Many publicly-listed companies pay what is known as ‘dividends' to their investors. Dividend investing is popular among traders as it gives them two potential sources of profits: guaranteed income via dividend payments & long-term capital appreciation. Short-term traders look to dividend investing as was to earn quick profits from dividend-paying stocks by employing dividend capture strategies.

YOUR CAPITAL IS AT RISK

In this guide we will explore the dividend capture strategy and how it can be an effective approach.

Table of contents

What is a Dividend?

In simple terms, a dividend comprises sharing a portion of the corporation’s profits with its shareholders. Typically paid out as cash, they are often drawn out from a company’s earnings and distributed on a per-share basis in periodic time intervals (usually monthly, quarterly, or annually).

Besides cash, the other methods of distributing profits could be stock dividends, the option to choose between cash or stock or the choice to buy additional shares along with the dividends. Dividend distribution comes under the purview of the board of directors of a corporation and once its approved, common shareholders are generally eligible to receive them.

Dividend Capturing

Many day traders are only interested in holding a dividend stock long enough to receive the payout. This short-term dividend strategy is what’s commonly referred to as the ‘dividend capture'. Short-term traders use the dividend capture strategy as an easy, straightforward method of producing income with limited exposure to capital losses.

What is The Dividend Capture Strategy?

The Dividend Capture Strategy is a two-trade system that allows investors to benefit from a stock’s dividend without encountering the risks involved when holding shares for an extended period of time. It is an active income-focused stock trading strategy which is popular with day and swing traders.

In any market, the longer an asset is held, the greater the potential it has to fall in value. Unlike most traditional trades in equities (where stock is held until its share price generates a profit), the central purpose of the dividend capture strategy is to receive a dividend payment and quickly exit the position.

In practice, a dividend capture strategy requires an investor to buy shares of stock just before its ex-dividend date. This allows an investor to ‘capture' the dividend and then immediately sell the stock once the dividend payment is made. In many cases, the shares of the underlying stock are held for just a single day.

Dividend Capture Strategy Timeline

YOUR CAPITAL IS AT RISK

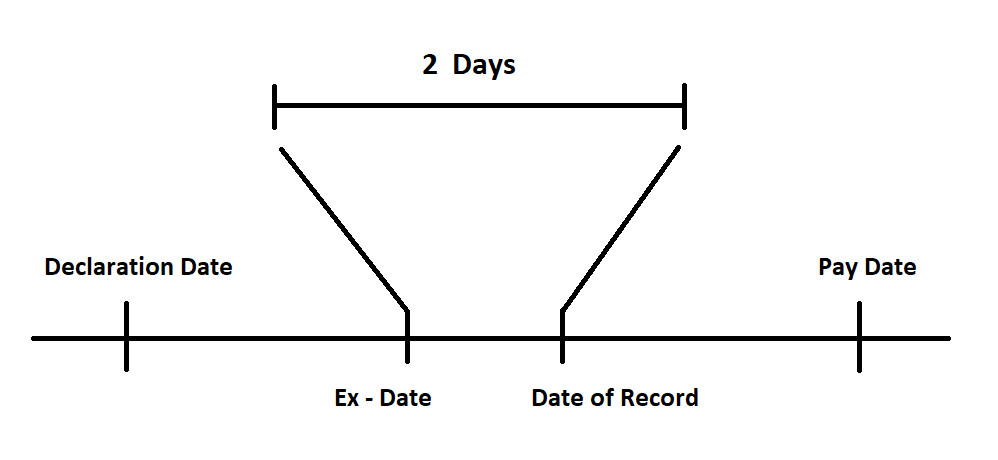

If you are new to dividend investing or are looking to build dividend capture strategies, it’s important for you to understand some of the key dates along the dividend timeline:

Dividend Capture Key Dates

1. Declaration Date

The date on which the Board of Directors go ahead and announce their decision to make a dividend payment. The announcement would also include a record date and a dividend payment date. Larger companies tend to announce their dividends in conjunction with quarterly earnings reports or through separate press releases.

2. Ex-Dividend Date

The cut-off date for eligibility to receive the stock’s dividend payment. Traders utilising the dividend capture strategy must buy the stock before the ex-dividend date. Anyone buying the stock after the ex-dividend date won’t be entitled to receive the upcoming dividend payment. It is also the day when the stock price adjusts for dividend payments and could witness a drop in prices.

3. Record Date

On this date, the company records all the shareholders that are eligible to receive dividends. Investors who purchased the dividend-paying stock before the ex-dividend date are entitled to dividends. In the UK, it is typically a Friday.

4. Payment Date

The payment date is generally a few weeks after the record date. All investors who owned the stock before the ex-dividend date would receive the dividend on this date. If it is cash dividends, they would either receive a cheque or the money credited to their investment account. Likewise, in the case of stock dividends, the additional shares would be deposited into their investment account.

YOUR CAPITAL IS AT RISK

Useful Pages:

Compare Stock Brokers | Compare Forex Brokers | Compare CFD Brokers

Choosing The Right Dividend Stock

Some businesses in recognised markets with predictable cash flow could choose to pay consistent dividends to attract long-term investors. However, as an investor, you should analyse some of the key criteria to understand the sustainability of dividend stocks, especially if you are a beginner.

Here are a few of the key things to look at:

1. Dividend Yield

The dividend yield is the annual dividend to the share price, expressed as a percentage. Just as you calculate interest on your deposits, dividend yields are an efficient way to compute the annual percentage returns on the stock. However, since they are inversely proportional to the share price, the yields could oscillate wildly.

For example, f a company offers a dividend of $2 a year for a stock trading at $100, the dividend yield is $2/$100 = 2%.

2. Dividend Payout Ratio

The dividend payout ratio is the amount of dividend paid as a proportion of the company’s net income. In simpler terms:

Dividend payment Ratio (DPR) = Dividend Paid/ Net Income

You can also calculate the dividend payment ratio on an individual share:

DPR = dividend per share/ earnings per share (EPS)

For example, if a company’s net income is $2 billion and it pays a dividend of $500 million, the Dividend Payout Ratio = $500 million/$2 billion = 25%.

3. Dividend Payout Tax

Depending on the jurisdiction you live in, there could be a dividend tax on the dividend income you receive from a corporation. In the UK, the dividend tax does not apply to the first £2,000 you receive.

Besides, if your entire income is from investments, the dividend tax becomes effective only if you exceed £12,500 in the tax-free personal allowance. However, once you exceed the dividend and the tax-free personal allowance, your tax rate on dividends would be as follows:

| Tax Band | Tax Rate* |

|---|---|

| Basic Rate | 7.5% |

| Higher Rate | 32.5% |

| Additional Rate | 38.1% |

*On dividends over allowance

One of the most important secrets to success when implementing the dividend capture strategy is to diversify the stocks you choose as part of a short-term trading portfolio.

Why is diversification so important? Diversification can help protect you from macroeconomic ‘shocks' that might occur in certain areas of the market. These trends can have a tremendous influence on the profitability performances of any dividend capture strategy.

When you are selecting stocks as part of this technique, you must also focus on company-specific elements that make the stock suitable for inclusion:

- Focus on stable large-cap stocks and mid-level dividend yields (3-4%)

- Select companies with strong revenue growth and a history of beating analyst expectations

- Diversify stock selections across industry sectors in order to avoid the effects of market volatility or unexpected macroeconomic events

- Use technical chart analysis to identify stocks with healthy trend momentum

- When favourable, rollover previous stock positions and re-invest profits into new dividend capture trades

- Exercise patience in the event share prices drop after the ex-dividend date

Traders might also consider buying exchange-traded funds (ETFs) and high-yielding stocks of foreign companies offered on the major European and U.S. trading exchanges as a way of finding additional opportunities to generate income.

YOUR CAPITAL IS AT RISK

Also Check:

Best dividend stocks in the UK

Dividend Capture Benefits & Risks

While, on the surface, the dividend capture strategy may look straightforward and profitable, it does have its own pros and cons you need to be aware of:

Dividend Capture Advantages:

- Quick entry and exit. You can sell dividend stocks on or after the ex-dividend date;

- A dividend capture strategy could work in all market conditions;

- There are several different ways to implement dividend capture strategies;

- Traders can use thousands of different dividend-paying stocks when implementing the strategy

- There are continuous prospects as you can find dividend-paying stocks almost every other day.

Dividend Capture Disadvantages:

- Dividends received beyond a certain threshold are taxable;

- All dividend stocks plummet on the ex-dividend date. Unless you have a strategy to counter it, you would end up waiting for the stock prices to recover before selling;

- Transaction costs could impact the overall profitability of the strategy;

- Market volatility could lead to inconsistencies in the stock price, affecting the predicted capital gains from dividend capture strategies.

Dividend Capture Strategy Example

Suppose company ABC is willing to pay a dividend of $2 a share and the share price one day before the ex-dividend date is at $100.

A trader buys 1000 shares of the company for $100,000 ($100*1,000).

Theoretically, ABC should open at $98 on the Ex-dividend Date. However, in practice, that does not always happen due to market conditions and other factors, which is basically the reason for employing the dividend capture strategy.

If the stock opens at $99, the trader sells the stock and collects $1,000 ($1*1,000) on the Payment Date, a few days later.

This is an example of a profitable dividend capture strategy.

On the other hand, if stock prices open at $97.50 on the Ex-dividend Date, the trader could end up incurring losses. To overcome this risk from adverse price movements, some sell ‘In the money call options’ or buy ‘In the money puts.’

Alternative Strategy Techniques

Advanced traders will also find ways to generate greater returns by selling options that profit when share prices fall on the ex-dividend date. One of the most popular options strategies used in these instances is the Covered Call, which is an approach that can benefit from the initial declines typically seen in share prices following the ex-dividend date.

This is one of the few investment strategies available in the financial market that is capable of producing investment income from multiple sources (specifically, from the dividend payout and from the option sale).

Since share price activity tends to be negative (or sideways) during the trading sessions that follow the ex-dividend date, Covered Call options can provide a powerful profit enhancement to any dividend capture strategy.

Additionally, announcements of special dividends can increase overall profitability when compared to dividend returns that can be captured through normally scheduled dividend payouts.

This is because special dividends offer one-off dividend payments that are structured differently (and tend to be much greater) than the regular dividends made available on a monthly or quarterly basis.

This elevated dividend yield helps balance brokerage fees and share price fluctuations often seen in the market during the periods that follow a stock’s ex-dividend date.

YOUR CAPITAL IS AT RISK

Summary

- In contrast to traditional dividend investments (which usually involve buying/holding the stock shares of dividend-paying companies to generate a steady stream of income), a dividend capture strategy is an active approach which requires frequent buying/selling and a willingness to hold stocks for a short period of time.

- In order to reach profits, traders must wait for share price gains to rise by an amount that’s greater than the dividend before selling the stock (assuming dividend eligibility is confirmed on the recording date).

- Options contracts are able to enhance total income returns for traders willing to manage multiple position strategies at the same time.

- The approach is popular with active money managers and day traders because of the high trade turnover required with this strategy.

- Initial trading risks are encountered when stock prices drop in value by an amount that is roughly equal to the declared dividend value.

- Capture strategists can also buy a stock at a low price when a company announces its dividend (or shortly thereafter) and sell the stock the day prior to its ex-dividend date (capitalizing on the rise in prices).

- Disadvantages of the strategy include the high capital outlay that is often required, the risk of initial declines in the stock, and the active trade management involved when opening/closing positions.

PEOPLE WHO READ THIS ALSO VIEWED:

- Best blue-chip stocks to buy

- Trade stocks with top-rated Pepperstone

- Explore and learn bollinger bands strategy