: WIZZ) rallied higher to recover this morning’s losses after the budget carrier reported a net loss of €243.1 million for the six months to September 30

The Hungary-based firm said it saw passenger numbers crash by 70% amid travel restrictions and lockdowns. In its second quarter, Wizz flew 5.8 million passengers at 66% load factor and 72% of last year’s capacity to “distinctly outperformed the industry,” according to CEO József Váradi.

In October, the number of passengers dropped 69% to 1.1 million compared to a year ago, with capacity down 55% and a load factor of 66%.

The company expects to burn through a €70 million per month, which shouldn’t create huge problems given the strong liquidity. At the end of the reporting period, Wizz Air had a total of €1.6 billion of cash.

“During the first half of the financial year, we demonstrated outstanding agility and invested in long-term market opportunities: we announced 13 new bases since the beginning of the fiscal year, and added more than 260 new routes,” Váradi said in a statement.

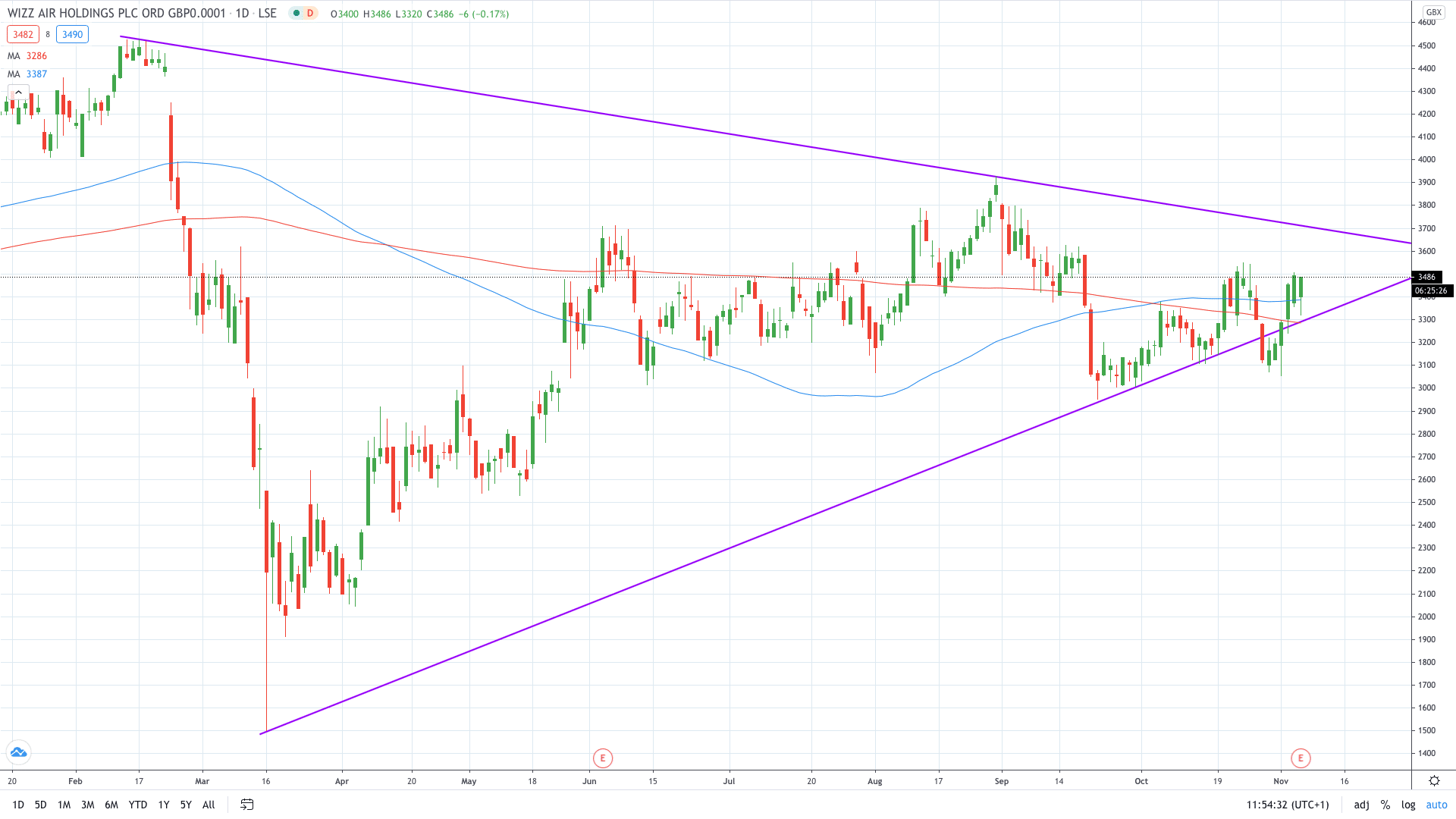

Wizz Air share price fell almost 5% in the morning before recovering to trade only 0.17% in the red at 3486p.

PEOPLE WHO READ THIS ALSO VIEWED:

- BRITISH AIRWAYS: HERE’S WHY IAG SHARE PRICE SOARED TODAY

- Learn more on how to open a demo account

- Learn what is a Pip in trading