This review will break down the reasons that Aston Martin shares might be a ride worth catching. It will also outline how buy Aston Martin shares using a trusted broker.

Overview of Aston Martin

Aston Martin Lagonda Global Holdings Plc is a British-based manufacturer of high-end sports cars. The firm traces its history back to 1913 but has in recent years undergone significant changes.

Despite going bankrupt several times in its history, the iconic brand has such strength that it has always found new backers willing to resurrect it. The firms and individuals that have recently taken stakes in the company are part of the reason many tip the firm’s fortunes are about to improve.

- On 31st January 2020, a consortium led by Canadian billionaire and investor Lawrence Stroll paid £182m in return for a 25% stake in the company.

- Mercedes-Benz increased its stake in the firm up from 5% to 20% in late 2020. The German manufacturer also provides engines and other parts for Aston Martin vehicles.

Aston Martin Shares: The Basics

Aston Martin was listed on the London Stock Exchange in 2018 and has a market capitalisation in the region of £2.6bn. It is a member of the FTSE 250 index where it trades under the ticker AML.

Lawrence Stroll not only owns a quarter of the firm’s shares but is also the CEO. Early signs are that Stroll’s methods could be working. His track record does, after all, include successful stints in charge of Racing Point Force India, Pierre Cardin, Tommy, Ralph Lauren and Michael Kors.

Aston Martin – Weekly price chart

Source: eToro

After reaching price levels as low as £5.50 in May 2020, the share price then increased by 252%. This is still some way off the all-time highs of £340 and the eye-watering proposition that the AML share price might hit those levels once more is generating a lot of buying activity.

Increased trade volumes

The share price move is not the only indicator that something interesting is going on. During 2018 and 2019, the stock was little traded as price slid from its once high levels. Since the middle of 2020, the number of shares traded has increased dramatically.

This reflects some of the long-term holders bailing out of positions as new buyers come in. It also points to speculators trading the stock using shorter-term strategies.

Share price moves backed up by increased trade volumes are generally traded as being more reliable indicators of momentum building. Trade volumes peaked in June 2020 but have still held strong.

Aston Martin – Monthly price chart

Source: IG

The cash-strapped firm isn’t one for those investors who like their targets to pay dividends. AML instead has a hefty amount of debt on its balance sheet, most notably a £1.1bn loan taken down in 2020 to weather the COVID-19 pandemic. The interest rate on that tranche of debt is an uncomfortable 10.5% and raises a key question for those considering buying AML shares.

If the life-saving support package is used to paper over the cracks, then the outlook for the firm is bleak. Any shareholders who bought into the firm in 2018 or 2019 will be painfully familiar with the phrase ‘a death by a thousand cuts’.

The alternative scenario involves the leading shareholders bringing about dynamic change and this could act as a catalyst for the Aston Martin share price. Factors to consider include:

- Makers of super-charged sports cars face the challenge of complying with new carbon-cutting regulations. The price tag of AML vehicles demands they offer the ultimate driving experience, but EU CO2 laws will involve stiff penalties for firms that don’t comply with new rules coming into place in 2021.

- The linkup with Mercedes-Benz could be one answer. It’s expected that as many as 30% of AML cars will be hybrids by 2024. The 612bhp electric super-saloon RapideE is already outperforming its 552bhp V12 counterpart.

- The impressive Mercedes hybrid and electric engine systems will, by 2022, be fully available to Aston Martin.

- Luxury items are vulnerable to economic downturns, but sales can be expected to pick up as the pandemic recedes. A return to pre-COVID sales would be a significant boost to the AML share price.

- In 2019, revenues were £650m and sales were 4,482 units, the corresponding figures for 2020 were £270m and 2,752.

Source: IG

Steps to Buy Aston Martin Shares

The great news is that online brokerage sites have revolutionised the investment sector. They’ve made the process easy and low-cost. Good brokers provide research and learning materials to help you develop the skills needed to make a profit.

Once you’ve identified an opportunity, buying the shares is as easy as logging into an online platform and booking the trade. You can then access and manage your holding using desktop machines or mobile apps.

1. Research Aston Martin Shares

If you’re looking to buy-and-hold Aston Martin shares, then your research will likely focus on long-term fundamentals. This article on the life of a trade based on fundamental analysis gives an insight into tools to use and the approach to take. Research can be easily found online via your broker or third-parties.

2. Find a Broker

This important step should not be overlooked. It’s an unfortunate reality that scammers operate in the sector, so choosing a regulated broker is a crucial first step. A list of FCA regulated brokers, which are trusted and offer clients a first-rate service, can be found here.

Trading the markets is risky enough without falling for the promises made by a disreputable broker and making the wrong choice here could mean you lose all your capital.

3. Open & Fund an Account

Regulated brokers have a duty of care to their clients, so the online registration process requires new clients to complete some Know Your Client (KYC) forms. This is so the broker can build a profile for you and ensure it treats you in accordance with market regulations. The process takes only minutes to complete and is actually a sign that you’ve made a good choice.

You’ll then be directed to the area of the site where funds can be paid into your trading account. Most brokers offer a variety of payment methods, including credit/debit cards. The different payment processes have different T&Cs, but it’s likely you’ll be able to find one that not only suits you but comes with zero fees and instant crediting of funds.

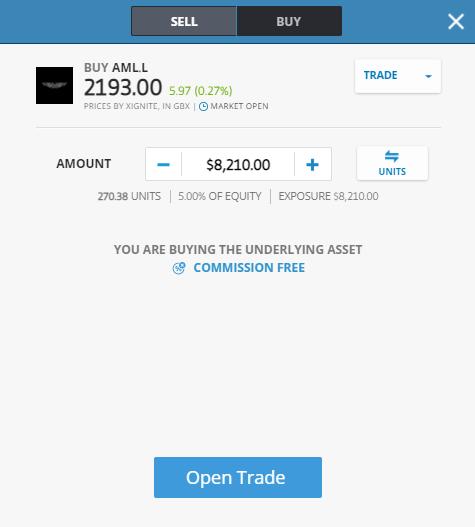

4. Set Order Types

Trading dashboards at brokers all have similar functionality. There are monitors to help you track and analyse price and a trade execution interface where you input the details of the trade you want to execute. There are also different order types — these allow you to manage your trade entry and exit points.

- Market Order — An instruction to buy at current price levels.

- Limit Order — An instruction to automatically buy if price reaches a certain price level.

- Stop Loss — A risk management-related automated instruction to sell your position if price reaches a certain level.

- Take Profits — A built-in instruction to sell your position for a profit if and when price reaches a certain level.

You don’t need to use the different order types, but being aware of how they work can save you time and money. It’s also important to check if stop-losses or take profits are, for example, included as default settings.

5. Select and Buy Aston Martin Shares

Once you’ve inputted the amount of Aston Martin shares you want to buy and have reviewed the extra types of orders on your trade, execution is as simple as a click of a button or a tap of a screen. The AML share price is quite volatile, so finding a good entry point can improve your chances of making a profit.

Source: eToro

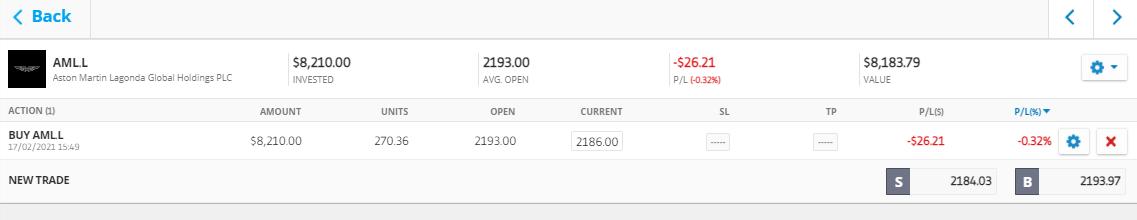

A good habit to get into is to check the portfolio section of your account straight away to ensure what you actually bought matches what you intended to. Any errors are best corrected before the price moves too much.

Source: eToro

Best Brokers to Buy Aston Martin Shares:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookThe length of time you expect to hold your Aston Martin shares will determine whether you buy the shares outright or in CFD form. This research report on CFD vs Share Dealing explores that subject in greater detail. The general rule is that if you intend to hold your investment for months and years rather than days or weeks, you are probably better off buying shares outright. It is important to check this is the case at time of trade as backing out of a CFD trade and buying again outright incurs unnecessary transactional costs.

Fees When Buying Aston Martin Shares

There is intense competition between brokers and this has driven down the costs associated with share dealing. The exact charges will be determined by the T&Cs on your account, but costs to look out for include:

- Payment processing charges — Most brokers don’t charge on deposits, but some do apply a fee on withdrawals.

- Third-party fees — These might apply if you choose a particular payment method.

- Commissions — A bit of research will help you find online brokers that don’t charge a separate commission when buying AML shares.

- Bid-offer spread — Most brokers make their money on the difference between buying and selling prices. The width of that spread is something to consider.

- FX conversion — Your brokerage account will be denominated in a particular currency. If that is different from the currency of the account you use to fund it, then there will be charges relating to converting one currency to another.

- Stamp Duty — Purchases of UK stocks, such as Aston Martin is subject to SDRT.

- Inactivity fees — Some, but not all brokers apply charges on your account if your account is dormant for a period of time. These can start kicking in after six months.

- Financing costs — Buying shares outright avoids the financing costs associated with CFD trading.

| eToro | Plus 500 | Markets.com | AvaTrade | |

| Live Account Fee | No charge | No charge | No charge | No charge |

| Demo Account Fee | No charge | No charge | No charge | No charge |

| Bid Offer Spread – AML shares | 9p | No market | 80p | No market |

| Cash Deposit Fee | No charge | No charge | No charge | No charge |

| Cash Withdrawal Fee | Yes – $5 per transaction | No charge | No charge | No charge |

| Inactivity Fee | Yes – $10 per month after 12 months inactivity | Yes – $10 per month after 3 months inactivity | Yes – $10 per month after 3 months inactivity | Yes – $50 per quarter after 3 months inactivity |

| FX Conversion Fee | Offers accounts in USD, only | Offers accounts in USD, GBP and EUR | Offers accounts in 14 base currencies incl. USD, GBP, EUR | Offers accounts in USD, GBP, EUR, CHF |

| Minimum Deposit | $200 (or equivalent) | $100 (or equivalent) | $250 (or equivalent) | $100 (or equivalent) |

Summary

Classic valuation models currently mark Aston Martin shares as cheap, so now could be the perfect time to buy AML shares. There are several potential catalysts in play and if some, or all, of those ignite, then a position in Aston Martin shares could be a profitable one.

RELATED: