** Content does not apply to US users**

If you're new to eToro (and Bitcoin), you no doubt have some questions. Not only do you want to know how to buy Bitcoin on eToro, but you probably also want to know whether it's safe, how much it will cost you, and whether or not you'll even own the Bitcoin, to begin with.

Bitcoin on eToro – What's on the page

Can You Buy Bitcoin on eToro?

Yes, you can buy Bitcoin on eToro. There is a wide range of digital currencies available to trade, but Bitcoin is the most popular, valuable and frequently traded. It can also be traded against other popular cryptocurrencies, including:

- Litecoin – read more

- Ethereum – read more

- Ripple and Dash – read more

- Various fiat currencies – read more

eToro offers both crypto-to-crypto and fiat-to-crypto trading and has a much wider range of virtual coins than many other brokers. It also offers benefits such as immediate execution of market orders and the ability to diversify and trade in other instruments.

How to Buy Bitcoin

eToro makes it easy to buy Bitcoin:

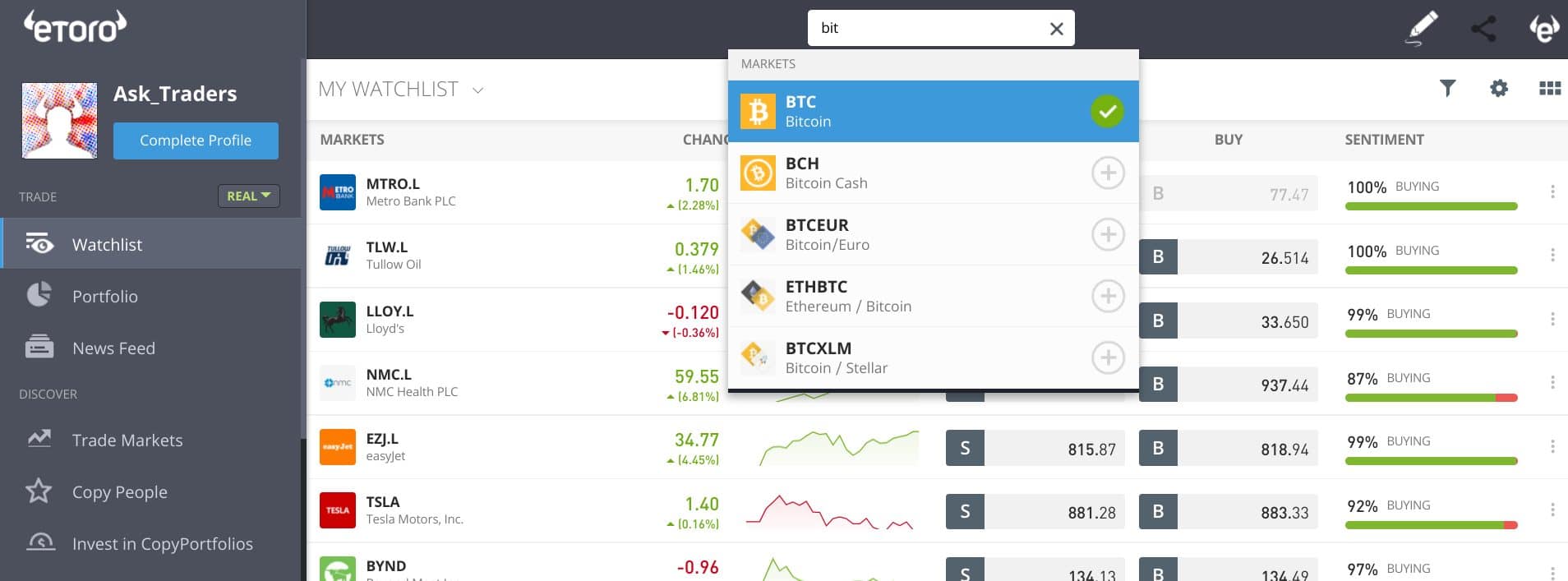

Log into your eToro account and search for Bitcoin/BTC and a drop-down menu will automatically appear. Select ‘BTC’ for Bitcoin. If you don’t have an eToro account, you’ll need to open an account to start trading.

- Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

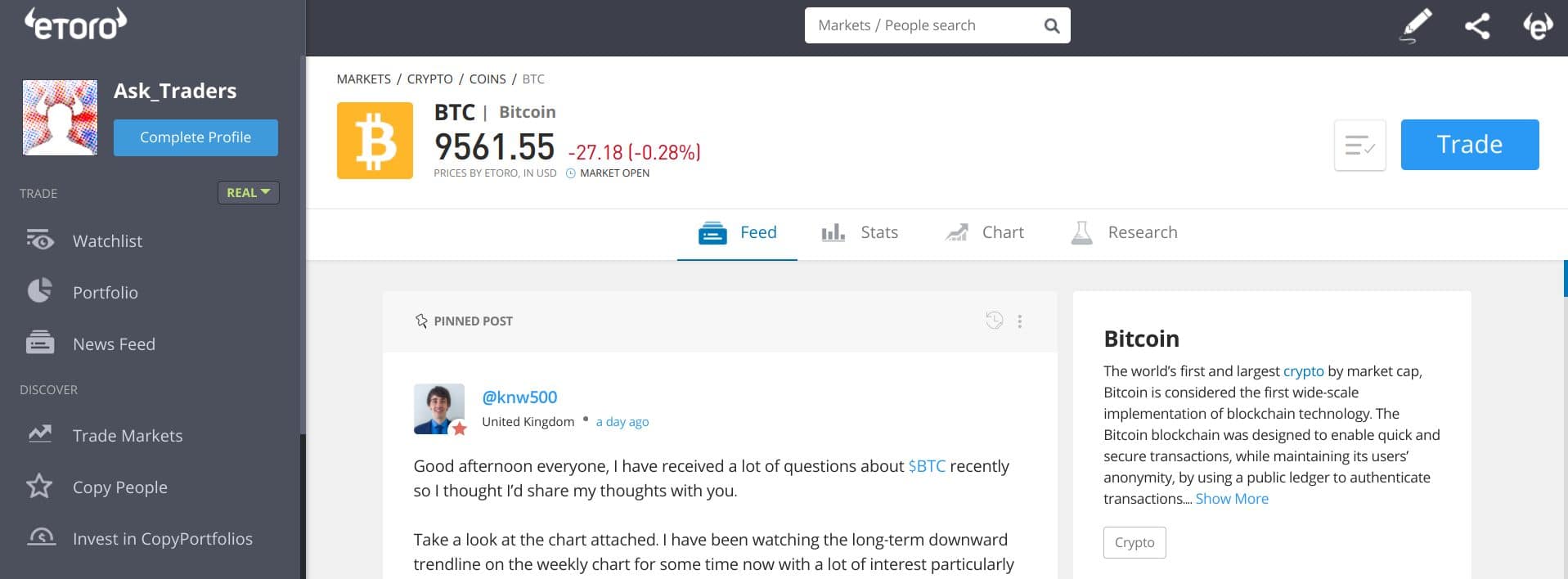

On the next screen, click the ‘Trade’ button in the top right corner:

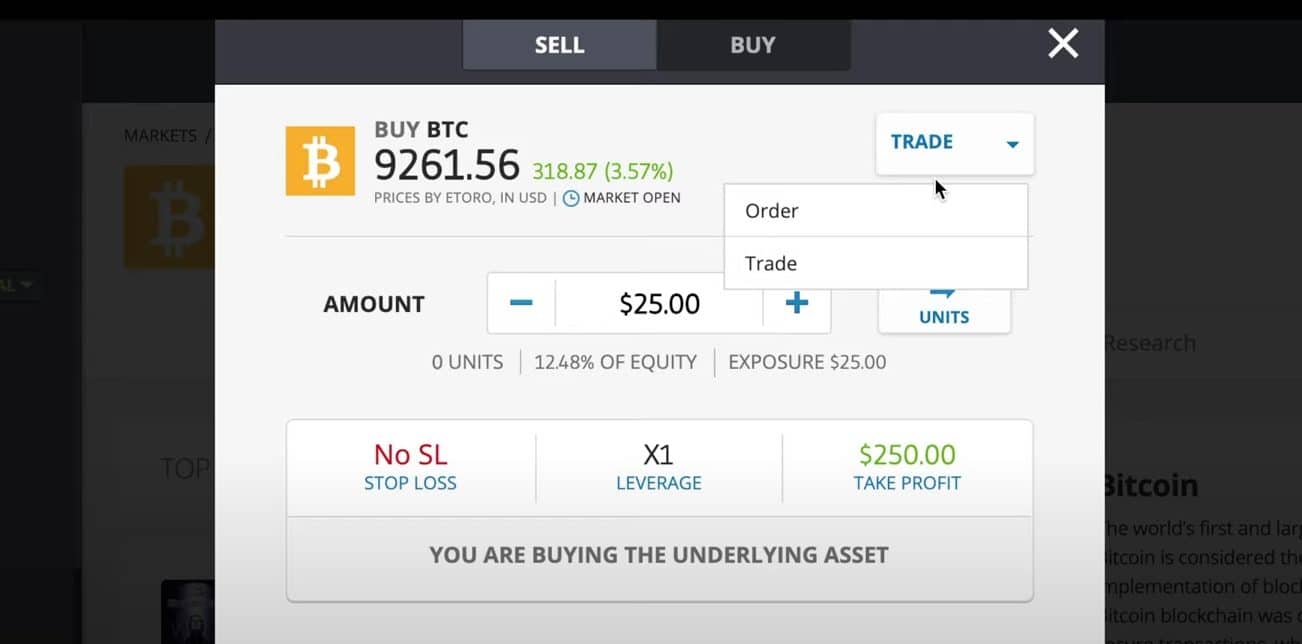

From here, you have a couple of options. You can either set your order or go ahead and execute an immediate trade.

- Order – placed above or below the current market price. Will only be executed when the market price trades to the price parameters you set

- Trade – Executed immediately based on the current market buy & sell prices

Decide how much money you want to put into Bitcoin. The smallest amount of Bitcoin you can buy with eToro is $10.00. Alternatively, if you click ‘Units’ you will be able to select the exact quantity of Bitcoin you want to buy, for example, 9.5 units.

Once you’re ready to buy Bitcoin, go ahead and click ‘Set Order’ if you’re placing an order, or ‘Open Trade’ if you want to immediately execute a trade.

Be aware that Bitcoin experiences such frequent price changes that the price can change between placing an order and the order being executed – even if this is done almost immediately. This is known as ‘slippage’ and is common when trading highly volatile instruments.

It can work for or against you by making your coins cheaper or more expensive. Unfortunately, there is little that can be done about slippage. Just be aware that it can happen and that it is the most likely explanation if you find you paid a different price than the one you were expecting.

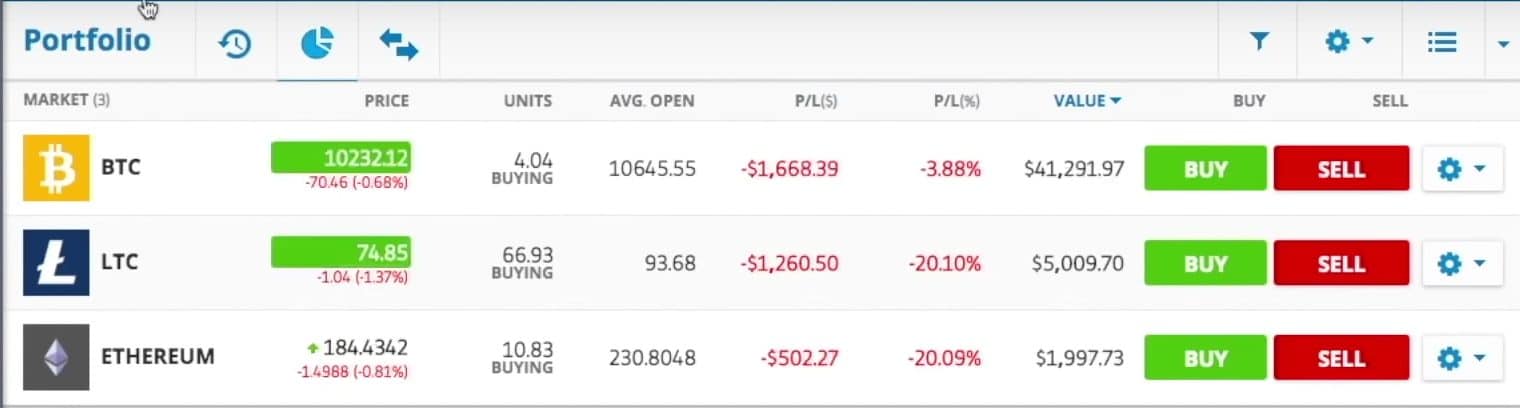

Back in the portfolio section of your profile, you’ll see your recent Bitcoin order sitting there:

Now that it’s in your portfolio, you can easily follow the latest Bitcoin stats, monitor its performance, set price alerts and see what other traders are doing with their Bitcoin trades.

Buying Bitcoin on eToro

You can buy Bitcoin directly using a debit card, or you can deposit funds using a bank transfer in order to buy Bitcoin. Another convenient option for buying Bitcoin is the fully-licensed eToro Wallet, which allows you to buy directly from a secure digital wallet.

It is possible to buy Bitcoin at eToro without a wallet, but many Bitcoin investors prefer to use one, especially if they will be keeping their digital coins for a while and want to ensure that they are securely stored.

Bitcoin Trading Fees on eToro

eToro does not charge a transaction-specific fee on trading. The only fees you need to be aware of that are not immediately obvious are:

- Inactivity fees on dormant accounts (if they are inactive for 12 months)

- Conversion fees (change one currency for another using the exchange)

- Withdrawal fees (minimum withdrawal $30, currently set at a flat rate of $5)

- Overnight fees (CFD positions)

Fees do not apply to non-leveraged buy positions. They are, however, applied to all sell positions, leveraged buy positions and all cryptocurrency pair positions (when you trade one digital currency against another).

It’s important for you to remember that fees are subject to change at any time and without notice. Always look at up-to-date spreads (they are clearly displayed on the website) before making any transactions.

Do I Own My Bitcoin?

That depends. In the UK, Crypto CFDs are no longer offered under FCA.

The terms of buying and selling Bitcoin will depend entirely on where you live and who your trade is regulated by. In the US, for example, it is not possible to trade with CFDs. eToro has recently started to offer cryptocurrency trading in many states within the US, but regulations regarding how trades can be executed are tight.

Do People Lose Money on Bitcoin?

If you’ve never bought Bitcoin before, you should be aware that Bitcoin – like most cryptocurrencies – is highly volatile, and the cryptocurrency market lacks traditional safeguards and regulation measures to protect investors. This lack of protection and high volatility means that you may lose money when trading.

Can You Send Bitcoin From eToro?

The fully-licensed eToro Wallet allows you to securely store crypto assets and send/receive cryptocurrencies to and from other wallets as long as they are supported by eToro. However, a lot of third-party wallets are vulnerable to hackers and Bitcoin transactions are not regulated. As Cryptocurrency operates outside of normal regulatory practices, there is no guaranteed protection, meaning you stand to potentially lose your money if your account is compromised.

People who read this also viewed:

- Check our eToro review

- Trade crypto with the best-rated IQ Option

- Find out what is the minimum deposit on eToro

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or

down. Your capital is at risk.

Don’t invest in cryptos unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.