The process of investing in stocks in the UK is relatively easy, but factoring in a few key points can help stack the odds in your favour.

The UK stock market roller-coaster ride continues to throw up opportunities for profits. Those looking at the price charts for 2024 will see countless opportunities, but those who had invested in the FTSE100 index will tell you, it has not exactly set the world alight. Growth of 6.90% over the past 12 months for the UK market significantly lags the US markets over the same time.

The Nasdaq 100 (NDX) has gained 30%, the S&P 500 (INX) has added 24%, and the NYSE composite 14%. In part the disparity has come from mega cap tech, which finds it’s home in the US, as when considering the FTSE 100, or the FTSE 250 against the Russell 2000, the results are broadly similar.

There are certainly opportunities in London listed companies, but you might have to look under the hood that little bit closer to find undervalued UK stocks.

Every trader has a different investment profile. Gaining an understanding of what yours is, and developing an understanding of the different approaches, can help your bottom line. There are lots of ways to invest in stocks, and running through a few questions can help you find the best one for you.

Investing in stocks – the basics

Whether you are a novice or an advanced trader, it’s important to consider the amount of time and resources you can offer to trading.

Also, keep a close eye on how this changes over time. Building in some contingency is also a good idea. The markets are a dynamic environment and noisy markets require more attention. Equally, unless trading is your day job, you may find that your attention is drawn away from the markets.

Once you have an account with a UK stock broker, or investment app that you can trust, the next steps are relatively straight forward.

- Select the stock you would like to invest in. In this case we are hypothetically considering dividend stocks, so will pick a bank that has been a historical payer above 5% such as Lloyds Bank shares. Find the shares either by name, or by using the ‘ticker’ (which in this case is LLOY), either preceded by LSE, LON, or just L. depending on the platform you are using. The full ticker would then read LON: LLOY for example.

- Put in the buy order. This involves selecting how many shares you would like to buy, at what price you are prepared to pay (the ‘bid’), and any limits to that order (such as if you only want it to be valid for today, or indefinite). If you limit the order to today only, if the price of the stock does not reach your bid price, the order will be cancelled.

- Allocate any stop losses, or take profit levels. Here you are effectively telling your broker or trading platform the extreme levels of price to hit where it should automatically exit you from the position. So the take profit level could be in percentage terms, or more typically a price level where you think is the ceiling or you are happy to sell. The stop loss is the level at which you want to stop out any further loss, so before the price potentially falls any further.

- Then you are done with setting up your position. Now monitor your account (frequency based on your goals), look for new areas to diversify. Generally build a well balanced investment portfolio.

There are multiple approaches you can take to financial markets that we are going to look at below but regardless of which method you are following you will need to know one big fundamental, tax. Understand how capital gains, and income tax may apply to you. Ideally you would seek professional tax advice.

Buy and hold – the straightforward approach

Buying some stocks – and let’s face it, forgetting about them to some extent – is a tried-and-tested investment method.

‘Over-trading’ is a common pitfall for beginner traders. Saying that, there is a need to get your market timing right.

The benefit of this approach is that it’s relatively hands-off. A lot of investors are looking at investing in the stock markets for a return on their cash. With global interest rates previously very low, any kind of return would have beaten what you can get at a high street bank account, but times are changing.

Interest rates at 5%, and inflation at similar levels will mean you will want to at least achieve this level of growth in order to avoid your portfolio depreciating in value. Then you will want to ensure there is some risk premium built in, owing to the fact that investing is not a risk free activity. If you cannot realistically expect an upside of a few % above what you could see from bonds, or a simple savings account, the risk reward balance might not be right.

Stocks & Shares ISAs

For many that are looking to invest in UK shares, stocks & shares ISAs may be the best way to do that. It depends significantly on your goals, timeline, and liquidity requirements; but as a UK investor there are significant tax benefits if you are profitable with your holdings over an extended period.

There are limits as to how much you can put into one of these accounts on a yearly basis (latest £20,000), but for many investors it would be worth having at least some of your portfolio in these tax efficient wrappers.

More active trading – short-term investment periods

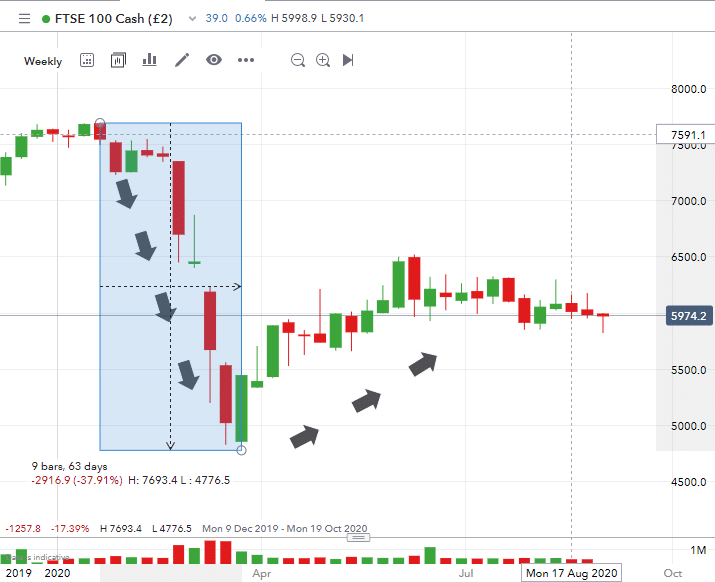

Revisiting the price chart for the FTSE 100 in 2020 shows the opportunities that come with more active trading.

If you had sold short in the FTSE 100 at the market top in January and ridden the COVID-19 crash-down until March, you would have made a 37% return.

FTSE 100 price chart – Weekly Candles – December 2019-August 2020

The market bounced back, posting a gain of more than 40%. If you had bought at the bottom and held, you would have made a return of almost twice what the buy-and-hold strategy generated over a period of years.

Modern online brokers such as IG, eToro and Pepperstone offer derivative products that allow you to sell short the market as well as going long. The trade works in the same way and your profit/loss on the trade is simply calculated by the price difference between your entry and exit points on the trade.

Types of shares

- Heavyweight Stocks (Blue Chips) – well established companies, usually very large cap, often dividend payers, and more stable than other segments

- Income Stock – pay dividends, creating a form of ‘income’

- Speculative Stock – have higher risk, with speculated higher rewards. This should not make up more than 5% of most regular portfolios

- Growth Stock – companies that have been showing high growth. Often do not pay dividends as reinvest profit back in to growing the business. Have a higher risk premium than blue chips or income stocks, and can have hits when there is less risk appetite in markets

- Seasonal Stocks (Cyclical Stock) – usually perform well during certain periods, having seasonal upsides and downsides, and predefined trends. Most of this behaviour is usually understood by market participants beforehand.

- Defensive Stock – these are companies that are generally stable, or seen as stable when there is less risk appetite in markets and investors are looking for a more safe place to put their capital. These are usually a lot more stable, and provide an avenue for lower risk seeking, longer term investors.

Copy trading – something new to try?

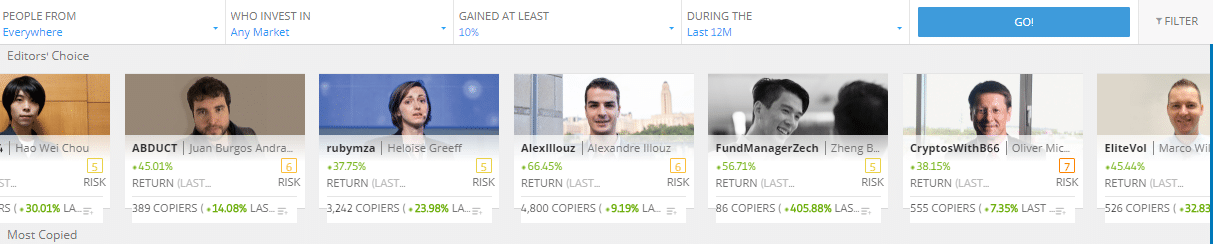

Copy trading offers a balance between active, even daily, trading and buy and hold. The neat feature here is that you outsource a lot of the research workload to third parties, who then share their trading signals with you.

Broker eToro has a particularly strong position in this market. A large percentage of the firm’s millions of clients use the platform’s copy trading service.

The approach involves selecting a particular trader from the many thousands that are on offer. They are graded in terms of their risk profile, and it’s possible to dig into their performance track record.

Most brokers offer some form of copy trading. Picking a winner is, of course, important, but do also keep an eye on ‘operational risk’. Due diligence of candidates can include checking if they trade with their own money or virtual funds – you want the lead trader to have some skin in the game.

Also, ensure that the signals are applied to your cash pile rather than you giving up your cash to them. Don’t allow your money to leave your account – you might not see it again.

Modern online accounts at regulated brokers are very similar to online bank accounts. As long as you don’t share your log-in details and keep your cash safe, you’ll also likely benefit from deposit protection schemes such as the UK’s Financial Services Compensation Scheme (FSCS).

Understanding Costs

Execution Fees

Increased market volatility means that price targets tend to be hit sooner rather than later. It is still important to ensure that your trading profits aren’t eroded by trading costs.

All brokers offer a bid-offer spread on the markets they provide. At any one time, there will be a slight difference between the price that you get for selling and buying the same thing. This is how brokers make their money.

The good news is that the online broker sector is highly competitive and most brokers are at least in line with their peer group. Once the broker has taken its cut from the initial trade, there are no further commissions to pay on any profits you make on trades. Those are yours to keep.

Financing Charges

While the bid-offer spreads offered at brokers catch the headlines, there are also other costs to consider. For buy-and-hold traders, these can be even more important.

Using leverage on a trade, for example, effectively involves ‘borrowing’ money from a broker to trade in larger size. Not only does this scale up your risk-return, but it also generates a daily ‘overnight financing charge’.

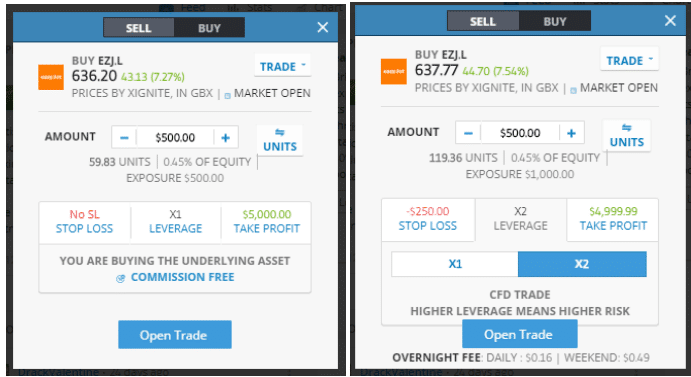

If, for example, you are looking to take a long-term view on airlines recovering from the COVID-19 pandemic, you might want to consider a long position in EasyJet (LSE:EZJ).

You can buy as little as $50 worth of EZJ stock at eToro. The below screenshots show a more aggressive position of $500 being put on.

Source: eToro

With no leverage being applied, we are ‘buying the underlying asset’ with no financing charges and ‘commission free’.

Using leverage of x2, the exposure of the position moves our position into a CFD (contract for difference), which equates to $1,000 and comes with a daily financing fee of $0.16.

The T&Cs on financing charges differ from broker to broker, and although relatively small, can rack up. If you’re trading a strategy with a medium-term or long-term holding period, then you would do well to double-check how they impact your break-even calculations.

Where to invest

You may already have an idea on what UK stocks you want to invest in. Maybe a news article has piqued your interest and prices just seem too low. Trading what you know is a good first step. If you want to gain exposure to equities but are unsure about which name to buy, help is on hand.

Most of the top stock brokers have extensive research and analysis sections on their sites.

The competition between brokers is not limited to trading costs. Some offer better educational and analysis materials than others. It’s good to shop around for ideas and try trading them on a Demo account first.

It is crucially important to choose a regulated broker with a strong background. Not only will the functionality be tried and tested by millions of users before you, but ensuring that your funds are safe is also of paramount importance.

With this in mind, it’s a good idea to limit your broker selection to brokers that operate under licence from a range of Tier-1 regulators, including:

- The UK’s Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The Cyprus Securities and Exchange Commission (CySEC)

Best Brokers to Buy UK Stocks:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookFinding the right broker for you is perhaps the most important part of the process. While you can buy UK stocks with most brokers on the market today, not all brokers are created equal. If you’re ready to start trading, you’ll need to use a broker that is FCA regulated, has low trading commissions and a reliable trading platform. Finding one can be an arduous and daunting task, which is why we’ve hand-picked favourites that tick all of these boxes to help you get started.

The bottom line

The process of registering with an online broker and investing in stocks is incredibly simple. Also, if you take care with your selection, your trading will also be cost-effective and safe.

As the aim is to make a profit, it’s important to make an honest appraisal of your investment aims and how you might be equipped to meet them. If you also factor in some of the basic good housekeeping pointers, then you are going to be starting out from a good position.