eToro has developed a huge following in recent years, and with good reason. It was launched in 2012, and within just two years it had amassed millions of customers – and that figure appears to be rising all the time.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

If you are one of these customers, and you made a profit recently, our eToro UK tax guide will help you understand your obligations towards Her Majesty’s Revenue and Customs.

Here we will cover:

Table of contents

eToro Tax Burden Overview

eToro UK tax rules are complex, and it’s not always easy to work out which tax rules will apply to you.

Generally speaking, when you make a profit on eToro, either via copying successful traders or by taking your own investment decisions, you may be required to pay tax on the proceeds if you are based in the UK.

Ultimately, it will come down to the decision of Her Majesty’s Revenue and Customs (HMRC) on whether or not you’re considered a trader or an investor.

A whole range of characteristics of your trading activity can be taken into account to work this out, including the frequency with which you traded, and how trading fits into your wider life and occupation.

“If you are doing this as a business or trade, then the income will be declared as self-employment. However, if you are doing this as an investor then the income or gains should be declared for Capital gains purposes”

Take a look at our other eToro guides:

- Read Our eToro Review

- Read Our eToro Demo Account Test

- Check Our eToro Take Profit Guide

UK Taxes for Traders and Investors

If you’re considered a trader in this regard, you’ll most likely be liable for income tax, and you may need to pay tax on any income you make above £11,500 in one year through the sole trader self-assessment process.

Remember, your total income figure includes your salary from any job you may have, but you may be able to reduce your tax burden by incorporating any losses you make from trading into your total income figure.

If you’re considered an investor, you may need to pay capital gains tax on any profits you make above £11,700. It’s wise to seek eToro tax UK advice from a professional before deciding how to report any income you gain.

Essentially, you may have to pay Capital Gains Tax in the UK if you make a profit when you sell or dispose of shares or other investments.

This will depend on if your total gains, after deducting any allowable losses, are above your Capital Gains Tax allowance for the tax year.

You are not eligible to pay tax if your total gains are less than the tax-free allowance.

However, you may still need to report your gains in your tax return.

You can check the official UK capital tax gains guide for more detailed information on Capital Gain Tax in the UK.

eToro Tax Reporting

eToro is committed to being fully FATCA-compliant in all countries in which they operate. In accordance with FATCA regulations, eToro may exit the relationship with customers who decide not to provide the necessary information and documentation within the regulatory time frame.

Additionally, eToro may need to provide authorities with information about customers who do not provide the required documentation or information to the applicable local tax authorities.

The Common Reporting Standard referred to as the Standard for Automatic Exchange of Financial Account Information (AEOI), developed by the Organisation for Economic Cooperation and Development (OECD), calls on countries to obtain information from their financial institutions and automatically exchange that information with other countries on an annual basis.

The CRS sets out the financial account information to be exchanged, the financial institutions required to report, the different types of accounts and taxpayers covered, as well as common due diligence procedures to be followed by financial institutions.

For clients of eToro (UK) Ltd., the above information will be reported to HM Revenue & Customs in the United Kingdom. This information will need to be sent and verified ever once a year.

Extracting Your Information

When settling your eToro UK tax bill, you’re likely to find you need lots of information about your transactions in order to work out what you owe. This applies whether you’re classified as a trader or an investor, so it pays to be organised and gather all of this information together well in advance so that you have it in one place.

While your taxes need to be paid separately through HMRC rather than through the eToro platform, you can’t pay your tax at the point of earning as you can with a regular job; the platform does make it easy to extract this information.

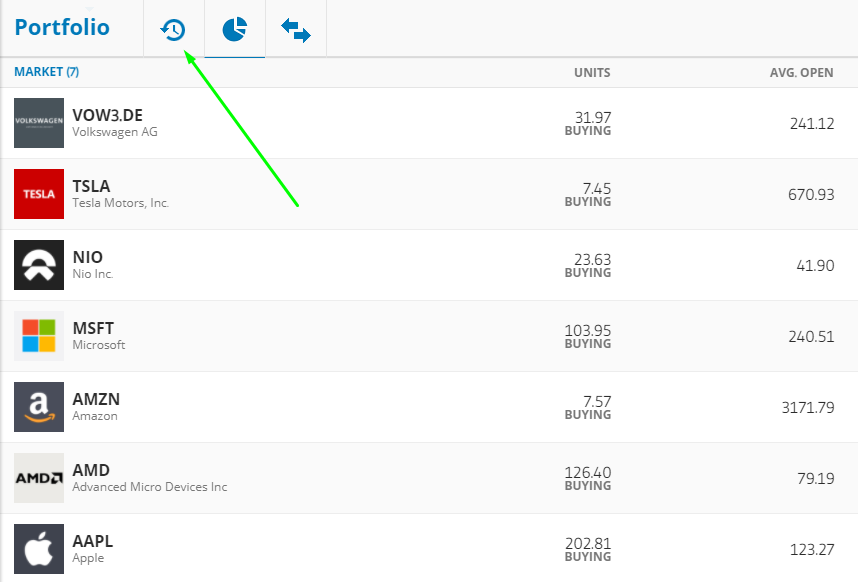

- Once logged in, you can navigate to the Portfolio tab (and, if needed, set your account to the “Real” setting) before clicking on the Portfolio drop-down menu.

- Then, click on “History”, and then the settings icon, in blue, in the top right-hand corner

There, you will be able to find your Account Statement. This document contains a wide range of information about your withdrawals, buy prices and sell prices, and so on.

If this process seems too complex or it’s not providing what you need, you can get in touch with the eToro customer service team. Generally, they provide a good service to traders on the platform both for eToro tax UK questions as well as broader questions.

Sign-up: Keep Records

When it comes to signing up to eToro, the experience is simple and easy. Unlike some other platforms where you might need to wait a long time to get on board, signing up here is quite simple. Firstly, you’re likely to need certain pieces of documentation in order to prove you are who you claim to be. Just as your tax affairs are regulated by a government body (HMRC), trading is also a regulated activity – and eToro is no exception. In the UK, it is regulated by the Financial Conduct Authority, and this body requires that eToro seeks information like proof of address, a government-issued identity card, and more. You should have these on hand so that the signup process is as quick as it can be.

- Payment methods like Skrill and PayPal accepted

- Quick sign-up process

- Documentation required for access

- FCA-regulated platform

Secondly, you’ll also need to make an initial deposit to eToro in order to start using the platform’s exciting real money trading functions. eToro accepts a wide range of major payment methods, including modern online payment formats like PayPal and Skrill, as well as traditional methods such as bank transfers and credit cards. No matter which of these methods you choose, you should make sure you keep accurate records of the transactions you make, as these could be needed when it comes to filling out an eToro UK tax return, or other official documents, further down the line.

eToro Tax: Platform Experience

Aside from the eToro UK tax implications, the platform itself is remarkably simple to use – and it brings with it lots of advantages to the trader, not least of which are the extensive opening hours and trading time it offers.

And while a tax bill may be an inevitability if you’re a dedicated trader and you amass a certain amount of earnings, you can use the innovative features on the eToro platform to boost your efficiency when it comes to trading.

For example, you can make the most of the platform’s mobile app to trade on the go, and you can trade when it suits you, 24 hours a day, five days a week between Sunday and Friday evenings.

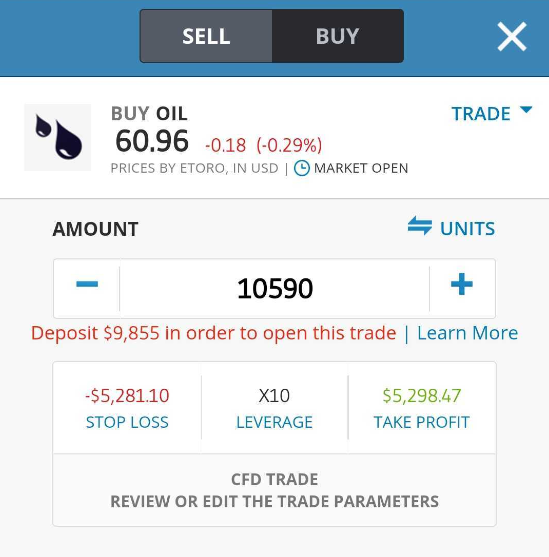

Risk Management Tools and Fees

You can also take steps to protect your capital by making use of some of the eToro platform’s risk management tools, such as a default leverage setting of 1:100, although this can be changed if you require more security, and a market exposure limit of one-fifth of your total capital.

In terms of fees, eToro does not charge commission fees, but you will need to pay a penalty if your account is inactive for an extended period of time. You may sometimes have to pay to withdraw your earnings on eToro, too, which can add to the costs.

Overall, however, while paying tax may be a drag on your return rate, the eToro platform is designed to help the rest of your trading career be as efficient as possible.

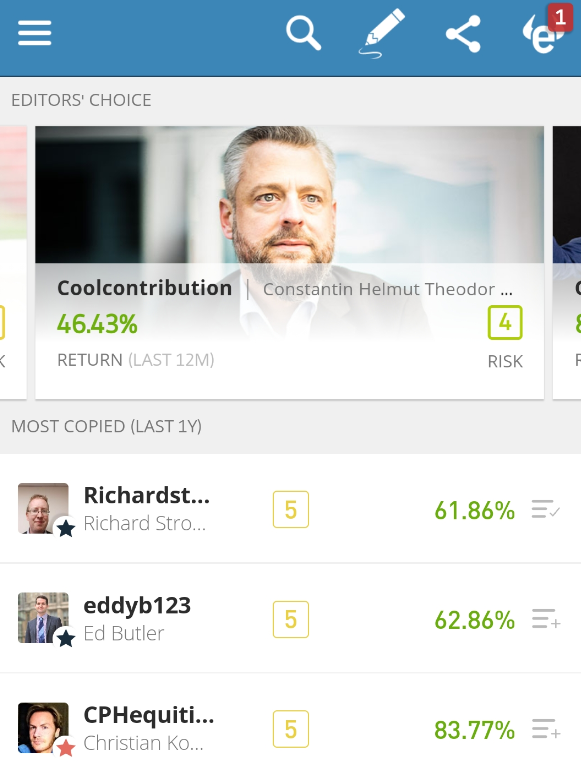

How eToro Works

The core principle behind eToro is that it is a social trading platform, so apart from offering traditional online trading methods that allow you to trade CFD assets, you can also choose to automatically copy some of the trades made by other, more experienced traders. This is powered by eToro’s patented CopyTrader system, which makes following your chosen investment guru simple and easy. You don’t have to invest the same amount as others, you can choose to track your chosen trader’s portfolio proportionally to your own investment. Say you invest 5% of the total value of your chosen trader’s investment: if they make profits, then you will receive 5% of any profits they make, before fees and taxes.

Note: Your past performance is not an indication of future results.

You can filter the traders you want to copy based on a number of their characteristics, including their appetite for risk and how high their rate of return has been in the past. So, you’ll always be able to find a trader who suits your own personal requirements. For full peace of mind, you also receive their full name and some information about their recommended investment path, so you know that you’re dealing with a legitimate person. If you want to harness top trading knowledge from across the eToro community, you can use the CopyPortfolio option to follow an investment strategy based on insights from across the community.

- Make the most of the CopyTrader system

- Borrow tips from the professionals

- Invest proportionally

- Filter based on risk appetite

Boost Your Earnings With eToro

Contrary to the beliefs of some traders, trading is a taxable activity in many circumstances – and you will always need to pay what you owe to HMRC as a result. Because of these eToro tax UK rules, ensuring that you keep as much of your earnings as you can is a smart move.

Luckily, eToro is already ahead of this curve. By charging relatively low fees compared to the wider trading industry, you can keep more of your profits even once tax is factored in.

As can be seen across the industry in almost all CFD broker comparison studies, eToro as a business makes its profits by charging a percentage fee on the spread between the buy price and the selling price.

Some brokers charge high fees at this point, but eToro actually has competitive rates on some of its CFDs. Trading gold, for example, would incur a competitive fee of 45 points, while some calculations have shown that trading one lot of Euro/US dollar on the forex markets could incur a saving of USD$21 compared to competitor platform AvaTrade.

What this means is that you can, in theory, keep more of your earnings from eToro, even after tax has been applied. It should be noted, however, that eToro does charge some relatively uncompetitive prices on some of the CFDs it has available for trading, such as the Dax 30 index, fees for which can in some circumstances be as high as 100 points.

eToro Taxes: Our Verdict

After a detailed analysis of eToro, it’s clear that this broker is one of the leading names in online trading, and it is arguably a pioneer in the world of social trading.

Tax, of course, may need to be paid if your eToro earnings push your yearly income above a certain amount, but the platform’s lack of commission fees and competitive spread fees on some CFDs means that you can keep more of the remainder of your earnings.

The ease with which you can extract your financial information from the platform means that you can compile your tax return simply and quickly. And although eToro does have its drawbacks, such as uncompetitive spread fees for some forex pairs, the number of users who remain with the platform shows that it has a loyal and dedicated follower base.

eToro is one of the most innovative trading platforms available on the web today and it has a massive range of advantages under its belt, including a highly-rated customer support function and a suite of handy risk management tools.

In addition to this, the social function of the platform is a massive advantage for those traders who need a little coaching when they start out because it means they can choose a trader who fits their own profile and borrow their top tips.

eToro is likely to remain one of the best and most popular CFD brokers available on the market for a long time to come.

Further Reading

- Before you start trading read our expert review on eToro

- Discover the best tech stocks

- Discover the best UK stock brokers

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Don’t invest in cryptos unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.