These five market gurus give their reasons why the 2022 market mudslide is about to overshoot to the downside and is creating an incredible buying opportunity.

S&P 500 Index – Daily Price Chart – March 2018 – May 2022 – Down 16.34%

Source: IG

Jim Cramer

One of the coolest heads in the market right now is high-profile markets guru Jim Cramer. He spent 25 years as a Wall Street trader and hedge fund manager before joining broadcaster CNBC.

Speaking before April’s market crash, Cramer was advising his fanbase that more short-term uncertainty could be expected. However, it could take as little as one month for investors to “bake in all the negativity”, and then the markets would be “poised for one incredible, tremendous rally”.

Part of Cramer’s thinking is that the current downturn in asset prices is understandable, but for those who can see through short-term noise there are reasons for economic fundamentals to come into play and kickstart a bull run.

Cramer’s interpretation of events since Covid torpedoed the global economy in 2020 is that prominent players in the financial eco-system have made completely understandable errors that are already working their way through the system.

He says that, in hindsight, the US Federal Reserve was too slow to raise interest rates. The plans to start cooling the economy in Q4 of 2021 were postponed due to the Omicron variant of Covid raising fears that another lockdown might be necessary. The Covid fears were overplayed but resulted in the Fed needing to adopt a sledgehammer approach in 2022.

Business leaders also made wrong calls, and many sectors are behind the curve. He says that oil companies are examples of firms that stripped back operations earlier than others but are now out the other side, and oil share prices are surging. Cramer’s opinion is that other firms will follow oil firms and retune their operations, which will send their stock prices rallying. There’s a lot of headroom for the likes of Apple, Amazon, and Netflix stocks which are down from their 2022 highwater marks by 15.96%, 35.31%, and 70.85%, respectively.

According to Cramer, the economy “has been totally upside down”, best demonstrated by the fact that used car prices traded over new car prices because new cars weren’t available. “Just as the Fed is swinging into action, I think the invisible hand of the free market is taking care of a lot of this. Mortgage rates are sky high; property prices have peaked; hybrid offices and second homes are fully built out.

“Suddenly, conventional wisdom says there’s too much of everything, and prices are going to come down. That is the reason markets are tumbling, and markets always overshoot, but they also bounce well ahead of when the required changes to the ‘real’ economy are implemented.”

Cathie Wood

Fund manager Cathie Wood has gained notoriety for her extremely bullish predictions on some tech stocks but is backed up by the fact that the Ark ETF, which she manages, made a +150% return in 2020. Performance of that fund in 2021 and 2022 has been equally dramatic, but in the other direction, but Wood’s high beta strategy captures the mood of the current market.

Wood shares information on her best stock picks through the media, but the buying and selling activity can also be tracked by accessing official disclosures of trading activity. The stocks she’s allocating capital to right now are some of the ones which have been most impacted by the 2022 sell-off, so if the market does rebound, then overshooting to the upside can be built in as well.

One advantage of digging into the investment approach of Cathie Wood is that it identifies real targets that retail traders can easily trade. What’s more, it pinpoints growth sectors rather than being bound by ‘traditional’ investment protocols. Describing the advantages of this approach, she said:

“Unlike traditional asset management firms, our analysts do not follow sectors. They follow technologies – the 14 different technologies that I mentioned, involved in these five major innovation platforms.”

Source: bq.com

The Ark ETF through May 2022 continued to build up positions in some of Cathie Wood’s favourite growth stocks. These include Shopify, Zoom, Roku Inc, and Coinbase Global Inc.

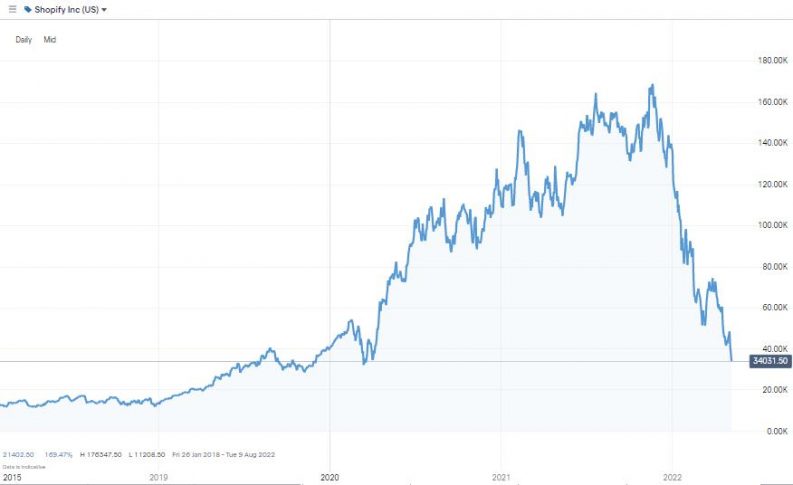

Shopify has been a long-term target of funds managed by Wood. The eye-watering share price rises in 2020 and 2021 were good news for the Ark ETF but proving she’s not a misguided perma-bull, Wood did scale back her position before the 2022 price crash. Between November 2021 and May 2022, Shopify stock fell in value by more than 78%, and Wood is stepping in to buy at those low levels.

Wood has gone on record to state Shopify, with a current market capitalisation of $44.3bn, could ultimately become as big as Amazon. The currently smaller platform’s use of social media platforms to generate sales is a USP Wood thinks will outlast a short-term bump in the road for tech stocks.

Shopify Share Price – Daily Price Chart – March 2018 – May 2022

Source: IG

Marko Kolanovic

One renowned dip buyer is Marko Kolanovic, Managing Director and Global Head of Macro Quantitative and Derivatives Strategy at J. P. Morgan. Kolanovic holds a five top rank in Institutional Investor surveys in the United States, Asia and Europe and individually ranks as number one in the Americas Equity Derivatives category.

His quantitative-based analysis leans heavily on technical strategies to help investment decisions incorporate price metrics rather than emotions. That can be the key to timing the right time to step in and buy a falling market.

Kolanovic’s confidence in the prospects for the US economy is based on the bad news in terms of inflation, interest rates and Ukraine-Russia already being priced into share prices. Short-term volatility must be factored in, but medium-term investors should be buying into the market to take advantage of price dips. This view is based on the balance sheets of corporations and consumer debt being at healthy enough levels to ride out the storm. He said:

“We think that outright recession should not be a base case given continued favourable financing conditions, very strong labour markets, an unleveraged consumer, strong corporate cash flows, strong bank balance sheets, a turn for the better in the China policy outlook, and the COVID-19 impact should be fading further.”

Warren Buffett

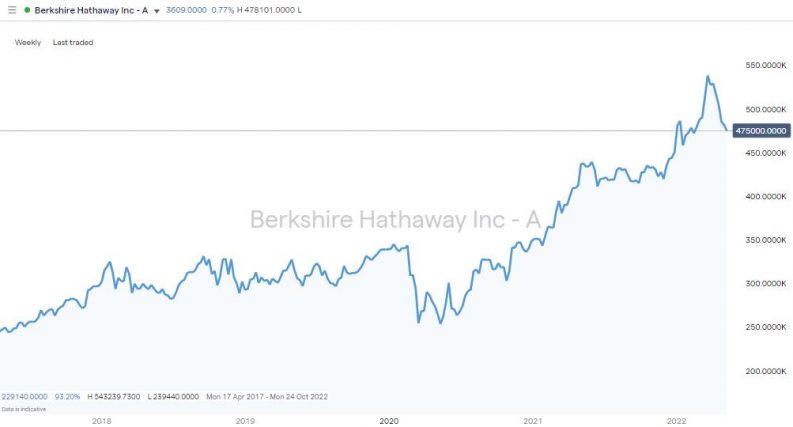

The ‘Sage of Omaha’ has one of the most impressive track records in the investing community. His Berkshire Hathaway investment vehicle increased in value by 92% between May 2017 and May 2022. That’s an impressive enough return in itself but is even more impressive because Berkshire Hathaway is widely regarded as one of the best defensive stocks.

Berkshire Hathaway A Share Price – Weekly Price Chart – May 2017 – May 2022

Source: IG

A decision to buy Berkshire Hathaway stock can be actioned by using an online broker. With one click, individual investors can get exposure to the basket of stocks in which the company has invested. Some of those positions are sizable, and in Q1 of 2022, Buffett scaled up his investment in oil company Occidental by $7bn, which took his holding to 14% of the free float.

The nature of the relationship between Berkshire Hathaway and the firms it buys into will offer additional comfort to investors. Speaking at a conference in April, Buffett remarked that Berkshire would always be cash-rich and that in times of need, the company would be “better than the banks” at extending financial support to companies.

Hathaway's share price performance has been clipped by the company stepping into the market through Q1 of 2022, just as share prices have been falling. This averaging into positions is the trademark of good long-term investors, and the short-term blip can be expected to pay off in the medium and long-term. Buffett said:

“Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can't buy what is popular and do well”.

Source: dinarrecaps.com

Buffett is a legend within the investing community, which is why a lot of new investors will often ask themselves, ‘What is Warren Buffett investing in?‘ when deciding on their first stock investments.

Joseph Piotroski

The last of our five market gurus who are bullish now is Joseph Piotroski, or more accurately, the methodology of Joseph Piotroski. Piotroski has a lower profile than some of the big names in the pundit space, but his value-based investment strategies are easy to follow and have a track record of picking stocks which outperform the market.

Piotroski, a professor of accounting at Stanford University's Graduate School of Business, built a model which has since been widely shared and delivers market-beating stock selections. It screens for high book-to-market stocks and then separates out financially sound firms by looking at improving financial criteria.

Whatever the market conditions, there is a ‘Piotroski’ stock to buy and some of the current picks currently look oversold.

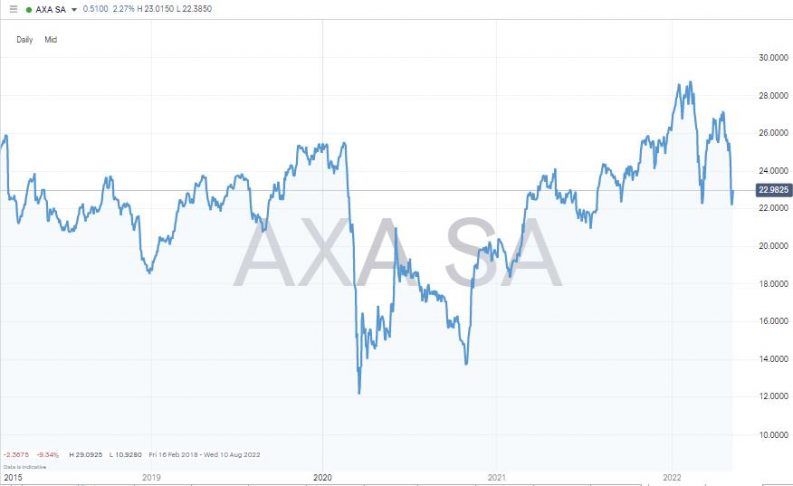

AXA SA has a market cap of €59.4bn and operates mainly in the Insurance (Life) industry. The Book/Market Investor rating, according to strategies based on Joseph Piotrowski’s models, is 80%. This number is based on the firm’s underlying fundamentals and the stock’s valuation. A score of 80% or above indicates that the strategy has some interest in the stock; that makes AXA a stock to buy now.

Axa SA Share Price – Weekly Price Chart – May 2018 – May 2022

Source: IG

The data crunched by Piotroski’s quantitative model includes return on assets, cash compared to income, change in long-term debt/assets, cash flow from operations and change in asset turnover. Each metric is graded as ‘pass’ or ‘fail’, and the greater the number of passes, the better the investment opportunity.

Piotroski’s methodology ties in nicely with the approach of Jim Cramer and Marko Kolanovic. Those gurus see the current pessimism as being overplayed because corporate balance sheets are relatively strong going into the 2022 uncertainty. The Piotroski model identifies the names of firms that are suitable to buy at the moment.

Final Thoughts

The caricature of senior portfolio managers at big banks and investment houses always being at lunch has been overplayed, but there’s no smoke without fire. The reason that top brass of City and Wall Street firms can appear to have “a lot of time on their hands” whilst junior staff are tasked with day-to-day jobs comes down to more than just the natural pecking order. Experienced traders are paid for what they know as much as for what they do. At times such as these, that can result in them putting on trades of a lifetime.

It takes minutes to set up an account with an online broker and take advantage of an opportunity to buy at the bottom of the market. One golden rule is to ensure it is regulated and trustworthy. This shortlist of good brokers includes firms reviewed by the AskTraders team. The review process takes a rounded approach and considers pricing, customer service and research materials on offer. Whether you’re an experienced trader or a newbie, they all offer ideal support to get your dip-buying trading off to the best start.