If you invest in a company that suffers a reputational crisis, it can seriously damage your wealth. According to research by the ReputationUP Studies Centre, companies risk losing 22% of their turnover when potential customers find just one negative link on the first page of search results or on social media.

YOUR CAPITAL IS AT RISK

One of the big no-nos of modern investing is getting on the wrong side of the ‘ethical business' debate. Steering an appropriate course through the potential challenges is a massive headache for corporations and spotting the next trip hazard in advance has never been more vital for investors.

This review will highlight what happens when businesses get it wrong and how you can mitigate that risk. Or, if you're adopting a more aggressive strategy, short a stock and post a profit when reputational damage results in a share price crash. When it comes to the most unethical companies, here are the topics to consider.

Table of contents

HOW DO FIRMS GET IT SO WRONG?

A significant shift in investor sentiment has seen ethical concerns given a greater weighting in the decision-making processes of retail investors and institutional fund managers. That's resulted in a wave of cash moving into highly regarded and trusted stocks whose share prices have then outstripped those of their peer group.

The shift in market sentiment also means that when firms fail to match current expectations they are likely to see investors rush for the door.

The hard-to-manage part of this risk is that two catalysts are needed for the situation to develop. The first is that a firm you are invested in makes a bad call, and the second is that it gets caught. In the worst-case scenario, a cover-up acts as a third contributing factor.

What is also hard to calculate is the impact on a company's valuation. Variables which come into play include the confidence investors have in the management team being able to turn a situation around or whether systemic failures cause the issues.

There are plenty of pitfalls for companies to avoid, including environmental issues, worker's rights, consumer confidence, social media, data loss, or corporate governance. The below firms are in the unfortunate position of being case studies of how reputational damage repercussions can significantly affect their share price.

ELECTRONIC ARTS (EA)

US video game company Electronic Arts (NASDAQ: EA) has been dogged by a long list of scandals. To make matters worse, the gaming sector is a passionate one, and customers are quick to praise or blame. They also do it loudly, often on social media platforms which can result in criticism snowballing.

That makes over-promising on a new product a risky endeavour which destroys consumer confidence, and that is just what EA did in 2018–19. On February 6th, 2019, EA's stock value plummeted 13.3%, mainly due to the over-extended hype surrounding its much-anticipated Battlefield V game. The game was met with a mixed reception and sold one million fewer copies than the sales target figure of 7.3m.

More recent challenges facing EA revolve around the firm carrying out marketing policies which critics claim are little more than gambling. What's more, they are aimed at youngsters on the part of the EA platform that didn't require parental supervision. Some youngsters ploughed hundreds of euros, pounds and dollars into the Ultimate Team scheme, which suggested they'd receive cards of star players but instead, they always received subs.

Bad press is particularly concerning for Electronic Arts shareholders. The proposed buyout of rival gaming platform Activision Blizzard by Microsoft in 2022 was followed by EA stock trading at a premium. That was thanks to rumours that Amazon could be tempted to make a similar move and acquire Electronic Arts. That premium, and the current valuation, could easily be jeopardised if EA suffers further reputational damage, which makes any Amazon deal less likely.

Alternatives to EA: Roblox (RBLX)

The simplicity of the Roblox gaming platform contrasts with the perception that EA engages in underhand tactics which exploit young users. It became a popular digital pastime for tween users throughout the pandemic. The subsequent reduction in traffic after lockdowns lifted resulted in RBLX stock posting a peak-to-trough fall of 80%.

Roblox's valuation appears to be already pricing in the bad news, and reports released in October 2022 suggest the firm's prospects could be improving. In September 2022, Roblox's bookings rose 11% – 15% year-on-year, and its daily active users (DAUs) increased 23% to 57.8m. Another sign that momentum could be shifting to the upside was that the total number of hours engaged grew by 16% to 4bn. Roblox faces challenges, but unlike EA, they don't involve bad publicity relating to years of dubious business practices.

BP (BP)

A list of unethical companies wouldn't be complete without mention of a carbon-emitting oil and gas company. While the global economy is shifting towards greener energy, carbon fuel companies are still operating on a ‘business as usual' basis. There remain opportunities to profit from buying oil firm stocks, but unfortunately, BP is synonymous with one of the greatest ecological disasters of all time.

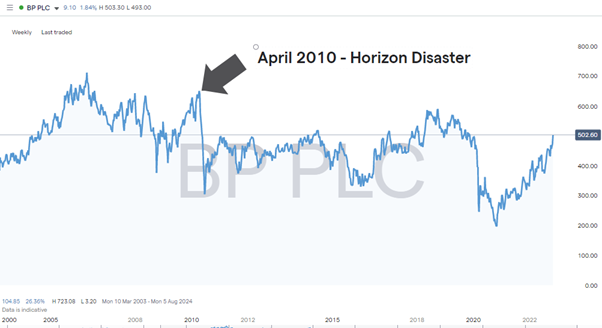

On April the 20th, 2010, the BP oil drilling rig Deepwater Horizon, which was operating in the Gulf of Mexico, exploded and sank. The disaster resulted in the death of 11 workers and was the largest crude oil spill in the history of marine oil extraction operations. The BP share price more than halved in value in the space of just 90 days and has never really recovered

As if that wasn't bad enough, the political fallout almost crippled the firm. The total cost of the clean-up operation was estimated to be at least $65bn, revenue that could otherwise have been returned to shareholders. Despite approaching the problem with deep pockets, the firm suffered extensive reputational damage in terms of perceptions within the industry and the general population.

Even without the Deepwater disaster to contend with, the firm is a capital-intensive behemoth in a declining sector. Oil prices are notoriously volatile, and despite a surge in the price of crude in 2021 – 22, the share price of BP has, thanks to legacy issues, been left languishing in the middle of its long-term range.

Alternatives to BP: The Good Energy Group PLC (GOOD)

BP's vast $101bn market capitalisation does mean it has the capital to invest in green technology projects; however, the smaller Good Energy Group, with a market cap of $41.8m, is an out-and-out renewable energy firm which captures the shift in the mood of investors.

The Good Energy Group is a 100% renewable electricity supplier and innovative energy services provider. It remains substantially debt free with a strong cash and cash equivalents position of £22.2m as of the end of August 2022 and has recently adapted its long-term strategy. The company's 2022 half-yearly report noted that it had shifted its capital allocation towards growth and investment, and revenues were reported to be 57.4% higher than in the previous six months.

IMPERIAL BRANDS (IMBBY)

Imperial Brands' downward price trend from 2016 onwards clearly indicates big investors leaving a sinking ship. There are opportunities for long-only investors to trade the upward retracements. However, an online broker such as IG, eToro or Plus 500 that offers short-selling in CFDs is a better bet for catching the underlying downward trend.

The fundamental analysis of Imperial Brands can't move away from the health concerns related to smoking and market contraction. As a result, the price of IMBBY stock has fallen from £40.68 in June 2016 to £21.20 in November 2022.

How far the share price slide goes is anyone's guess, but the harsh truth is there are unlikely to be any surprising news stories taking the share price to the upside. Imperial has been identified as one of the most unethical companies in the market. It is also an example of what can happen to your capital if you fail to keep up with current investment trends.

Alternatives to Imperial Brands: High Dividend Stocks.

With tobacco being what it is, no like-for-like alternatives get around the issues relating to the core product. But unravelling the attraction of the stock does throw up ways for investors to find an appropriate substitute.

A large percentage of the shareholders of Imperial Brands buy the stock because of its track record of paying a high dividend. That income stream is based on the products IB sells being associated with consistent revenue streams. They aren't the only firm in that situation, and many alternative companies operate far fewer toxic brands. Aegon, Pearson, Annaly Capital Management, and United Microelectronics Corp all offer an alternative route into high-yield stocks.

If you want to mitigate against single stock risk, then investing in a fund-style product is another option. This selection of the best performing dividend ETFs would be a good place to start, as it details funds which mimic the approach of Imperial Brands and prioritises income over growth.

NESTLÉ (NESN)

A food producer based in Switzerland might not be an obvious candidate for having a track record of unethical business practices. Still, Nestlé has a long history of getting on the wrong side of action groups. With a market cap of over $300bn, it could be doing a better job of protecting itself from reputational risk.

Nestlé has been the target of a decades-long boycott because it promoted the use of its baby milk in some of the least developed countries in the world. The aggressive policy of providing some, but not enough, powdered baby milk to new mothers was criticised as being a marketing ploy and is claimed to have caused unnecessary death and suffering of infants around the world.

It was suggested that the infant formula product was almost as good as a mother's milk: a highly unethical policy for several reasons. It often left mothers spurning a free and superior natural approach that would have decreased infant mortality.

The policy was criticised for breaching international marketing standards and the babymilkaction.org website still campaigns against the Swiss food manufacturer.

Another ethical black mark against Nestlé stems from its position as the world's largest producer of bottled water. Not only does that involve unnecessary amounts of single-use plastic, but company chairman Peter Brabeck-Letmathe drew substantial criticism when he said that access to water is not a fundamental human right.

Nestlé isn't alone in including the controversial ingredient palm oil in its foodstuffs but added to the other issues it already faces there's little wriggle room for the Swiss giant. The poor management, which resulted in the firm falling into a series of bear traps, has left an indelible mark on the firm's reputation. With institutional investors giving added weight to ethical concerns, the legacy issues surrounding the firm point to reduced demand for NESN stock.

Alternatives to Nestlé: Danone (BP)

Danone (BN) operates in the same sector as Nestlé and is cherished in its home country of France. When subject to a hostile takeover bid from the US giant PepsiCo in 2005, the French government stepped in to block the deal. Danone was famously placed on the list of ‘key industries', which was intended to include utility companies and arms manufacturers, not yoghurt makers. This reflected the protective approach of the French government but also the support the firm receives for its more socially conscious approach to doing business. Danone's revenue stream is less susceptible to slip-ups and consumer boycotts than Nestle's, and rumours of another bid for the company occasionally resurface to boost the share price.

SMITH & WESSON BRANDS (SWBI)

Gun manufacturers have long been an investment opportunity many are happy to decline due to the sector walking an ethical tightrope. Smith & Wesson's core products are designed for use in military conflicts, law enforcement, leisure, and personal protection but invariably end up in the hands of the wrong people.

There is also the problem of the international arms trade being a murky world full of allegations of corruption and bribery. If you want to find political arm-twisting closer to home, just look at the strength of the US lobby groups.

In 2020 a climate heavy with COVID fears and public unrest saw demand for handguns rocket and with it the SWBI share price. The subsequent price crash from $39.6 to $11.2 per has left Smith & Wesson investors wondering what positive catalysts could possibly result in the value of the stock rebounding.

Alternatives to Smith & Wesson Brands: American Outdoor Brands (AOUT)

American Outdoor Brands, Inc. (NASDAQ: AOUT) provides outdoor products and accessories. It is in an excellent position to tap into demand from shooting enthusiasts and those pursuing other outdoor activities. With solid footholds in the US and international markets, American Outdoor Brands is in a good position to navigate the risk of US legislators bringing in new laws which specifically target gun manufacturers. Compared to Smith & Wesson, AOUT stock is a win-win, thanks to capturing any potential upside but not being too directly exposed to the legislative challenges facing the sector.

FINAL THOUGHTS

Being caught in a harmful and potentially toxic situation is a genuine threat. It's no longer the case that you can invest in tobacco, carbon, or guns and just hold your nose while the money rolls in. The situation is more complicated than that, and price moves can be brutal.

One strategy involves spotting a situation with a limited further downside. The ‘how bad can it get' school of thought has generated returns for investors over many years. While bad management practices continue to be revealed, it is also important to establish if they have been fully priced in.

Using reverse psychology and ascertaining if a situation has been overblown might throw up opportunities to buy the dip. A more risk-aware approach is to find a stock with a similar profile and avoid the risk of reputation damaging your trading bottom line.

People Who Read This Also Viewed:

- Learn To Trade Like an Expert

- The Best Starter Stocks For Beginners

- Top Trading Strategies to Help Improve Your Returns

- Strategies to Trade During a Bear Market

- The Best Momentum Stocks To Buy Now

- The Best Growth Stocks for 2023

- Learn Stock Scalping Trading Strategies

- The Best Ethical and Environmentally Friendly Stocks to Buy