The mechanics of monetary policy mean that central bankers such as the Fed actively use interest rates to influence the cost of money and credit, and thereby inflate, or deflate, the economy. That means Fed interest rate decisions affect elements of economic activity such as consumer spending levels. If spending slows down, that means corporate revenues fall. The ways how Fed interest rates affect stock markets are one of the key factors for investors to consider when deciding what to invest in.

Who Decides US Interest Rates

Given the crucial role interest rates play in an economy, it’s unsurprising that the process of how they are set is carefully mandated. In the US, the responsibility of setting rates has, since 1913, sat with the Federal Open Market Committee (FOMC) in accordance with conditions set out in the Federal Reserve Act.

The FOMC meets eight times a year. At each meeting, committee members under the guidance of the Chair of the Federal Reserve consider economic and financial conditions and determine an appropriate stance in terms of interest rates.

There are 12 members of the FOMC. Some, such as the Chair are permanent members, though the person fulfilling that role will change over time. Seven are members of the Board of Governors of the Federal Reserve System and the remaining four are selected on a rotating basis from a pool of regional Reserve Bank presidents.

Members of the FOMC determine the Fed Funds rate and the committee’s decision is released at a predetermined time. This ensures all market participants are able to react to the news at the same time.

Aims of the FOMC

The US Congress has assigned the Fed two equal goals, maximum employment and stable prices, which means low, stable price inflation. The monetary policy levers of the Fed are pulled and pushed in an effort to meet these aims and promote a healthy economy.

Fed policy is largely associated with the setting of interest rates, but other types of action are taken. These include direct market intervention, such as buying or selling assets or quantitative easing. All of the tools at the Fed’s disposal can influence asset prices and investor sentiment.

How Fed Interest Rates Affect Stock Markets

Lower interest rates are associated with increased economic growth. Money becomes cheaper, which removes one of the barriers that might prevent firms investing in new projects. That is typically good news for stock prices as increased investment and improved consumer confidence results in greater spending on goods and services. A virtuous circle develops, which leads to future corporate earnings being greater than previously expected.

Lower interest rates can also make other investments that are alternatives to stocks less attractive. The rate the FOMC sets feeds into the savings rates on bank savings accounts and if interest rates fall, some investors will decide to put their cash into the stock markets, rather than leaving it on the side-lines making a low return.

The reverse is true if interest rates rise and borrowing becomes more expensive. Those making regular debt repayments will have to allocate more of their monthly income to servicing debt, rather than buying goods and services.

Interest rates can influence share prices in specific sectors as much as the wider economy. If interest rates rise, the risk of counterparties defaulting on their contracts also increases. Firms with high levels of exposure to counterparty risk, bad debts, and increased credit risk, can therefore see their share price fall to a greater extent than the rest of the market. Investors are able to sell up and invest in other stocks that aren’t as risky in the new high-interest rate environment.

Interest Rates and Rotation Between Sectors

Lower interest rates are generally seen as being positive for stock valuations, but there are some more nuanced scenarios.

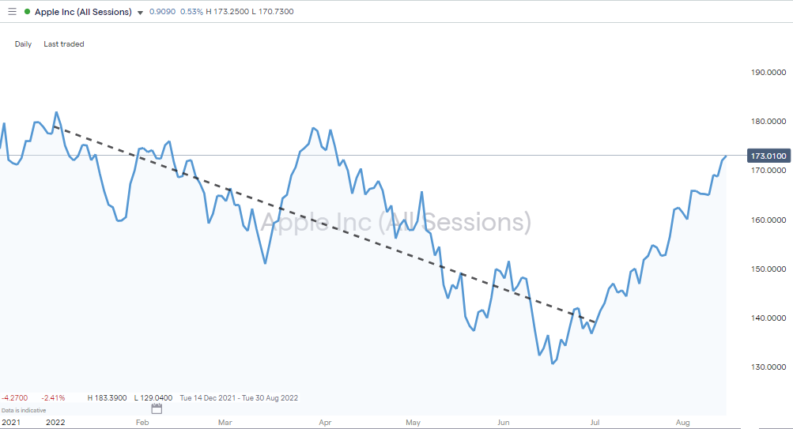

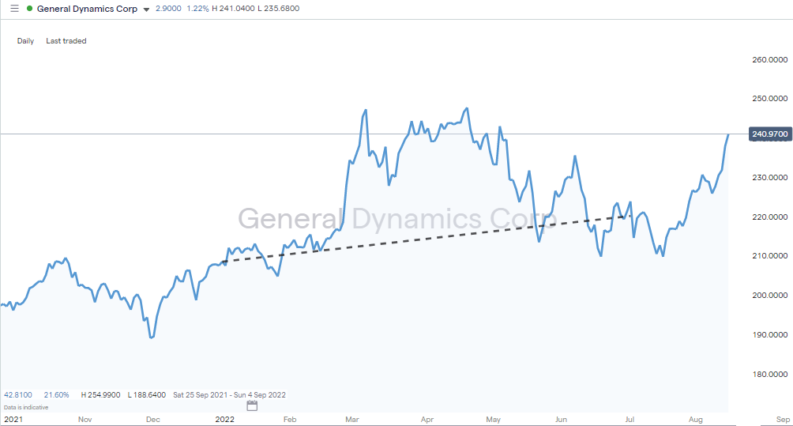

Higher rates, used to snuff out inflationary pressures in the economy, can trigger a move out of growth stocks and into defensive stocks. Higher rates can be bad for both sectors, but the rotation to security means the relative losses in the growth stock sector stocks such as Apple will be greater than those in defensives such as General Dynamics Corp (GDC).

During the first half of 2022, at a time when the Fed was hiking interest rates, the price of Apple and General Dynamic stock diverged. By the end of June 2022, Apple stock was down 22.3% on a year-to-date basis, whereas General Dynamics shares were up in value by 7.36%.

Apple Inc – Daily Price Chart – 1H 2022 – Down 22.3%

Source: IG

General Dynamics Corp – Daily Price Chart – 1H 2022

Source: IG

Interest Rates, the Currency Effect, and Stock Prices

Interest rate rises can result in currency prices changing and that in turn can influence the price of certain stocks. If the US Fed increases interest rates, then the US dollar becomes relatively more attractive when compared to other currencies because it offers higher rates of return on cash deposits. As ‘hot money’ in the global financial system is converted into US dollars, that drives the price of the dollar upwards in currency markets.

Multi-national firms such as Johnson & Johnson (JNJ), which generate a lot of their revenue in international markets, will find profits on operations from Germany to India will be worth less in dollar terms. A US interest rate rise can impact firms that report in dollars but make money abroad. The share price of firms such as JNJ may fall, or be suppressed, due to that currency effect.

Interest Rates and Banking Share Prices

Firms in the banking sector, such as Citigroup Inc (C) face a paradox when interest rates move. When rates rise, there is a risk that borrowers are exposed as being overextended and more likely to default on their loan.

At the same time, higher interest rates can be good news for banks if it results in them being able to widen the spreads between their savings and lending rates. When interest rates are close to zero, banks struggle to ‘make a turn’ on their normal day-to-day activity. If banks offer savers a negative interest rate on their savings accounts, then customers are more likely to keep their money under the mattress. That problem goes away if interest rates as set by the Fed move above 2%.

Position of the Fed in Global Markets

When discussing US interest rates, it’s important to consider the US Federal Reserve’s position as the dominant central bank in the world. Due to the size of the US economy, developments in that country can be expected to have ramifications for the entire global economy. That means Fed interest rate decisions not only affect US stocks but international ones as well.

Fed Interest Rates and Short-Term Stock Trading Strategies

The analysis of how Fed interest rates affect the stock market has so far considered medium and long-term trading opportunities. It is also worth factoring in how the announcement of whether rates will rise, fall, or remain unchanged, can create a burst of extremely high price volatility.

Trade volumes tend to increase at the time of an announcement as big investors pile into positions to reflect how the economic outlook has changed. This means price can whipsaw and spike to the upside and downside momentarily before heading off in one direction. This is an ideal situation for day-traders who are looking to speculate on short-term price moves.

It can also lead to buy-and-hold investors temporarily taking off any stop-loss instructions they have on their positions so that they aren’t flipped out of a position on the back of a momentary price swing.

How To Predict Fed Interest Rate Decisions

Given the impact of interest rate decisions, anticipating the Fed’s next move can be a profitable move. As a result, the period prior to any FOMC meeting and rate announcement is marked by analysts and market gurus sharing their thoughts on what path the Fed might take.

If you want to look deeper into whether the market expects rates to change, and by how much, then the CME FedWatch tool is something to consider. This tracker monitors trading activity in 30-Day Fed Fund futures on the CME exchange. That data has long been relied upon to express the market's views on the likelihood of upcoming interest rates. It provides a reading of what probability investors are giving to each outcome at upcoming meetings.

The FedWatch tracker is not a 100% reliable indication of what the Fed will actually do – traders and analysts can easily make the wrong call. But it does show in real-time how sentiment among the investment community shifts in the build-up to the next announcement.

Final Thoughts

Interest rates set by the US Fed are a big factor in determining whether stock markets go up or down. There aren’t any hard and fast rules, but lower interest rates are generally considered to be good news for stock prices and vice versa.

Whether you’re an experienced investor or a newbie taking your first steps into the market, using interest rates as a core element of your decision-making is highly advisable. Not only do the principles involved make intuitive sense, but rates are a metric that some of the biggest investors in the world monitor. If they buy stocks on the back of a rate cut, then a new long-term trend could be about to start.

An announcement of a rate change is big news. It can signify a long-term shift in market dynamics, which excites buy-and-hold investors, and at the same time, can result in dramatic short-term moves that create opportunities for day-traders.

Whichever type of strategy you are running, it is important to set up with a trusted and reliable broker. The ones on this shortlist of good brokers have been reviewed by the AskTraders team to ensure they are well-regulated, and that they provide all the services investors need to trade the markets and interest rate news successfully.