Generating a profit on a forex trade takes two things: making a correct call on the direction of the market and staying in the position for the optimal amount of time. The latter is often overlooked despite being a crucial aspect of forex trading.

YOUR CAPITAL IS AT RISK

When looking for a forex market to trade, you need one that suits your personal skillset – one where you’re able to spot the entry and exit points and can also ride the volatility out until the end.

Table of contents

How Do You Predict the Direction in Which a Forex Pair Is Going?

If anyone tells you that they can consistently predict the direction of the market, then block them. Any trader who is better than the rest at picking those moves is likely sitting on a yacht and keeping quiet about it. They won’t be online trying to sell you their ‘signals’.

The good news is that you don’t have to be perfect. One common misconception among new traders is that every trade needs to be a winner. Remember, even a win-loss ratio that is slightly above 50% can make you long-term profits. Accepting and cutting losing positions is a fundamental element of successful strategies.

Different currency markets have different characteristics. These stem from the differing underlying features that drive price. As a result, it might be easy for you to spot trade entry points in one market and impossible in another.

How Long Do You Hold a Forex Position?

Let’s say that you toss a coin and base your trading on the outcome. If 50 out of 100 of your trades are correct, then you’d expect to at least break even.

Unfortunately, this isn’t the case, and most traders lose more money than they make. It all comes down to trade management.

USDGBP – 2012-2022

Source: Investing.com

“Run your winners and cut your losses.” is a popular Wall Street mantra that is best understood with a forex demo account. Depending on the market, strategy, and goals, a forex trader can hold their position for a few minutes or years. A demo account can teach you which markets best work with holding a position longer and which don’t. Review different forex demo accounts and find the best one for you.

The demo account trade history might also show that your strategy works better in one forex market than another. Again, this comes down to the different characteristics of the different forex pairs.

Source: eToro

Forex pairs with higher price volatility might trigger stop-loss if you set them too tight. However, they might also suit your trading if you favour short-term ‘scalping’ strategies.

Lower-volatility markets can be associated with longer, gentler price changes. These low volatility markets can fit well with traders working day jobs who can’t follow minute-to-minute changes.

What Are the Similarities Between Different Forex Pairs?

The next question is, what are the characteristics of the different forex pairs? Before we go into this in more detail, it is worth noting the generic features of forex trading.

Liquidity

The greater the amount of trading in a currency pair, the greater the liquidity. This is important to consider for several reasons:

- Cheaper trading– bid-offer spreads are narrower in more liquid markets.

- Less slippage– instructions to execute a trade can fail if someone else beats you to hit the price shown. This happens less in busier markets.

- Transparency– it’s harder for a single event or market participant to influence the market.

- Research and news– lower costs and increased transparency draw in traders. Follow the crowd to find more free research and analysis being offered.

Non-directional

As many traders stepping into the forex markets have exposure to the equity markets, it’s worth pointing out a difference between the two groups’ price movements.

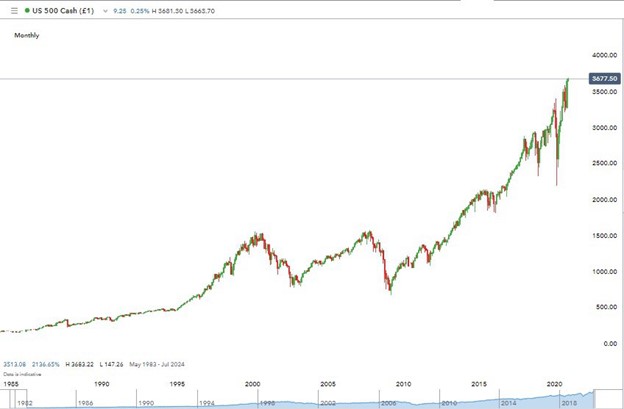

Equity prices are a function of future income flows to a firm. With long-term global economic expansion continuing, the price chart broadly goes from the bottom left-hand corner to the top right. There are blips along the way, corrections, and sell-offs, but there is a long-term bias towards one direction.

S&P 500 Equity Index 1982-2020

Source: Investing.com

Forex markets are different. They represent the respective strength of the two economies. There is no reason to assume that the US will outperform the Japanese economy or vice versa.

As a result, there is less inherent bias. Price will be driven by fundamental and technical features of the markets, but they can move as easily in both directions.

EURUSD 1991-2022

Source: Investing.com

The price of EURUSD in February 1990 was 1.215. That price has only fallen by 0.1 three decades later, in 2022. despite some interim price swings. However, it’s a good time to trade EUR/GBP pair as the rate is trading near the top end of its 5-year trading range.

What Are Major, Minor, and Exotic Forex Pairs?

Most brokers will offer all or more of the following forex pairs. They are broken down into three categories: major, minor, and exotics.

Other major currency pairs and their nicknames are:

- The US dollar and Japanese yen: USD/JPY – ‘Gopher’

- The Australian dollar and US dollar: AUD/USD – ‘Aussie’

- The US dollar and Canadian dollar: USD/CAD – ‘Loonie’

- The New Zealand dollar and US dollar: NZD/USD – ‘Kiwi’

- The euro and US dollar: EUR/USD – Euro-Dollar or ‘Fiber’

- The British pound and US dollar: GBP/USD – ‘Cable’

- The US dollar and Swiss franc: USD/CHF – ‘Swissie’

The major currency pairs are popular markets for beginners and advanced traders. These are the markets with the most liquidity and narrow spreads between the bid and ask price. The high liquidity also allows trade with large position sizes that don’t cause prices to move significantly.

Minor forex pairs are often called ‘cross-currency’ pairs. You’ll note that USD is not involved in these. As the base currency of the global financial system, USD is categorized as major when traded against another important currency.

- EUR/GBP – Euro/British pound

- CAD/JPY – Canadian dollar/Japanese yen

- GBP/AUD – British pound/Australian dollar

- GBP/JPY – British pound/Japanese yen

- EUR/JPY – Euro/Japanese yen

- CHF/JPY – Swiss franc/Japanese yen

- EUR/NZD – Euro/New Zealand dollar

- EUR/AUD – Euro/Australian dollar

- AUD/JPY – Australian dollar/Japanese yen

- NZD/JPY – New Zealand dollar/Japanese yen

- GBP/CHF – British pound/Swiss franc

- GBP/CAD – British pound/Canadian dollar

- EUR/CHF – Euro/Swiss franc

- EUR/CAD – Euro/Canadian dollar

Some of the exotic pairs are listed below. Some brokers do not support all exotics pairs due to liquidity in the markets drying up. There are also market anomalies such as USD/HKD being a pegged currency. A pegged currency limits trades within a pre-determined and closely managed price range.

- USD/SGD – US dollar/Singapore dollar

- USD/SEK – US dollar/Swedish krona

- USD/HKD – US dollar/Hong Kong dollar

- EUR/TRY – Euro/Turkish lira

Forex trading is a 24/5 business, so something else to consider is choosing a market that suits your day-to-day activities. This review gives a detailed breakdown of the global forex market hours.

What Are the Differences Between the Forex Pairs?

Hands-on trading of virtual funds in a demo account is the best way to get to know the different markets. It’s also a risk-free way to establish which ones turn a profit and which don’t.

Forex trading is largely about risk management. And new traders with small accounts need to understand how to manage risk by properly placing their pips stop-loss and choosing the correct forex pairs. Case in point, trading with a 65 pips stop-loss and a 0.01 micro lot in an account with $100 means a 6.5% risk.

A 6.5% risk in a trader is risking $6.5 which is a lot in a $100 account and a highly volatile market. A good risk management strategy should have a 2% risk or lower (20 pips or lower.) A trader should also use the ATR (Average True Range) to measure the volatility of a market. Starting out by trading currency pairs with lower ATR in a demo or real account can help learn how to manage risk.

Unfortunately, there is no time to relax as market conditions can quickly change. What works for a while might stop working, and ‘paradigm shift’ is the enemy of all traders.

- EUR/USD – The most popular forex pair to trade. Relatively low volatility, tight spreads, and lots of technical trade set-ups.

- GBP/USD– In recent years, this pair has become a measure of the consequences of Brexit, with smooth negotiations and contentious deals both creating repeated spikes.

- NZD/USD – Seen as a way to trade the global appetite for risk. Positive sentiment in the market sees the Kiwi strengthen, and downbeat forecasts drive prices down.

- USD/JPY– often associated with the ‘carry trade’. USD/JPY can provide longer, smoother price moves, which are favoured by momentum

- USD/CHF – both of these are known as ‘safe-haven’ currencies. As the market swings between ‘risk-on’ and ‘risk-off’ conditions, these two stay relatively in line with each other. This currency pair has one of the lowest levels of volatility.

- Minor and exotics pairs– Pairs such as USD/ZAR, USD/KRW, USD/BRL, and other emerging market currencies are at the high-volatility end of the spectrum. Markets in these pairs often have low levels of liquidity and the inherent risk of emerging-market trading. While this doesn’t mean that you can’t make a profit, entry-level traders are discouraged from starting out trading these.

Between 1997 and 2022, the value of USD/ZAR increased by 332%.

Source: Investing.com

Final Thoughts?

Starting out with the major pairs would appear to be an excellent first step. There would also be value in trading them all and understanding the nature of the different markets.

Be sure to use a demo account to do real-time market research. If you don’t learn the basics by using a paper trade then you’ll likely burn through your capital before you complete that project.

Liquidity is a key consideration, but keep in mind that even the major currencies have quieter times of the day.