Rising prices result in corporations and consumers recalibrating their decision making. That means inflation can affect the stock market by directly influencing the variables relating to both supply and demand. Whilst the need to react to rising inflation is clear, there are few ‘catch all’ answers to the questions rising prices pose. The below analysis breaks down the challenges and opportunities that look set to dominate the markets for the foreseeable future.

What Is Causing Inflation?

Answering this question and developing an understanding of the different types of inflation is a crucial first step toward predicting the ways inflation affects stock prices.

Inflation is easy to identify and measure and simply requires recording asset prices over time. The trick is establishing which of the different factors that can cause inflation are in play. The annual US inflation rate for the 12 months ending in April 2022 was 8.3% and has been driven mainly by supply-side issues. This cost-push inflation can be attributed to blockages in global supply chains, which are still recovering from Covid and lockdowns. Big corporations have had to pay whatever it takes to ensure their operations work at optimal efficiency, which leaves them hoping they can pass on the extra costs to consumers in the form of higher prices.

Assuming customers will stump up extra cash is a risky business which makes cost-push inflation particularly concerning. The alternative, demand-pull inflation, is more benign and associated with high levels of employment and rising wages, which results in consumers driving prices higher. In that instance, corporations and their share prices can benefit from the potential of increased margins and greater profits.

Is The Current Inflation Bubble Transitory?

The 0.50% rise in US interest rates by the US Federal Reserve in May 2022 was the first 50 basis point rate hike for more than 20 years. It reflected an about-face by the most important central bank in the world, which less than six months previously had described inflation as “transitory”.

In hindsight, the decision to hold back on rate hikes in 2021 now looks mistaken. Consideration does need to be given to the Fed factoring in the risk of the Omicron variant of Covid having a more significant impact on the economy than it did. The problem for government officials and investors is that the genie is out of the bottle.

S&P 500 Index Daily Price Chart – 2019 – 2022 – Buy the dips?

Source: IG

Predictions that the Fed would ultimately clamp down on inflation by upping interest rates gained momentum in 2022 and explains why by mid-May, the S&P 500 index and Nasdaq 100 index were down on the year by 20.34% and 29.90%, respectively. Jerome Powell, head of the US Fed, eventually gave up on the idea that this period of inflation was “transitory”, but investors made that same call month before the May rate rise.

Why Have Stock Markets Fallen In 2022?

The Ukraine-Russia conflict and rising oil prices have unnerved investors, but the majority of the 2022 sell-off has been attributed to concerns about inflation. It is possible to find shares which do well during times of inflation, but inflation can be bad news for stock markets for the following reasons.

Inflation Leads To Increased Uncertainty

Stock markets hate uncertainty, and inflation increases tension massively. The underlying fear of investors is that the monetary and fiscal tools of governments and central banks are ill-equipped to manage rising prices. Historical data points to this being the case. Reassuring words from those managing the economy offer little comfort, and hyperinflation and stagflation can quickly materialise.

Billionaire hedge fund manager Bill Ackman takes things one step further and thinks the US Fed not only has tools too blunt to be effective but that it has misplayed its hand and “lost the room”.

Inflation As A Long-term Influence On Stock Prices

Interest rate hikes take time to feed into the economy, which means policy measures can easily under or overshoot. To make matters worse, as inflationary pressure builds, cost-push inflation can trigger demand-pull inflation as cycles of wage rises are demanded by workers. When both types of inflation work in conjunction, even more variables come into play.

Predicting where inflation will be in three, six, or twelve months is notoriously hard, making stock valuations increasingly tricky. Standard valuation models derive current stock prices from future earnings estimates. Inflation can erode earnings potential and depending on their take on the situation different analysts can make differing calls on what a firm’s stock price should be. That means that one of the most likely ways that inflation affects stock markets is that there will be increased price volatility.

Stocks That Perform Badly During Periods Of Inflation

The problems for investors go far beyond having fuzzy data with which to make predictions. Some stock sectors suffer to a greater extent than others because they are particularly exposed to the economic fallout from inflation and higher interest rates.

Growth Stocks And Inflation

Growth stocks are one such category, which explains why the tech-heavy Nasdaq 100 index fell further than the S&P 500 during the first half of 2022. Firms such as Amazon and Netflix have spent years prioritising developing market share rather than generating profits to distribute among investors in dividends. The problem is that those future earnings calculations now have a discount applied to them due to inflation. The textbook definition of inflation is a decrease in the purchasing power of a currency. That increases the likelihood of consumers stepping back on purchases in the future, and small loss-making tech stocks, which last year were the next big thing, suddenly look even less attractive.

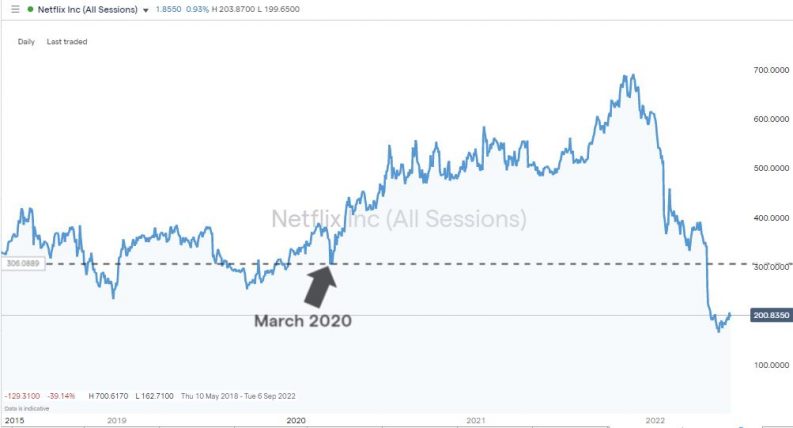

Established and profitable growth stocks can also suffer during times of inflation. As of 31st May 2022, Amazon shares were trading 27.35% lower on a year-to-date basis, whilst Netflix was down a stomach-turning 46.28% from its all-time highs of November 2021. The home streaming service is so exposed to inflation eating into discretionary consumer income that it is now trading below the price low of 2020 and has given up all of its gains as one of the best Covid stocks.

Netflix Inc Daily Price Chart – 2019 – 2022 – Covid Premium Given Up

Source: IG

Losses such as these in market darling FAANG stocks highlight how even the most favoured growth stocks can lose value during periods of inflation.

Dividend Stocks And Inflation

Investors looking to rotate out of growth stocks and into lower-risk positions would typically consider moving into high yield dividend stocks. The added layers of complexity that inflation brings means that whilst defensive stocks might outperform growth stocks in relative terms, they could also make negative absolute returns.

Interest rate rises designed to counteract and control inflation make cash and bonds relatively more attractive. They might also be losing trades due to their spending power eroding by inflation, but they are more secure than stocks, even defensive ones. If market sentiment moves to be highly risk-averse during periods of high inflation, even low-risk stock prices can suffer.

Stocks That Do Well During Inflation

There are winners in every situation, and some stocks become more popular when inflation takes off. Value stocks, commodity stocks, and consumer staple stocks all offer some degree of protection but be warned, even these can expect to meet some bumps in the road.

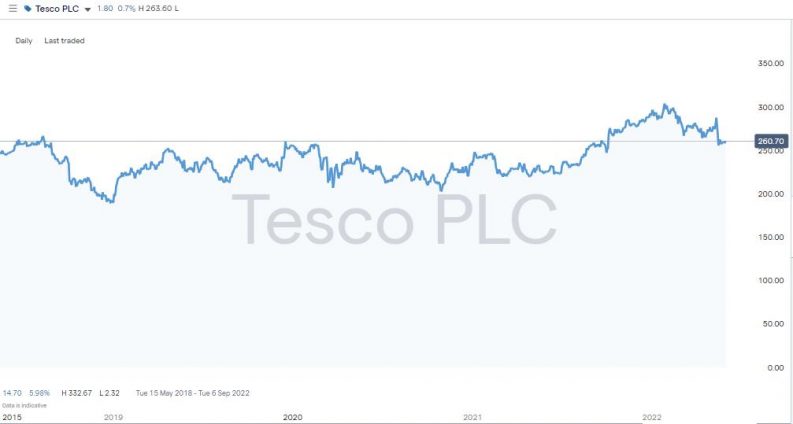

Value stocks with a P/E ratio lower than the market average might be overlooked in the boom years but can be one of the best stocks to buy when inflation is high. Tesco PLC has limited growth prospects due to having saturated the UK market to the extent that there are no areas left to build new stores, but poor growth prospects now look less of a problem for shareholders. Instead, investors can take comfort from holding shares in a company which sells products with ‘sticky’ demand. Food, cleaning products, lightbulbs, and clothes, still need to be bought regardless of the rate of inflation.

Tesco PLC Daily Price Chart – 2018 – 2022 – Share Price Stability

Source: IG

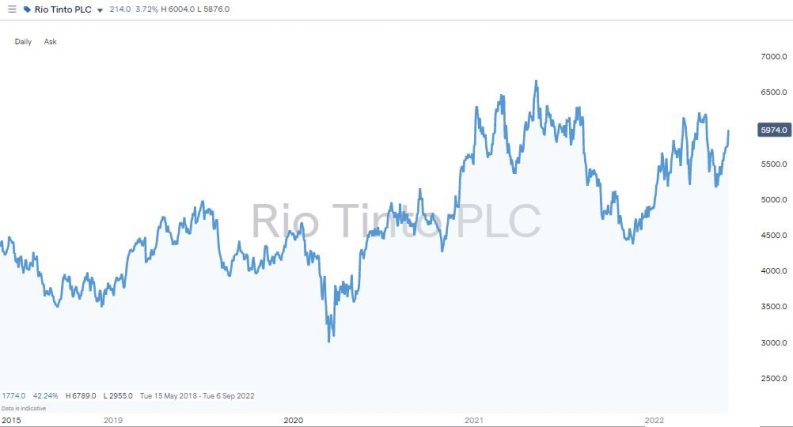

Commodity stocks such as these best copper mining stocks to buy now own tangible assets, which means they offer some protection from inflation. The copper reserves of Rio Tinto PLC, for example, will keep their value regardless of how much the value of cash depreciates. As firms in the commodity sector make products vital to economic activity, they are one of the best stocks to buy now.

Rio Tinto PLC Daily Price Chart – 2018 – 2022 – Commodity Stocks During Inflation

Source: IG

High Beta Stocks During Inflation

The doom and gloom associated with inflation can be overplayed. Even the stocks abandoned by alarmed investors can be discounted to the extent that they provide opportunities for long-term investors to buy the dip. Empirical data points to inflation being hard to control, but it always peters out in the end.

High-beta stocks with price volatility levels above the market average tend to overshoot to the downside during periods of economic uncertainty but rally harder when the rebound ultimately comes. If you’re a buy and hold investor, then Netflix, tipped as a stock which performs poorly during inflation could soon be reaching price levels where it becomes impossible to resist.

Stocks vs Inflation Over Time

The traditional view is that there is an inverse relationship between stock prices and inflation but stepping back reveals that reaction is essentially a short-term phenomenon. It could be argued that the bad news is already priced in, and these market gurus are bullish right now.

Yes, revenue will be impacted, investment projects might be scaled back, and investment into cash-based assets such as bonds can appear more appealing to investors. But as inflation works through the system and is brought to manageable levels, stocks can look undervalued.

In the long run, stocks can even be seen as a hedge against inflation. Long-term returns from investing in the S&P 500 index currently sit above 10%, which is still higher than the rate of inflation and is significantly greater than returns available on bank savings accounts.

Companies which find a way to pass increased input costs on to consumers can restore their profit margins. Assets such as brand recognition and the machinery needed to conduct business which has already been bought are inflation-proof.

Rebalancing portfolios and increasing the levels of diversification are intelligent moves and setting up an investment programme based on smaller regular injections of capital into stocks can help smooth out returns.

Eric Henderson, president of the annuity business segment at Nationwide Financial, was speaking with CNBC about inflation and stock investments when he said:

“Historically, being invested in equities is the only good way to stay ahead of inflation. Equities can be volatile but for the long run that has been a winning formula in the past.”

Source: Eric Henderson

Final Thoughts

Analysts are divided on how high inflation rates might go and for how long. One thing they can agree on is that the subject has become the main driver of share prices. That will result in some stocks falling out of favour and others becoming more attractive.

Whether you’re an experienced trader trying to navigate the storm or a new investor looking to get into positions during the market shake-down, it’s essential to factor in operational as well as market risk. Inflation applies pressure across the financial system, so heading to this list of well-regulated safe brokers is the first step toward successful trading.

Investors who take the long-term view can consider this an opportunity to average into positions in anticipation of a rebound. A bumpy ride is almost certainly guaranteed, but debates about fair value and spiralling price volatility can be a trader’s friend.