Dash Cryptocurrency – Key Features

- Dash is a privacy coin. That means the address of the sender and a receiver in a Dash transaction can be masked. It is more fully described as an open sourced, privacy-centric digital currency with instant transactions. In other words, while the blockchain is public and open source, its primary concern is privacy for users.

- While most transactions on the Dash network operate very much like a Bitcoin transaction, users also have the option of making transactions private and instant. Private transactions have their origin masked by mixing the transaction with other transactions. Instant transactions cost slightly more, but are

- Dash also differs slightly from Bitcoin in that mining rewards are split between miners, participants that hold a certain amount of the currency, and a development fund.

- Dash has consistently been ranked amongst the 30 largest cryptocurrencies, and is popular with the early adopters of cryptocurrencies who are generally concerned with privacy. Dash is one of the most popular crypto assets amongst exchanges, with the majority of large exchanges listing it.

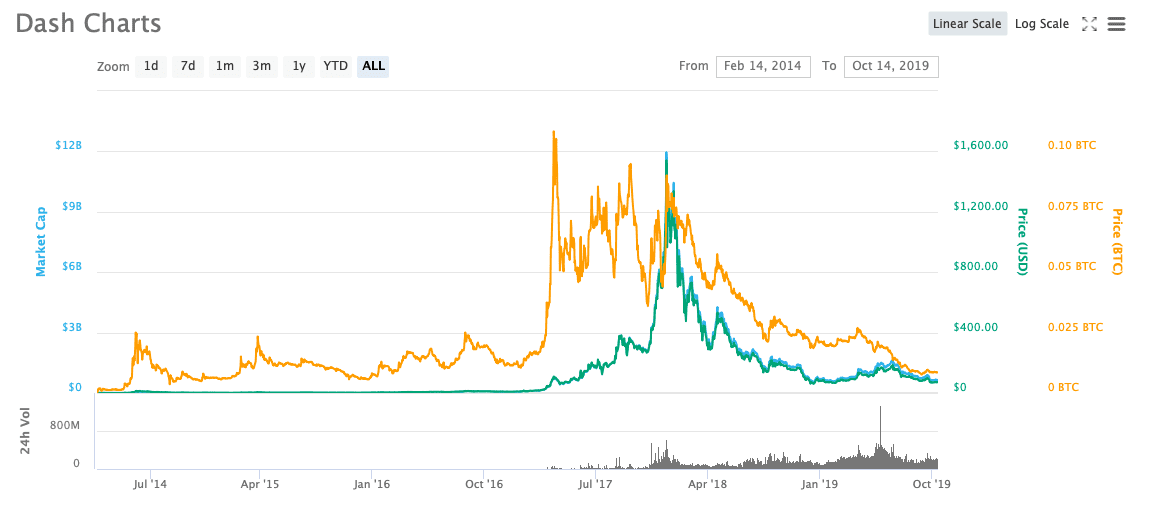

- However, it has to a certain extent been displaced by utility tokens that gained popularity on the back of the ICO boom in 2017. It has also underperformed some smaller privacy coins since 2017.

Dash as a Payment Coin

Dash offers the ability to transmit value instantly if required. This makes it a good choice for frequent purchases. However, the cost of private transactions can be quite high which is a weakness that has to be considered.

Dash is already one of the most widely accepted cryptocurrencies by vendors and can be accessed via ATMs too. That means that regardless of the technology it already has a head start. Dash is compatible with most popular multi-currency wallets as well as its own wallet.

It also has a large group of supporters, which means other currencies will struggle to displace it. The developer community is talented and committed, which means it is possible that transaction costs can be reduced.

When it comes to making payments, Dash is already superior to Bitcoin, with lower fees for standard transactions and faster processing times. Dash fees are as low as 3 percent of Bitcoin’s fees and transaction times are as low as 5 percent of Bitcoin transaction times.

Because Dash incentivizes not just miners but those that run master nodes and a development fund, governance on the network is strong. This is a major factor when looking at the long-term potential for a cryptocurrency.

Dash Coin as an Investment

The major concern with privacy coins is that whenever there is a breach on an exchange, everyone looks at privacy coins to take the responsibility. When considering crypto trading strategies, privacy coins are a topic that will often come up.

Monero is likely to take the first place in the “privacy coin” race, just because of its improved features.

The biggest risks are probably related to the Dash coin itself and the crypto market in general. If the broader market does not make new highs, Dash will be unlikely to generate substantial returns.

As far as the coin itself is concerned, if the network is compromised, or if master node operators lose faith in the potential, Dash will underperform. And, if private transactions are ever traced, its privacy characteristics will be discounted.

As it stands, Dash is probably best held as a part of a portfolio rather than as a standalone investment. If on the other hand there are positive developments that make it stand out, it may emerge as a standalone investment.

How to Buy Dash Coins

There are multiple ways to buy dash cryptocurrency. One of the simplest is to directly buy from another individual online or in person. The other way is to reach the nearest crypto ATM and make a direct purchase.

However, one of the safest ways to purchase dash coins is to use a reliable crypto exchange. For instance, CEX.IO allows you to buy dash coins using Mastercard or Visa by paying in dollars or euros. You can make a purchase by registering and using your credit card directly on the website, or via bank transfer for larger amounts.

And if you find deposit fees might be too high on CEX.IO, Kraken is a viable alternative with low fees and excellent security system.

However, while these two platforms might be great to start with, we would always recommend researching other exchanges and comparing fees, to find the one that suits you best.

It is also prudent to consider investing in a Dash wallet if you plan to own larger amounts of this crypto. Experts suggest that it is safer to store coins in your hardware wallet than to keep them in an exchange. Hardware wallets are almost impossible to hack while there were many notable cases of crypto exchange breaches.

It is also worth noting that Dash, similarly to any other crypto, is a highly volatile asset, and that, while profits are possible, so are losses. We would suggest starting with smaller amounts for your first investments.

Dash Coin History

- Founded in 2014 by Evan Duffield who thought that Bitcoin did not go far enough to provide users with privacy. Bitcoin is pseudonymous which means the senders name is masked, but the wallet address is not. That means it is sometimes possible to trace a transaction back to the sender.

- Developed on the back of Bitcoin’s code with certain changes to it.

- Dash quickly gained a following in the crypto community and was the third cryptocurrency to reach $100. It has remained one of the top two privacy coins by value despite numerous other privacy coins coming onto the scene. Currently, Dash trades for around $71.

- Dash was originally named XCOIN. The name was later changed to DarkCoin and then Digital Cash which is shortened to DASH.

- As of 2018 coins were mined using a proof-of-work algorithm with a hash function named “X11”, with 11 rounds of hashing, and the average time to mine a coin was around 2.5 min.

- As of 2019, it is the most popular cryptocurrency in Venezuela according to Der Spiegel.

How Does Dash Blockchain Work?

The blockchain of Dash is similar to that of Bitcoin, with some major differences.

While the blockchain is operated by miners who act as nodes on the network, it also has master nodes, which are nodes owned by entities holding a minimum quantity of Dash. Master nodes facilitate private and instant transactions. When a user decides to use the private send function for a transaction, a message is sent to the master node, which then looks for other similar transactions to mix that transaction with. The master nodes then combine several private transactions into one, before splitting them into the original amounts. In this way, it’s impossible to see which transaction came from which address originally.

When users choose to send DASH using Instasend, the master nodes facilitate the transaction in less than a second. Users pay a higher fee for these transactions, and these fees are earned by the master node. This makes DASH a better option for frequent, fast payments than Bitcoin.

The master nodes protect the Dash network from attacks. Anyone wanting to attack the network would need to accumulate more Dash than half the master nodes combined hold.

Dash as a Privacy Coin

While Dash is one of the two most successful privacy coins on the cryptocurrency market. However, there are some critics of the privacy characteristics of Dash. Firstly, some believe that because not all transactions are private, the sender of a private transaction could theoretically be traced back via master node.

Another concern is that private transactions can be quite slow. Because private transactions are combined to mask their senders, the master nodes have to wait for enough transactions of similar values to be made before they can be processed. In order to combine similar transactions together, private payments have to be in specific denominations too. That means a sender cannot send a specific dollar amount to pay for a purchase.

Dash Vs. Monero

Critics also believe that Monero, the other leading privacy coin, has better privacy characteristics. While they also believe that many other smaller coins may be superior, the fact that Dash is already the market leader makes these coins less relevant.

Monero is a legitimate challenger as all transactions are private, and transactions are faster. Monero’s weakness is that the voting system makes it more difficult to make improvements to the network.

The Other Privacy Coins

More and more privacy coins have emerged since 2012. ZCash is another “big” privacy coin. Zcash was developed as an alternative to Bitcoin, just like Dash, and has enhanced privacy and security. Unlike Monero, private transactions are not required when transacting with Zcash. Instead, users have can use the enhanced privacy feature to blur transaction details and use either a transparent wallet address or a “shielded address” to keep all transactions 100% private. In order to do that, Zcash uses the “Zero-Knowledge Succinct Non-Interactive Argument of Knowledge” and the zero-knowledge security layer (ZSL).

Other privacy coins include: Verge, Bytecoin, Komodo, Zcoin, Grin, Loki and many others.

Conclusion

Dash is a major privacy coin. Its blockchain rewards miners, master node operators and a development fund which goes toward improving the network. Mater node operators hold a minimum number of coins which makes the network resilient against attacks.

Users can make standard transactions which are relatively fast and cheap. They can also pay a fee to make instant transactions, or make private transactions though these take a bit longer.

Besides being popular amongst investors Dash is one of the most widely accepted altcoins and is available on most major exchanges.

PEOPLE WHO READ THIS ALSO VIEWED: