Cryptocurrencies and NFTs aren’t for everyone but do have the potential to be game-changers —holding them in the long-term could result in life-changing returns. Putting them alongside more traditional assets such as shares highlights why they may need to be considered. This also reiterates the benefits of diversifying your portfolio, as well as understanding your investment aims.

How To Approach Risk When Investing?

There’s no avoiding the fact that cryptocurrencies are high-risk investments. With over 18,000 currencies available on unregulated crypto markets, this technology is ground-breaking but could become worthless.

NFTs (Non-Fungible Tokens) are an even riskier proposition, having become a more prominent part of the investment sector over the last two years. The novelty of the bewildering range of NFTs available is matched only by the innovation and complexity of the blockchain storage technology they utilize.

Trading in stocks is seen as a safer bet for responsible investors. Listed stocks are regulated, and price volatility tends to be much lower for stocks than it is for digital assets. Historical returns aren’t a guarantee of future performance but buying stocks has been a long-term winning trade for many investors. But even seeming safe bets like utilities sector Pacific Electric and Gas have gone bust, leaving shareholders empty-handed.

At the other end of the risk-reward spectrum is holding wealth in cash bank accounts. This might look like the lowest-risk approach, but holding cash can be a losing trade. With inflation eating into the value of fiat currencies, taking no action and adopting a passive approach is a risk in its own right.

Buying Stocks as a Long-term Investment

There are very good reasons why standard investment advice suggests allocating between 60% and 75% of your investment portfolio to stocks. Stocks have been traded for hundreds of years and the historical track record points to them offering informed investors the right combination of risk and return.

Positions taken in shares can be relatively volatile in the short-term, but the S&P 500 index posted losses in only 11 of the 47 years from 1975 to 2022. The trick is to be able to spend time in the market rather than trying to call the bottom or the top.

The first feature which makes stocks a popular investment choice for both retail and institutional investors is the way the market is regulated. Firms which list on stock exchanges are required to comply with official rules and regulations. Details of how the company has performed have to be regularly shared during earnings season, and the information needs to be presented clearly and consistently so that investors can analyse business fundamentals to a granular level.

The transparency of the market means investors can categorise each of the shares into groups and build a portfolio with exposure to a range of sectors. With long-term gains in mind, you might consider small-cap, stocks to buy in India, or the niche but growing market of healthcare stocks in Singapore. The range of stocks available is staggering, with the online broker IG, for example, offering more than 10,000 different markets. There’s something for everyone and each investor can build a well-diversified portfolio designed to smooth their returns.

S&P 500 Stock Index – Weekly Price Chart – 2000 – 2022

Source: IG

Stock trading is also welcomingly cost-effective. The bid-offer spreads in most markets are kept tight by the huge trade volumes associated with the market. If you choose to hold your stock position in a share dealing account, then ongoing costs will be negligible. CFDs (contracts for difference) have improved functionality which appeals to those running short-term strategies, but they do incur daily financing charges. That means long-term buy-and-hold investors will improve their returns if they avoid using these instruments.

Another feature of stock investing is the passive income received through dividend payments. A position in high-yield dividend stocks will generate a regular and consistent amount of passive income. If this is reinvested in more shares, it can result in your long-term stock position snowballing. When this happens, investors benefit from compound returns, leading to returns on historical charts becoming quite impressive.

Buying Crypto as a Long-term Investment

Cryptocurrencies are often associated with stories of investors making life-changing returns overnight, but adopting a long-term approach can be the smarter way to trade the market. The notoriously extreme price volatility associated with crypto markets can shake investors out of positions, so approaching the subject with a buy-and-hold mindset can pay off.

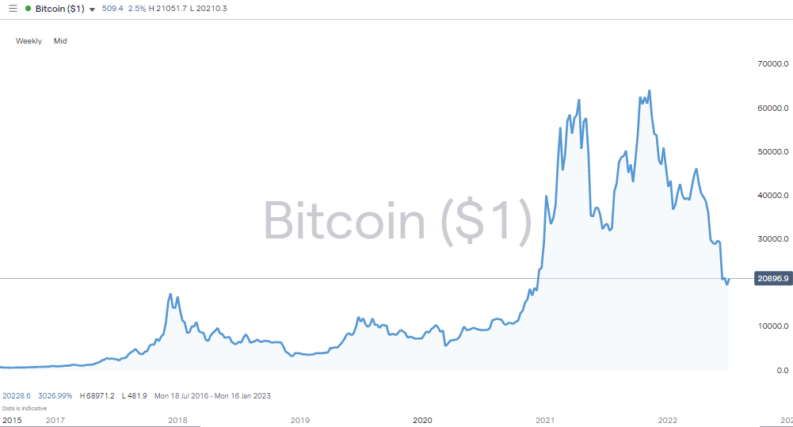

Despite the massive sell off in crypto in the first half of 2022, a lot of early days investors are still sitting on substantial gains. Anyone who bought Bitcoin in January of 2019 would have a 456% return by July 2022, despite the price of BTC suffering a 68% price fall from the highs of November 2021.

Bitcoin – Weekly Price Chart – 2016 – 2022

Source: IG

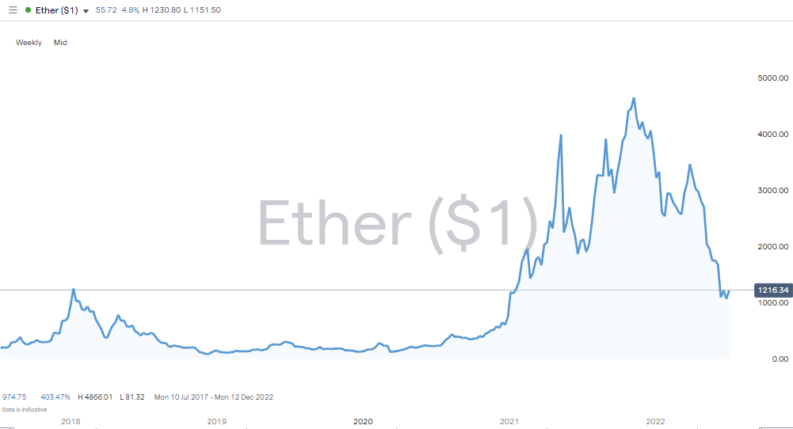

Investors in ethereum would have posted a return of 918% over the same period. Ethereum is in the process of moving to using proof-of-stake protocols which could make it more energy efficient. Despite the delays to the planned roll-out, the improved functionality of the new ETH 2.0 system could help ethereum develop market share.

Ethereum – Weekly Price Chart – 2016 – 2022

Source: IG

Ethereum and bitcoin are the two best known and largest cryptos by market cap. Bitcoin’s position as the crypto which is best for storing wealth is counter-balanced out by ethereum’s role as the crypto which is more widely used to carry out transactions. Both coins have posted gains thanks to their strong brands, but insurgent altcoins can offer even greater risk-return for long-term investors.

The likes of Dogecoin and Shiba Inu form part of a group of second generation coins that are looking to gain market share from bitcoin and ether. Like other altcoins, they have a creative way of approaching the subject of blockchain finance. Investing in these second generation coins can be a moon-shot style strategy, so risk-management techniques need to be applied. However, the 7,894% rise in the value of Dogecoin between January and May 2021 highlights the kind of returns which can be made if investors make the right selection. Long-term investors looking to get exposure to the crypto sector could do well to allocate a small amount of capital to altcoins.

Dogecoin – Daily Price Chart – 2020 – 2022

Source: IG

A relatively recently feature of the crypto markets is staking. This is something any long-term crypto investor might want to consider. Staking allows holders of coins to lock them up for some time in return for receiving more coins. The returns from staking can be thought of as being similar to dividends paid on shares, and some of these top-ranking offer annual yields above 10%

Successful long-term investing requires the right trading mindset. There is always room for more aggressive positions in a well-balanced portfolio and adopting the approach of a sensible investor can help traders navigate the riskiest of markets. Trading in small size removes some of the emotion out of trading, which can be useful when a position suffers a momentary loss before improving. This advice is particularly apt in the crypto market. Few would suggest going all-in on crypto, but a small position can hedge against a missed opportunity. The dips in price which regularly occur can be seen by long-term investors as buying opportunities and applying a patient approach can optimise returns.

Buying NFTs as a Long-term Investment

Rule number one of NFT investing is to only trade money you can afford to lose. The sector is in its formative stages and the jury is still out on how to establish fair value. Each NFT is a blockchain stored piece of code which gives the holder full ownership of that item. One of the most exciting features of the market is that whilst a lot of attention to date has focused on artwork, NFTs could be in many more formats.

There is some intrinsic value in NFTs. As is the case with traditional artworks, some buyers obtain a piece because they like it, as much as because they think the price will go up. Weighing against this is the fact that NFTs offer no yield in the way bonds and stocks can.

NFTs burst onto the scene in 2021 when the total size of trades carried out in them topped $22bn. This is compared to just $100m in 2020. Some of the growth of the market can be attributed to an aggregate increase in the number of NFTs sold. According to research by nonfungible.com by the end of 2021 2.5m crypto wallets belonged to people holding or trading NFTs, up from just 89,000 one year earlier. The number of buyers of NFTs rose from 75,000 to 2.3m.

A lot of the increase in market size was down to the prices of the digital tokens spiralling upwards as more people stepped into the market. In 2021 NFT investors generated a total of $5.4bn in profits from sales and more than 470 wallets managed to make profits over $1m million.

The ability to make a quick turn on an NFT trade attracted a lot of speculators, but when the initial surge of interest subsided prices began to fall. Eric Siu of Singlegrain.com explained “I think a lot of people are still looking at NFTs as a trendy new way to make short-term cash – but that’s not really going to work out.” For Siu the potential of NFTs is related to the impact of long-term trends, most notably concepts such as the decentralized web and Web 3.0. These innovations will take time to become a reality but investing a small amount of capital in an NFT could at least help insure against a severe case of regret.

Long-term investors in NFTs may face the problem of their holding becoming longer-term than they initially anticipated. The market is far less liquid than those of shares or cryptos because each NFT is unique. Finding a buyer for your NFT therefore requires finding someone who is not only interested in NFT block-chaining but also a fan of the particular item you possess.

The owner of the piece of digital artwork known as Cryptopunk #7804 found a buyer for their NFT in 2021 and the piece fetched a price of $7.57m but there’s no guarantee a buyer for any NFT will materialise in the short term. It’s also difficult to make accurate valuations of assets held in liquid markets which makes tracking the performance of your investment difficult.

Final Thoughts

Shares, crypto and NFTs sit at extreme ends of the investment spectrum so asking which is a better long-term investment might at first glance appear strange. What it does highlight is that well-diversified portfolios tend to perform better over the long-run. As long as you allocate capital responsibly, you have the potential to post an inflation beating return, with the possibility of riskier assets bringing a little bit of stardust to the bottom line.

Whether you’re an experienced trader or a newcomer, embracing risk doesn’t extend to broker selection. When choosing an account opt for a trusted broker from this list to ensure your trading gets off to the best possible start. All of these firms have impressive track records, competitive T&Cs and some have been operating since the 1970s, which points to them being ideal partners for anyone looking to invest with a long-term view.