Some recession-proof stocks come to the top of the pile during an extended economic downturn. Using technical and fundamental analysis, our expert traders have identified the best stocks to invest in during a recession.

What Is A Recession?

In the broadest sense, a recession is a significant, widespread, and prolonged downturn in economic activity. To tighten up the definition, one popular technical method of confirming one is to state that a recession starts when a country’s economy posts two consecutive quarters of reduced Gross Domestic Product (GDP).

Between January and March 2022, the US economy saw its GDP contract by 1.6%. When the April to June data showed that GDP had fallen once more, this time by 0.9%, the US economy was confirmed to be in a recession.

Given the extent to which economies are interrelated, a recession in one country can signal or trigger a recession in another.

Recession-Proof Utility Stocks – SSE PLC (SSE)

One of the tricks used when picking the best recession-proof stocks is to identify firms that provide goods and services that are still needed regardless of the broader economic situation. Utility firms which provide the heating, lighting, and water needed to support everyday life typically outperform firms which provide consumer discretionary stocks such as mobile phone handsets. As the cost-of-living squeeze spreads through communities, a hard choice has to be made about how spending needs to be prioritised.

SSE is one of the ‘Big Six’ utility companies operating in the UK. It generates electricity and supplies natural gas, which powers large areas of the UK and the Republic of Ireland. Its client base of 3.8m homes and businesses is likely to have ‘sticky’ demand for the energy the firm provides, which explains why in the first half of 2022, the SSE share price held up while the rest of the equity market crashed.

SSE PLC – Weekly Price Chart – 2003 – 2022

Source: IG

The impressive dividend yield of 5.18% ensures shareholders benefit from passive income, and the P/E ratio of 11.80 reflects that SSE stock can be considered undervalued even at current levels.

| Growth, Valuation, Trading | Information |

| Market cap | £16.88B |

| EPS recent fiscal year | £2.15 |

| Dividend yield | 5.183% |

| Profit margin | 35.556% |

| Return on investment | 13.52% |

| Normalised P/E ratio | 11.808 |

Source: IG

Recession Proof Healthcare Stocks – GlaxoSmithKline PLC (GSK)

Pharma giant GlaxoSmithKline (GSK) boasts an impressive range of healthcare products that it provides to a global client base. The demand for and delivery of GSK products is a long-term project which is unlikely to be impacted by whether a country’s GDP is contracting or not. Four in ten children receive a GSK vaccine each year, with 1.7bn doses administered annually to protect lives from diseases including meningitis, shingles, flu, whooping cough, measles, and hepatitis.

The GSK share price in the last two years reflects that it missed out on being a member of the ‘vaccine producers club’. There was some rotation from GSK into rivals such as Pfizer and AstraZeneca, which deflated the GSK share price. But with Covid vaccines not being the money-spinner they once were, it’s time to join the big institutional investors who are taking a fresh look at GSK.

GlaxoSmithKline PLC – Weekly Price Chart – 2003 – 2022

Source: IG

Glaxo’s market cap of £76bn provides it with enough critical mass to weather any recession, and the products it makes generate a dividend yield of 5.31% to shareholders. The GSK P/E ratio of 14.73 is higher than that of utility firm SSE but reflects pharma stocks offering greater potential for capital growth if and when new ground-breaking drugs are released to the market. In comparison, the P/E ratio of AstraZeneca currently registers at 44.71, and that divergence can be expected to narrow as Covid treatments become less sought after.

| Growth, Valuation, Trading | Information |

| Market cap | £76.53B |

| EPS recent fiscal year | £0.87 |

| Dividend yield | 5.314% |

| Profit margin | 14.938% |

| Return on investment | 10.07% |

| Normalised P/E ratio | 14.783 |

Source: IG

Recession Proof Discount Retailer Stocks – B&M (BME)

Discount retailer B&M European Value Retail SA (BME) follows the ‘pile it high, sell it cheap’ approach, which can appeal to consumers looking to get by on a budget. As a relatively new entrant to the retail space, the firm could also post long-term gains due to a recession. There’s a real chance that shoppers who were previously reluctant to cross the threshold into B&M stores will become established customers, even once the worst of the economic downturn is over.

B&M – Weekly Price Chart – 2014 – 2022

Source: IG

Those looking to buy B&M stock will also benefit from the shake-down in price caused by BME being previously regarded as a growth stock. Its aggressive expansion plans saw the BME share price more than double in value between March 2020 and March 2021.

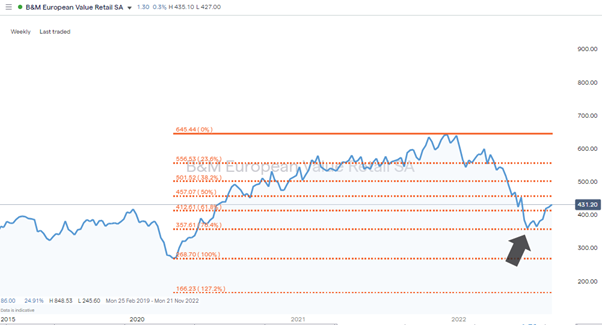

B&M – Weekly Price Chart – 2019 – 2022 – With Fib Levels

Source: IG

Concerns about the global economy resulted in B&M and other small-cap stocks being discarded by investors retreating to safer assets. However, the overshooting to the downside in 2022 has been followed by a bounce off the 76.4% Fibonacci Retracement support level. At current price levels, BME stock offers a way to weather the recession and to be in an excellent position to benefit when markets rally.

| Growth, Valuation, Trading | Information |

| Market cap | £5.79B |

| EPS recent fiscal year | £0.43 |

| Dividend yield | 3.111% |

| Profit margin | 8.939% |

| Return on investment | 16.364% |

| Normalised P/E ratio | 13.43 |

Source: IG

Recession Proof Consumer Staples Stocks – Procter & Gamble (PG)

Household and personal products company P&G sells well-known brands such as Pampers, Downy, Febreze, Olay, Tide, Charmin, Gillette, Head & Shoulders, Dawn, and Crest. Consumer staples with solid brand loyalty remain in demand during recessions.

In the earnings report released in July 2022, Procter & Gamble demonstrated the firm’s ability to cope with inflationary and recession-based pressures. Revenue came in at $19.52bn, which was above what analysts had forecast ($19.4) despite a fall in the volume of products sold. The PG management confirmed that the higher prices the firm had passed on to consumers have so far been swallowed up. Net sales rose 3% on a year-on-year basis thanks to organic sales growth of 9% in its key health care and fabric and home-care divisions.

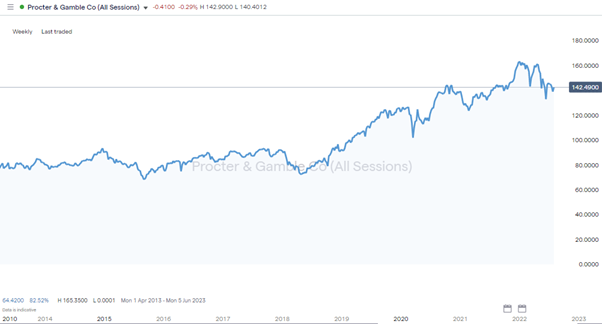

Procter & Gamble – Weekly Price Chart – 2014 – 2022

Source: IG

Procter & Gamble is by no means cheap. The P/E ratio of 26.32 suggests a lot of the good news is already priced in. But during a recession, allocating capital to a defensive blue-chip giant can protect against downside risk. The 2.29% dividend yield demonstrates the firm’s willingness to return cash to investors and is accompanied by a share buyback program of $24bn to $30bn, which is expected to run for the next three years.

| Growth, Valuation, Trading | Information |

| Market cap | USD 363.78B |

| EPS recent fiscal year | USD 5.50 |

| Dividend yield | 2.293% |

| Profit margin | 18.54% |

| Return on investment | 16.566% |

| Normalised P/E ratio | 26.329 |

Source: IG

Recession Proof Gold Mining Stocks – Newmont Mining Corp (NEM)

One asset which is regarded as a safe haven is gold. Historical price data points to precious metals performing relatively well during downturns and periods of high inflation. The security offered by the metal makes investing in gold stocks attractive when the global economy slows down.

The mining sector is very much about long-term projects. Companies take years to bring new reserves into production, so their approach to developing new fields remains consistent through the ups and downs of the economic cycle. A downturn can offer an opportunity for mines to negotiate better deals and cut costs as the rest of the economy contracts.

Newmont Mining Corporation – Weekly Price Chart – 2003 – 2022

Source: IG

The long-term view of gold mining companies and the resilient price of the metal makes gold mining stocks such as Newmont Mining Corp (NEM) a top pick for those looking to ride out a recession. US-based Newmont Mining is the world’s largest producer of gold and each year produces twice as much of the metal than the third-ranking company.

Newmont’s gold reserves aren’t going anywhere. In fact, with such a large part of its known deposits being located in North America, there is also an added layer of geopolitical protection from them being based in one of the most secure regions of the world.

| Growth, Valuation, Trading | Information |

| Market cap | USD 53.20B |

| EPS recent fiscal year | USD 1.38 |

| Dividend yield | 3.297% |

| Profit margin | 0.082% |

| Return on investment | 0.027% |

| Normalised P/E ratio | 36.011 |

Source: IG

The firm has a $53bn market cap and currently generates a dividend yield of 3.29%. Like the rest of the stock market, it had a tough first half of 2022, but the price of gold has held up relatively well. This suggests the sell-off was more about equities temporarily falling out of favour with stock investors. The price support offered by the price of gold can be expected to provide support going forward.

Gold – Weekly Price Chart – 2004 – 2022 – + 1,000% Return

Source: IG

Recessions and Stock Prices

The ‘real’ economy and share prices are not the same thing. When the data was released on Thursday, 28th July 2022, that the US was confirmed to be entering a technical recession, all the major stock indices in the US posted an up day. The Nasdaq 100 index, S&P 500 index, and Dow Jones Industrial Average index rose in value by 1.00%, 0.94%, and 0.98%, respectively, despite what at face value looked like negative news dominating the news wires.

The forward-looking approach of stock investors involves using valuation models based on future earnings rather than historical GDP data. That can trigger buying activity and lead investors to enter into new buy trades before a recession has fully worked through the system. On the same Thursday that the poor GDP numbers were announced, market bellwether Apple Inc released a solid Q2 trading statement which beat analyst forecasts and counterbalanced the bad macro news. Investors decided to focus on the Apple data, which resulted in the market as a whole rallying.

Final Thoughts

There’s never a wrong time to apply the strategies used by sensible investors. Defensive stocks which perform well in a recession might not offer some of the fireworks of smaller growth stocks during a bull market. But growth stocks can be a distinctly uncomfortable ride when the global economy contracts.

Recessions can unnerve investors in other ways. Credit lines are often squeezed, which results in even household names going bust. Protecting yourself from market risk, the chance of investments falling in value can be complemented by factoring in counterparty risk, the chance that your broker, or even bank, might become a victim of a recession. This list of trusted brokers includes names which are not only regulated but also have impressive track records. Brokers that have been operating in the markets for years or even decades have experience navigating economic downturns. Those selected for the AskTraders shortlist have also been checked to ensure they offer competitive T&Cs and the additional services which provide their clients with the best route into the markets.