Achieving the best bottom-line return is helped by finessing your stock picking, so this user-friendly guide will outline how to find the best long-term stock investments. It also covers how to move into the market and apply a strategy that works for you.

Historical Stock Market Performance

Historical data indicates that the actual risk with stock trading is not actively investing in the market. To some extent, the temptation to keep cash in savings accounts is understandable. However, if you have a sum of money you can afford to tie up for years, it is highly likely keeping that cash on deposit will be a losing trade.

Records stretching back to the end of World War II (October 1946) show that annualised returns on the S&P 500 index have been impressive in terms of total profits and consistency for long-term stock investments.

S&P 500 Index – Daily Price Chart – 1982– 2022 – +2,868% Return

Source: IG

Nominal returns on the index over that time are 11% on an annualised basis. Once inflation is factored in, the actual total returns still rack up at an impressive 7.3% annualised. The fear of having missed the train is very real for investors, but data points to stock investing being a reliable way of generating a long-term return. In 84% of cases, actual returns over a 20-year period are above 3%. If, during those many decades, you'd timed trade entry and exit points into a 30-year investment strategy as badly as you possibly could, then the real return would still be 4.0%.

Investing in companies allows shareholders to protect themselves from some of the threats associated with wealth creation, such as inflation. Even after inflation is factored in, earnings posted by corporations in the S&P have increased 3.4% annually.

There is, of course, a chance that a paradigm shift will occur, and the whole financial system, which has been operating for decades, suddenly breaks down. Whilst not wanting to dismiss the risk of that happening, if it does, it would have to involve an economic and political shake-up on a scale which meant the returns on your investment portfolio would probably be the least of your concerns.

How To Invest In Stocks As Long-Term Investments

The names on any list of hot stock picks will change over time as companies fall in and out of favour with investors and analysts. That's part of the usual ebb and flow of markets, but some principles and tips on how to trade are more durable.

One basic principle of investing is to diversify your portfolio. That can involve investing in asset groups other than equities and spreading your capital across different stocks and sectors. This minimises single stock risk and smooths out returns.

Another vital piece of advice is only to invest amounts of cash which aren't going to play havoc with your emotions. That is less about welfare but reflects that investors who panic because they're suddenly on the wrong side of a trade can make rash decisions they later regret.

The stocks listed below come from a variety of sectors. Those from the utilities and defensive sectors have been selected for their ability to weather economic storms but also because they pay dividends. One factor to consider is the importance of reinvesting those dividends back into the market and buying more shares. That way, your investment snowballs and the returns from strategies that have adopted compounding have historically outstripped portfolios where dividends were taken out as cash.

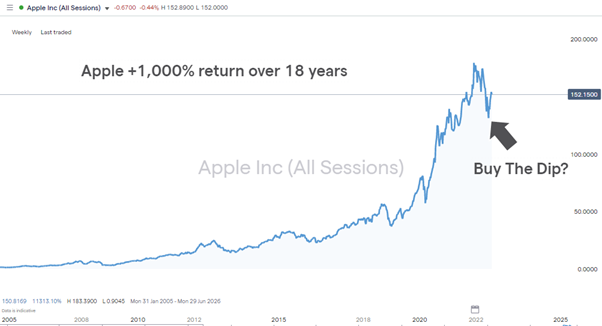

Best Tech Stock To Invest In For Long-Term Returns – Apple Inc (AAPL)

It's hard to put a value on the Apple Inc brand, but the instant recognition and global fan base for its products have resulted in the AAPL share price soaring to levels where it is now one of the world's biggest companies by market cap. The dominant position in the market makes it an excellent long-term investment as the chances of rivals challenging its position remain slim.

Consumer technology stocks are a subset of the growth stock sector which took a significant hit in the first half of 2022, but that represents a buying opportunity for long-term investors looking to optimise their trade entry point. Much of the sell-off in tech stocks was driven by fears of interest rate rises impacting consumer spending levels. The record-breaking hikes made by central banks, especially the US Federal Reserve, suggest that the bad news is now priced in. If, or more accurately when, central banks weight their rate policy towards supporting economic growth rather than taming inflation, Apple's share price can be expected to continue its upward trajectory.

It's hard to bet against the industry-leading manufacturer of smartphones, laptops, mobile devices, watches and computers, particularly now the firm has resumed paying dividends.

Apple Inc – Weekly Price Chart – 2004 – 2022 – + 1,000% Return

Source: IG

Best Long-Term Pharma Stock For Continuous Returns – Johnson & Johnson (JNJ)

The share price chart of pharma giant Johnson & Johnson shows that over the last 18 years the stock has generated a 212% return for investors. In numerical terms, that's some way off the stellar returns of Apple, but JNJ returns have the advantage of being more consistent. Not only is the stock a good buy in its own right, but its position as a defensive stock means it complements the higher volatility returns of other more volatile stocks in the portfolio.

2022 was the year when investor mood shifted away from risk-on assets. While sentiment can quickly shift once more, the benefit of buying Johnson & Johnson shares is that their price should hold up relatively well even if the global economy enters a recession. The products it makes have inelastic demand, and even if there is a downturn, there's little reason to think the impressive 2.68% dividend yield will be impacted. Like other pharma stocks, Johnson & Johnson offers potential for capital gains and passive income returns over the longer term, which make JNJ the ideal stock for long-term investing.

Johnson & Johnson – Daily Price Chart – 2004 – 2022 – Low Vol Returns

Source: IG

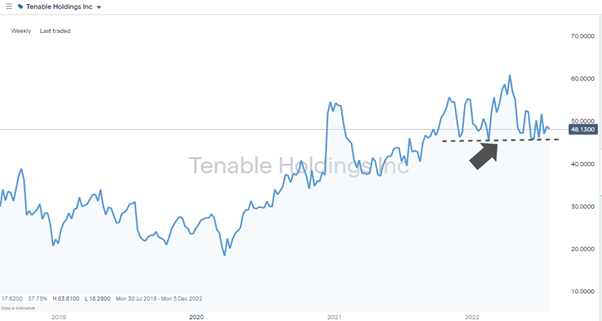

Best Long-Term Small-Cap Stock To Invest In – Tenable Holdings Inc (TENB)

Investments in small-cap stocks can pay off in the long run. Buying smaller firms with potential opens the door to one of them becoming the next big thing. Few would suggest going overweight in the small-cap stocks, but cybersecurity firm Tenable Holdings Inc is an example of a stock which could, over the long run, add some extra juice to returns.

Tenable has a market cap of $5.4bn and benefits from operating in an industry which looks set to become more important as work and social activities move online. The firm's Nessus software is designed to help clients resist a wide range of online attacks. It scans both networks and servers but can also be used to protect different areas of a firm's operations.

The Tenable share price has held up relatively well during the first half of 2022, which points to investors being more than willing to ride out any short-term bumps in the road. It has found significant support in the region of $45 per share, and many major shareholders are ‘sticky money'. Vanguard Group Inc and Blackrock Inc own 9.4% and 8.9% of the firm, respectively. Institutional investors like that will have gone over the firm's prospect in granular detail before deciding Tenable was an ideal long-term investment.

Tenable Holdings Inc – Daily Price Chart – 2018 – 2022 – Price Support

Source: IG

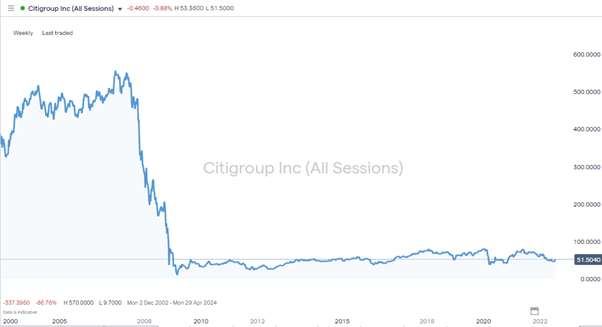

Best Banking Stock To Invest In For Long-Term Returns – Citigroup (C)

With two tech stocks already picked for our portfolio as the best long-term investments, there's room for the inclusion of another more stable stock. Wall Street giant Citigroup fits the bill thanks to its huge market cap of $120bn but also because it is, on many metrics, currently undervalued.

It offers investors a dividend yield of 3.36% and has an incredibly low P/E ratio of 5.78. That P/E ratio reflects the firm falling out of favour with investors. Still, the long-term strategy update released by the firm's management in March outlined a five-year plan to overhaul its operations.

Long-term investors benefit from being able to wait for reforms to work through the pipeline, so they are in a prime position to buy and hold Citi stock. Jane Fraser, CEO of the bank, told investors:

“We have an urgent need to address the issues that have kept our firm from living up to its full potential… Our business mix is somewhat disadvantaged and that needs to change to drive higher return fees and growth.”

As interest rates rise, the banking sector should be one of the winners. They can expand their profit margins due to wider spreads on borrowing and saving rates. While any bank would be a good fit for a long-term investor, picking the current underperformer makes sense, especially as the management has shown an appetite for implementing reforms.

Citigroup Inc – Weekly Price Chart – 2004 – 2022 – Undervalued

Source: IG

Best Green Economy Stock To Invest In For Long-Term Returns – ITM Power Plc (ITM)

Any investor in the fortunate position of locking up some capital for a long-term gain would do well to consider being part of the move to green energy. Global leaders have aligned to the extent that the shift towards EVs, clean energy, and renewables has built momentum, which makes the transformation of the global economy a certainty.

London listed ITM Power offers something of a rollercoaster ride for shareholders, but there are plenty of reasons to believe it has overshot to the downside in 2022. Now trading more than 70% lower than the all-time highs of February 2021, ITM is a high-beta stock with a track record of generating breath-taking returns. In 2020 the stock rose by more than 500% in the space of 12 months, which means even small investments can generate significant returns.

ITM Power PLC – Weekly Price Chart – 2006 – 2022

Source: IG

Best Long-Term Mining Stock Investment – Anglo American (AAL)

Mining stocks offer exposure to the commodity markets, which due to the nature of the sector, can operate on multi-year cycles of boom and bust. Thanks to a range of factors converging, many analysts are forecasting we could be about to enter a commodity supercycle which is one of those times when long-term investors really cash in.

Investment in mining infrastructure dried up in 2020 as the Covid pandemic brought economic activity to a standstill. The need for social distancing also hampered work conditions. As a result, the pipeline of new mines for materials such as copper has been severely impacted. It's not easy to make up for that lost time, so supply constraints look set to result in higher commodity prices.

At the same time, demand could be about to pick up. The move towards cleaner energy will require vast amounts of raw materials to be sourced to build the new infrastructure.

With demand and supply factors both pointing towards higher prices, now is an ideal time for long-term investors to buy mining stocks. The first wave of buying pressure came into the market in 2020, but the pullback in the first half of 2022 presents an opportunity to buy into commodity stocks for long-term gains.

Anglo American Plc is a multinational operation which mines iron ore, nickel, copper, diamonds and 40% of the world's uranium. That last metal is essential for the production of nuclear power, and it could be about to experience an upward price shift. That is because the move towards renewables such as wind power remains hampered by the unpredictable nature of weather-based energy. Nuclear offers a carbon-free way of ensuring that base-load electricity supplies are kept at a healthy level.

Anglo American PLC – Daily Price Chart – 2004 – 2022 – Commodity Super-cycle

Source: IG

Final Thoughts

The adage used on trading desks is that the secret to investing is time in the markets rather than timing the markets. If you're starting your trading journey, another top tip is to average into positions and build up your portfolio over time. Other solid ground rules include only using trusted brokers, which are not only regulated but also offer competitive T&Cs, customer support and up-to-date research materials. Once you've taken up positions in the best long-term stocks to invest in, a lot of the process involves being patient and watching the returns roll in.